The US equity market has been dominated by just a handful of names over the past year, as investors flocked to the group of stocks known as the 'Magnificent Seven'. While these seven companies – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – sit across several different sectors, all have business models that are heavily dependent on technology and the current excitement around artificial intelligence (AI).

With many of these names once again delivering stellar earnings results during the latest reporting season, the S&P 500 has reached new all-time highs.

Concentration in context

Understandably, the increased concentration of the US stock market has become a source of interest, if not concern for some investors.

Close to 90% of the price returns delivered by the S&P 500 last year can be attributed to the performance of just seven stocks: in a year where the S&P 500 returned 24%, the median stock in the index returned a less impressive 8.2% in comparison.

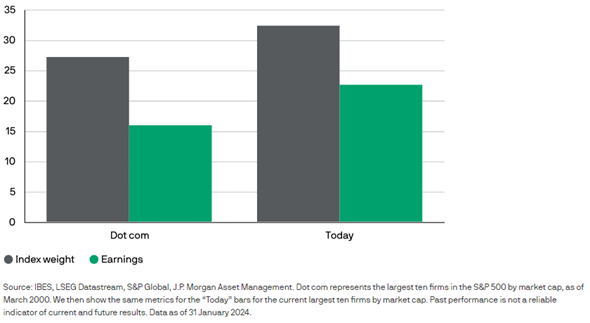

The S&P 500 now has a higher level of concentration than was experienced during the 2000s tech bubble.

Unlike the early 2000s, today’s mega-caps are already consistently delivering earnings, rather than merely trading on the hope of future earnings growth.

Profit margins are a key part of the story: margins for the largest 10 stocks stood at close to 20% at the end of 2023, in comparison to around 12% for the broad index. The challenge is that with every solid earnings report, expectations for future growth keep moving higher.

Percentage contribution to index market cap and trailing earnings from the largest 10 stocks

Meeting these earnings expectations will in part depend on whether AI lives up to current hype

Although the mega-caps operate in different industries, a common theme is that artificial intelligence is expected to be a source of supernormal profits for years to come. Chipmakers are expected to see soaring demand, advertisers will use AI to transform the user experience, and automakers will use AI to make cars drive themselves.

What are the prospects for the S&P 493?

During former periods of huge technology excitement, identifying the eventual winners in real time has been incredibly tough. Yet although it is unclear whether AI can fully live up to expectations, we are not overtly worried about the magnificent seven catching down to the broader market in the way the mega-caps did in the 2000s.

What is the likelihood that the rest of the index catches up?

Conceptually, we would argue that if AI does prove as transformative as some mega-cap valuations suggest, then a productivity and earnings uplift will be felt across other sectors too. In this situation, we might expect the rest of the index to at least partly close the gap to the current leaders, as investors realise other stocks are also set for an AI-related boost.

History shows that in the short term – for example, in the one year following elevated valuation dispersion – there’s no guarantee of smaller firms outperforming. However, previously when the gap in valuations between the largest 10 and the remaining 490 stocks has been as wide or wider than it is today, this has consistently led to stronger performance for smaller names over a five-year horizon.

That is, smaller stocks generally do better than the mega caps following elevated concentration.

It’s time to diversify

The magnificent seven are too big a part of US – and world – stock markets to avoid, and they have demonstrated their ability to generate strong earnings in the past.

We would argue, however, that investors should be active in their mega-cap allocations, tilting towards those companies they think have the best chance of surpassing current earnings expectations.

Beyond this, history suggests that we are likely to see returns broaden out over time. With the S&P 500 hovering around the 5,000 mark, today’s market may present a good opportunity for investors to rebalance their portfolios.

Hugh Gimber is a global market strategist at J.P. Morgan Asset Management. The views expressed above should not be taken as investment advice.