Seven funds have delivered the best returns that Japanese equities had to offer in the past 10 years through high conviction active management.

Research by Trustnet identified funds with a high tracking error that beat their benchmarks and sit in the top quartile of the IA Japan sector.

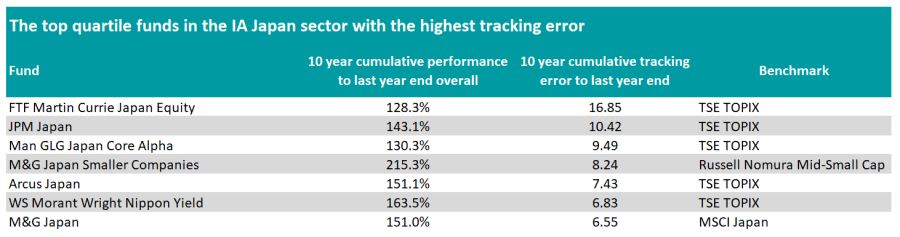

Top quartile funds in the IA Japan sector with the highest tracking error

Source: FE Analytics

FTF Martin Currie Japan Equity deviated the most from the TOPIX, which is one of the main indices in Japan.

Paul Alan Danes has managed the fund since 23 September 2022, replacing Hideo Shiozumi who retired.

The change in manager has led to the adoption of a new investment philosophy. While Shiozumi focused on domestic growth, the fund now backs companies more exposed to global growth.

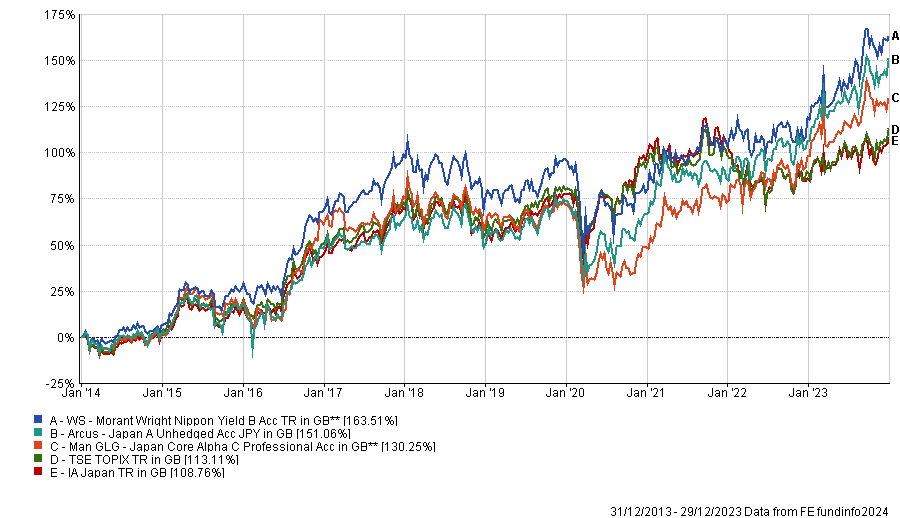

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

M&G Japan Smaller Companies delivered the highest return of all the funds in the list, up 215% compared to 120% for the Russell Nomura Mid-Small Cap index during the decade ending 29 December 2023 in sterling terms.

Managed by FE fundinfo Alpha Manager Carl Vine since September 2019, the fund invests in small- and mid-cap companies and was recently moved into the IA Japan sector, following the closure of the IA Japanese Smaller Companies last year.

Another fund managed by Vine – M&G Japan – also features among the sector’s top quartile performers that strayed from their benchmark.

The fund has a bottom-up approach, but tends to be overweight mid- and small-caps and underweight large-caps.

Speaking to Trustnet last year, Vine summarised his investment process as follows: “We're style agnostic. I'm building a portfolio that is a bit more insulated from the tremendous volatility that you see between different factors. What we're trying to do is to build a portfolio where the excess return and the risk in that portfolio are driven by the stock picking component.”

Analysts at Rayner Spencer Mills Research (RSMR) suggested using the fund as a core holding, but stressed that performance may struggle in the short-term during periods when the market only rewards growth stocks and ignores everything else.

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

Three funds with a distinctive value bias – WS Morant Wright Nippon Yield, Man GLG Japan Core Alpha and Arcus Japan – also made it into the list.

WS Morant Wright Nippon Yield has a multi-cap approach to the Japanese equity market, looking for companies with strong balance sheets, low valuations, sustainable franchises and dividend yields higher than that of the TOPIX index.

Analysts at Square Mile said: “The team are conservative and risk-averse bottom-up fundamental stock pickers with an emphasis on balance sheet and cash flow analysis.

“In addition, meeting management is a vital part of their process, as the team need to ensure they are comfortable with the management team and their attitude towards minority shareholders.

“There is inherent risk management within their approach, as the team want to identify and reduce the risk of permanent capital loss, and by focusing on businesses’ sustainability, they believe they can reduce undue risk.”

As a result of the investment approach, the fund has a structural bias towards consumer discretionary, industrials and financial sectors, but tends to be underweight or absent from the healthcare, technology and consumer staples sectors.

Analysts at Square Mile added that the fund would be suitable for investors looking to diversify their exposure to Japanese equities but stressed they will need to be able to tolerate volatility relative to the benchmark over shorter periods.

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

Man GLG Japan Core Alpha is more of a contrarian fund, with the managers building a position in a company when its share price is becoming cheaper relative to the broad market and reducing it when it gets more expensive. Unlike WS Morant Wright Nippon Yield, Man GLG Japan Core Alpha focuses on large-caps.

Analysts at FE Investments said: “The team’s contrarian approach can be a tricky one to understand, since it effectively sells its winning stocks and buys back into the losers, often companies experiencing a lot of bad short-term publicity. While this style has not been in favour for a prolonged period, the long-term record highlights the managers’ ability to, on average, outperform peers in market environments that favour stocks and sectors trading at cheaper valuations.”

On the opposite side of the investment-style spectrum, JPM Japan achieved a similar feat, albeit with a quality growth approach.

Managers Nicholas Weindling, Shoichi Mizusawa and Miyako Urabe, who are based in Tokyo, look to identify companies that, they believe, will benefit from long-term structural trends in Japan. They also avoid businesses operating in industries that are losing their competitive advantage.

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Analysts at RSMR said: “The most attractive companies in Japan are sought by considering three viewpoints: is the business creating shareholder value, can value creation be sustained and what factors impact shareholder value. From here a company is assigned an internal strategic classification of premium, quality, standard or challenged.”

They warned that the fund is more appropriate for investors seeking capital growth and comfortable with volatility.