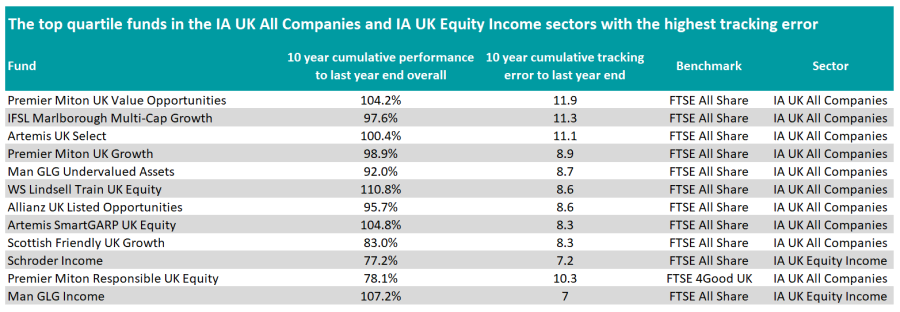

Eleven UK equity funds managed to deliver top quartile returns in the past 10 years by ignoring the FTSE All-Share index and taking high conviction bets.

Research by Trustnet identified funds with a high tracking error that beat their benchmarks and sit in the top quartile of the IA UK All Companies and IA UK Equity Income sectors. We excluded funds that use their sector as a benchmark.

Premier Miton UK Value Opportunities has the highest tracking error of all the funds in our list. It is a multi-cap fund with a strong bias towards small- and mid-cap companies.

Premier Miton invests in companies with improving profitability and growing cash flows that have the potential to re-rate as and when other investors come to appreciate these qualities.

FE fundinfo Alpha Manager Matthew Tillett has led the fund since November 2022, but Andrew Jackson was in charge during most of the measured period.

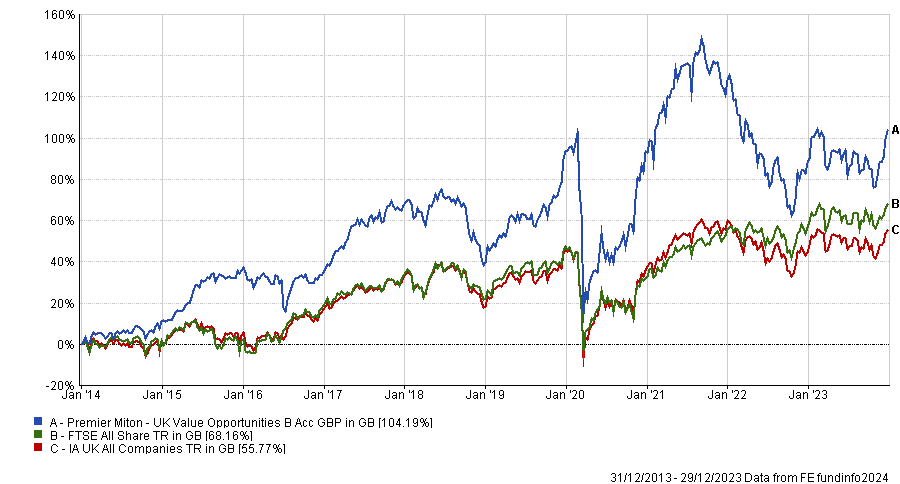

Performance of fund over 10yrs (to year-end 2023) vs sector and benchmark

Source: FE Analytics

Other funds with a value tilt whose conviction was rewarded include Man GLG Undervalued Assets, Artemis UK Select and Allianz UK Listed Opportunities.

Man GLG Undervalued Assets, managed by FE fundinfo Alpha Managers Henry Dixon and Jack Barrat, invests in undervalued but cash-generative companies with strong balance sheets.

Analysts at Rayner Spencer Mills Research (RSMR) said: “Particular focus is placed on the balance sheet, where the managers look to gain a thorough understanding of a company’s assets and liabilities. This is done through their own research and meeting a target company’s management.

“The managers then determine the value of both the invested capital and the equity within a business and use this to generate their own estimates as to the value of the company and they use balance sheet trends to define cashflow and cash earnings. The managers can then decide if the current share price undervalues the company’s replacement cost and profit streams.”

The fund has a low turnover, as it can take time for the market to rerate the underlying companies.

Analysts at RSMR suggested using Man GLG Undervalued Assets as a satellite rather than a core holding due to its potential volatility.

Performance of fund over 10yrs (to year-end 2023) vs sector and benchmark

Source: FE Analytics

Value was not the only investment style that enabled managers to make top quartile returns while disregarding the benchmark.

For instance, WS Lindsell Train UK Equity, managed by FE fundinfo Alpha manager Nick Train, achieved the same feat with a quality growth bias.

Analysts at Square Mile said: “Train's philosophy is based on the principle of investing in what he sees as strong businesses and holding them for the long term. However, given the approach employed, there are very few companies that actually meet the manager's strict investment criteria and, as a result, the final portfolio is concentrated across a limited number of holdings (20-30).

“Although the bulk of the portfolio is invested in large-cap companies with a global reach, there is an allocation to some more niche firms that are often located further down the market cap scale.”

They also pointed out that the fund uses a non-UCITS retail structure, which means it does not have to comply with the UCITS diversification rules. As a result, the fund is highly concentrated, with the top 10 holdings accounting for more than 80% of the portfolio.

Analysts at RSMR suggested pairing WS Lindsell Train UK Equity with a value fund. They warned against using it as a short-term core holding because its style may go in and out of favour over the medium term.

Other outperformers that strayed from their benchmark include Artemis SmartGARP UK Equity, IFSL Marlborough Multi-Cap Growth, Premier Miton Responsible UK Equity Premier Miton UK Growth and Scottish Friendly UK Growth.

Source: FE Analytics

Among the 11 outperformers that departed the most from their benchmark, two belong to the IA UK Equity Income sector: Schroder Income and Man GLG Income.

Schroder Income deviated the most from the FTSE All-Share, with a tracking error of 7.19.

It shares some similarities with its stablemate Schroder Recovery, but with a stronger emphasis on income generation.

A central tenet of Schroders’ philosophy is that share prices overreact and move further than is justified by a company’s fundamentals, according to analysts at Square Mile..

“When markets are low and falling, the managers are likely to be aggressively positioned as often they see short-term volatility as an opportunity to increase exposure to their preferred stocks,” the analysts said.

“We would highlight that, although this can be painful for investors in the short term, these periods may often represent times at which the strategy has the greatest opportunities ahead of it.”

Performance of funds over 10yrs (to year-end 2023) vs sector and benchmark

Source: FE Analytics

Man GLG Income has delivered higher returns over 10 years than Schroder Income, even though it has a lower tracking error.

Alpha Manager Henry Dixon also manages this strategy. He looks for undervalued companies with strong balance sheets that produce high levels of cash and have greater potential to grow their dividends. He also invests opportunistically in bonds if they are more attractively valued than a company’s shares.

Analysts at FE Investments said: “The fund is managed in a methodical manner in the way positions are bought and sold based purely on valuations and dividend growth prospects, within clearly defined limits on single positions, sectors and geographic exposures. As a result, the portfolio would have a higher turnover than its peers.”

They suggested holding the fund for a minimum period of three years as the recovery process needs time to come to fruition.