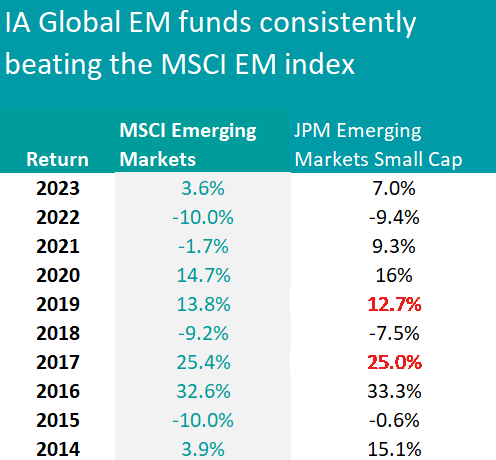

JPM Emerging Markets Small Cap is the most consistent strategy of the decade within the IA Global Emerging Markets sector, data from FE Analytics has shown.

It is the only fund out of the 98 with a 10-year track record to have beaten the sector’s most common benchmark, the MSCI Emerging Markets index, in eight of the past 10 years. It only fell short in 2019 and 2017 and only by a few percentage points, as the table below shows.

Source: Trustnet. The red highlight represents underperformance against the benchmark.

Co-managed by FE fundinfo Alpha Manager Amit Mehta and Austin Forey, the fund follows a fundamental, bottom-up stock selection process to assemble a portfolio of 86 high-conviction positions in companies that are thought to be able to grow sustainably.

Geographically, the $994m fund in skewed towards the pacific basin (where 40.6% of its assets are invested) and the Asia Pacific region (25.1%) and the Americas (14.6%).

Against the MSCI Emerging Markets Small Cap index, which serves as its benchmark, the fund’s main overweights are to Mexico (8.3%) and China (11.4%), while it has less conviction in Korea (-6.8%) and Taiwan (-4.1%).

The main sector exposures are consumer products (30.3%), telecom, media and technology (21.7%) and financials (21.3%).

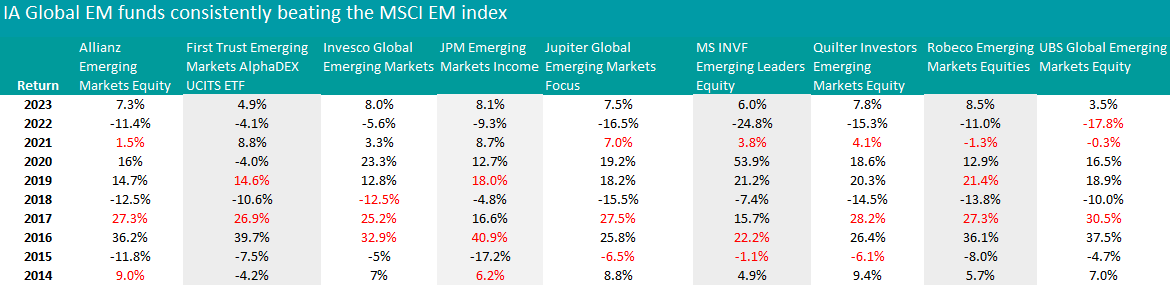

Many more funds managed to hit our requirements in seven years throughout the past decade, as highlighted in the table below.

Source: Trustnet. The red highlight represents underperformance against the benchmark.

JPMorgan AM is included again with JPM Emerging Markets Income, a strategy with a FE fundinfo Crown rating of five. It is also among AJ Bell’s favourite funds because of the “well-resourced JPMorgan analytical team” and the “equally impressive” experience of fund managers Isaac Thong, Jeffery Roskell and Omar Negyal.

Another of note is the £331m Invesco Global Emerging Markets portfolio headed by Alpha Managers William Lam and Charles Bond alongside Ian Hargreaves.

Lam and Hargreaves have been in place since 2018, when veteran fund managers Stuart Parks and Dean Newman retired. Bond joined in 2020.

It has been the best performer of the group over the period, with its 116.4% the fourth-best in the sector. The only other to more than double investors’ money over the decade was MS INVF Emerging Leaders Equity.

At £937.2m, UBS Global Emerging Markets Equity is the largest fund on the list and another strategy based on fundamentals. It stands out as a core emerging markets option for people seeking exposure to higher-quality companies that are trading below what the team deems as their intrinsic value.

Analysts at RSMR said: “This is a core fund looking to deliver index plus performance with a team-based approach. Behind the portfolio construction committee is a team of experienced industry analysts who have delivered risk adjusted outperformance on a consistent basis. The fund is best suited to an environment where fundamentals are being rewarded.”

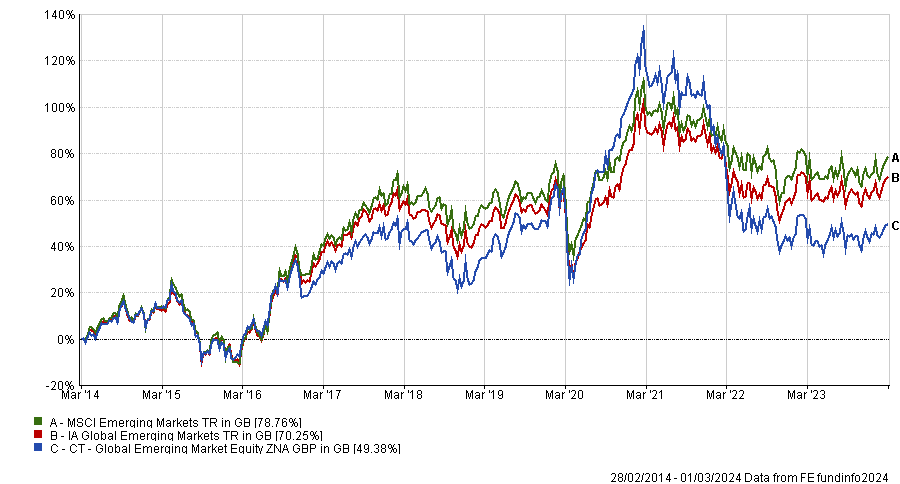

On the other side of the coin, there were three active vehicles that managed to outperform the reference index in only two of the past 10 years – CT Global Emerging Market Equity, JSS Sustainable Equity Systematic Emerging Markets and MI Somerset Global Emerging Markets.

Of the three, the Columbia Threadneedle fund is the largest, with £227.9m of assets under management. After two years of strength between 2020 and 2022, the fund’s fortunes reversed and it lagged its index and peer group, continuing a trend of underperformance that started before 2020, as the chart below shows.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

The only vehicles that did worse were passives. In particular, two never managed to beat the reference index – the Pictet Emerging Markets Index and Vanguard Emerging Markets Stock Index.

Every year for the past decade, these index trackers fell slightly behind the MSCI Emerging Markets index that they try to follow, which is largely expected as, minus fees, these funds should have little way to beat the index.

This article is part of an ongoing series on consistency. Find the previous instalments here: IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds.