British companies’ low valuations, exacerbated by cheap sterling, have placed them firmly in the crosshairs of international corporate buyers and private equity firms, leading to a spate of mergers & acquisitions (M&As), often at a significant premium to the current share price.

This is something investors can arguably benefit from. For instance, US investment group Elliott and Chinese online retailer JD.com recently both bid to acquire British electricals group Currys. Although both takeover attempts failed, the bidding news propelled the company’s share price to gain 13% over three months.

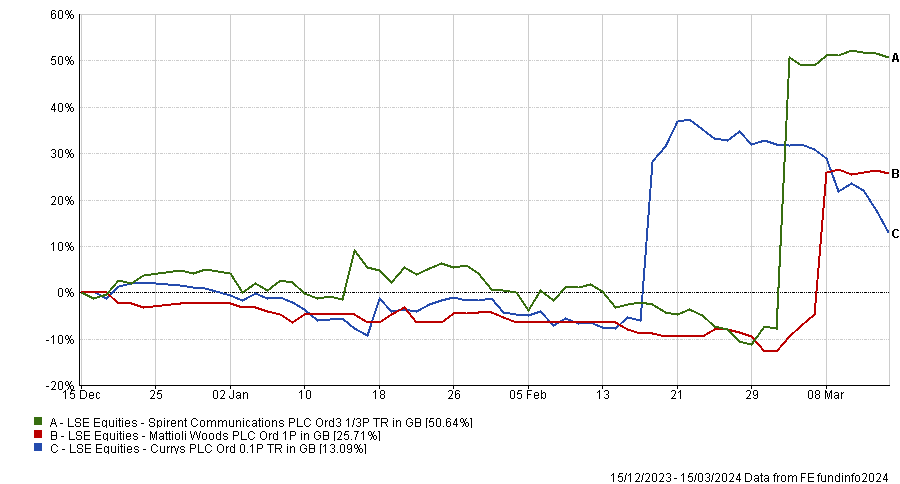

Recent dealmaking in the UK has involved wealth and advice firm Mattioli Woods and telecoms testing group Spirent Communications being acquired by private equity firm Pollen Street and US competitor VIAVI Solutions, respectively. Both target companies’ shares prices spiked as a result, as the chart below shows.

Performance of shares over 3 months

Source: FE Analytics

For investors keen on benefiting from the re-ratings those takeovers tend to spur, Trustnet asked experts which funds are best-positioned to benefit from this market dynamic.

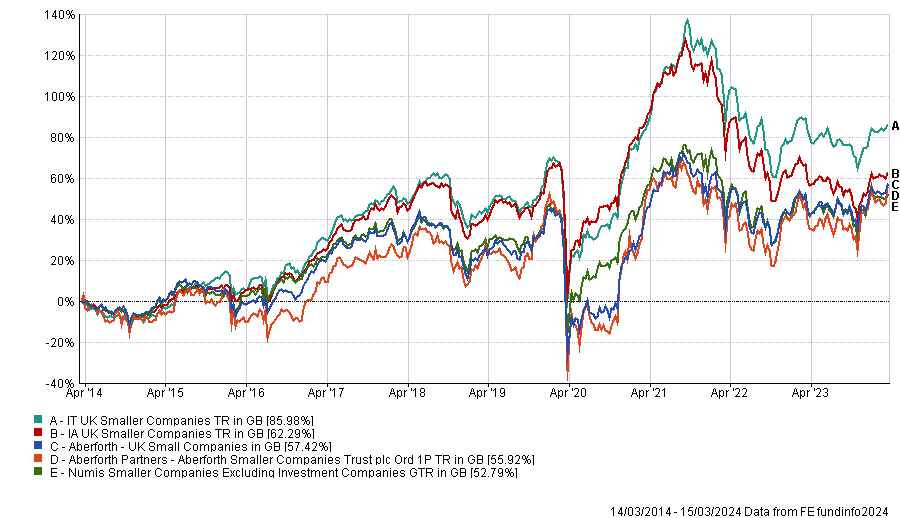

Three fund selectors – Daniel Lockyer, senior fund manager at Hawksmoor Investment Management, Rob Morgan, chief investment analyst at Charles Stanley and Gavin Haynes, co-founder of Fairview Investing – pointed to Aberforth UK Small Companies and its investment trust sibling, Aberforth Smaller Companies.

