Sustainable investments have been out of sight, out of mind since banks have started to ramp up interest rates, but they have been the best way to consistently generate a higher average alpha over the past five years, data from FinXL shows.

Three of the five global funds with the highest rolling average alpha in the IA Global sector focus on environmental, sustainability and governance (ESG) principles.

With active managers needing to demonstrate their ability to consistently outperform their benchmarks if they want to survive the rising competition from passive funds and convince investors to pay the higher fees they charge, it seems that ESG funds are delivering the most bang for investors’ buck.

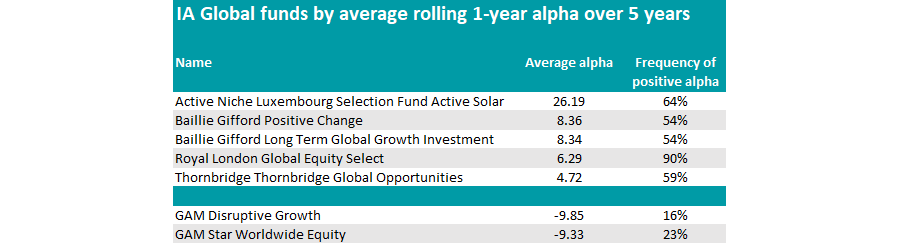

In this series, Trustnet shows which active managers outperformed thanks to their stock picking rather than the market rising. Below, we measured the average alpha above the fund’s relevant benchmark over 61 12-month periods from 2018 to 2023 in the IA Global sector.

We begin with the Active Niche Luxembourg Selection Fund Active Solar fund, which stood out head and shoulders form the rest of the peer group.

It invests in companies that are mainly in the solar photovoltaic industry and at 26.2, it has by far the highest average alpha of the sector versus its MSCI World benchmark. However, it only had a positive alpha in 39 of the 61 periods in consideration.

The strategy focuses on mid-caps names, which make up 84% of the portfolio, across the photovoltaic value chain. The top three positions are US solar panels manufacturer First Solar (8.2%), US solar panel and battery storage provider Sunrun (7.8%) and German solar energy equipment supplier SMA Solar Technology (7.7%).

It’s a big jump down from an average alpha of 26.2 to 8.36, where we find the second-best fund in the list, Baillie Gifford Positive Change.

Another strategy focused on sustainability, this £2.2bn fund has been managed by Kate Fox and Lee Qian since it was launched in 2017 and they were later joined by Edward Whitten, Thaiha Nguyen and Apricot Wilson. It is benchmarked against the MSCI ACWI index.

Square Mile analysts said this is “currently one of the most attractive responsible fund offerings in the market”.

“We believe this fund has the right ingredients to deliver on its stated objective,” they said, which is to outperform the MSCI AC World Index by at least 2% per annum over rolling fiveyear periods.

The portfolio is concentrated in 25 to 50 stocks and can have some sizeable stock positions. However, to ensure diversification, the fund will not hold more than 10% in an individual stock and it must invest in a minimum of six countries and six sectors.

It was closely followed by another Baillie Gifford strategy, the Long Term Global Growth Investment fund, which has been led by FE fundinfo Alpha Manager Mark Urquhart since 2017. Its management team also includes Alpha Manager John MacDougall, who joined in 2022.

Source: FinXL

Further down the list, Royal London Global Equity Select had an average alpha of 6.3 versus its MSCI World benchmark. The portfolio also stood out as it managed to maintain a positive alpha in 55 of the 61 periods in analysis, one of the longest streaks within the IA Global sector.

The only vehicles that beat it were four exchange traded funds (ETFs), which only had a positive alpha due to minimal outperformance against the tracked index.

The fund has a FE fundinfo Crown Rating of five and is managed by an Alpha Manager trio consisting of James Clarke, Peter Rutter and Will Kenney, who mainly buy information technology (in which 20.5% of the fund’s £773.76m of assets under management are invested), healthcare (16%) and industrial companies (14.6%), predominantly in the US (62.6%).

Finally, the £169.4m Thornbridge Global Opportunities concludes the top five with an average alpha of 4.7. It has been managed by Robert Oellermann since December 2022, when Thornbridge appointed Laurium Capital as sub-investment manager in place of Ranmore Fund Management.

The fund mainly invests in the telecom, media and technology sector (19.1%), consumer companies (18.9%) and financials (15.7%). Its main holdings are Alphabet (4%), Shell (3.5%) and Broadcom (3.4%).

As for the worst alpha figures, the bottom two funds all belong to the same provider – GAM Disruptive Growth (-9.9) and GAM Star Worldwide Equity (-9.3%), which have been seriously struggling compared with their average peers over the past 10 years, as the chart below shows.

Performance of funds vs sector over 10yr

Source: FE Analytics

Previously in this series: The UK funds that keep delivering the most bang for your buck.