Haynes said: “The managers follow a strict value process and focus on the smaller end of the small-cap universe. In a recent meeting they explained that M&A has been stronger than expected, with private equity taking over listed UK companies at healthy premiums. The team will follow an active engagement with M&A suitors that has boosted the premiums.”

Lockyer added that the fund has received bids for several holdings each year. The latest was Wincanton, which received an approach at a 100% premium to its share price as recently as January.

Performance of funds over 10yrs vs sectors and benchmark

Source: FE Analytics

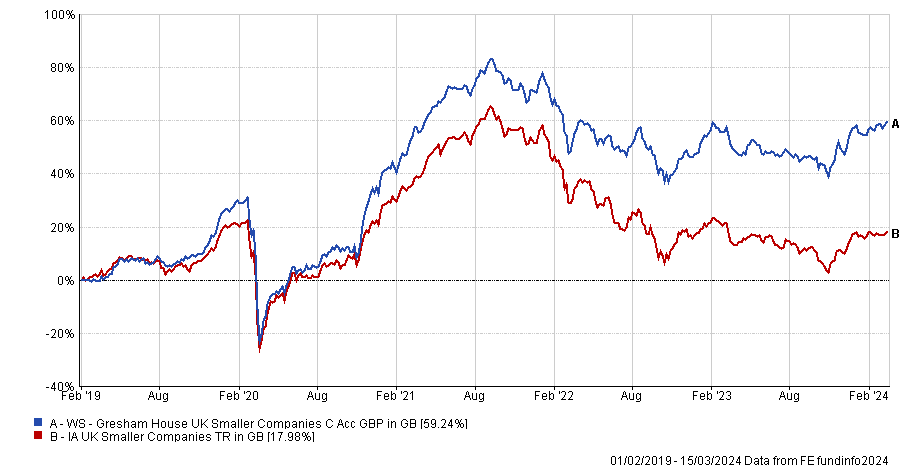

Lockyer and Haynes also see Gresham House UK Multi Cap Income as a good candidate to chase this theme.

FE fundinfo Alpha Manager Ken Wotton applies a private equity approach to public market investing and also benefits from a strong venture capital trust (VCT) team and external network supporting him.

Haynes said: “The team’s focus is on quality UK businesses and it is prepared to hold large positions of favoured businesses. M&A has been a material catalyst of returns for the fund in recent years.”

Lockyer noted that the fund is holding Mattioli Woods and has, as such, benefited from the recent acquisition by Pollen Street Capital.

Performance of fund since launch vs sector

Source: FE Analytics

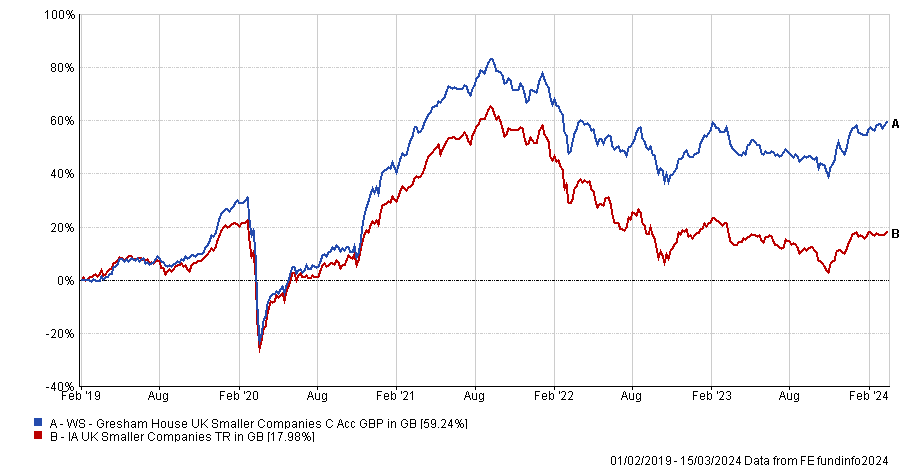

Simon Evan-Cook, manager of the VT Downing Fox funds range, also highlighted Gresham House UK Smaller Companies, another fund managed by Wotton.

Many potential acquirers of UK firms are likely to be private equity firms, he explained. As Wotton comes from that world and uses similar valuation techniques, he is well positioned to identify which companies could catch the eye of private equity firms.

Evan-Cook added: “Wotton has seen plenty of takeovers of his companies in his long history of running funds, so this looks as good a bet as any if M&A-driven returns is a theme you’re looking to chase.”

Performance of fund since launch vs sector

Source: FE Analytics

Rockwood Strategic, a £64.6m investment trust, could also benefit from M&A, according to Lockyer.

He explained: “Manager Richard Staveley and his team build significant stakes and get very active with the holding companies, typically sitting on the boards in order to drive change from the inside.

“As these companies tend to be small and sit below the radar of most UK institutional investors, a takeover is often the last resort if the public market fails to recognise the fundamental improvements made by management and Staveley.”

Performance of investment trust over 10yrs vs sector

Source: FE Analytics

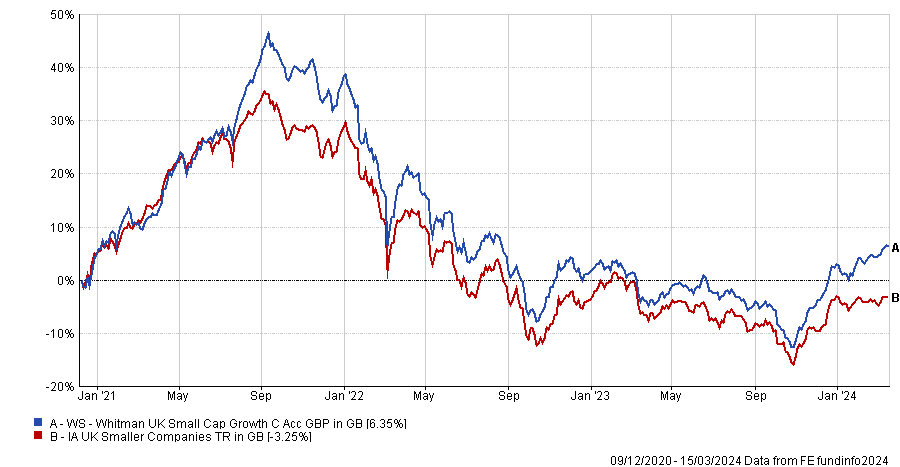

Evan-Cook also tipped WS Whitman UK Small Cap Growth.

He explained: “In the past, the higher-quality parts of the market might have been too expensive for potential acquirers, but given the widespread antipathy towards all things UK, even the great companies held within this portfolio are now available at compelling prices. You’d have to believe potential buyers are at least having a look.

“The WS Whitman UK Small Cap Growth Fund, run by Josh Northrop and Sean O’Flanagan, has recently seen a couple of their companies sell parts of their businesses for good money, which suggests they’re at least fishing in the right waters.”

Performance of fund since launch vs sector

Source: FE Analytics

Finally, Morgan tipped Fidelity Special Values, whose holdings are regularly the target of M&A activity. For instance, insurance company Direct Line recently received a £1.3bn bid from Belgian competitor Ageas.

Morgan said: “Manager Alex Wright invests in unloved companies with potential for positive change. A natural contrarian, he will seek companies at the beginning of their change, hold on as the market catches onto the improvement and sell when change has been fully priced in, recycling this capital back into new special situations.

“He also favours companies with strong balance sheets and low debt levels and tends to be skewed towards mid and small-caps, theoretically a less efficient part of the market and typically where more M&A takes place.”

Performance of investment trust over 10yrs vs sector and benchmark

Source: FE Analytics

However, Morgan stressed that almost any UK fund or investment trust could benefit from M&A activities due to the low valuations prevalent across the UK market. This is especially true for those targeting small- and mid-sized companies.