Growth stocks are outperforming once more in 2024 although Charles Stanley thinks investors should ensure they are diversifying their portfolios through some exposure to the value investing style.

Value investing – or buying out-of-favour companies that are trading at less than their true worth – has struggled to keep up with growth investing – or looking for companies with strong earnings potential and prospects for promising expansion – for much of the past decade.

Although the value style outperformed in 2022, when inflation was surging and central banks were hiking interest rates, growth has returned to the fore more recently as investors have started to anticipate rate cuts in the future. But this doesn’t mean investors should pour everything into growth, warned Charles Stanley chief analyst Rob Morgan.

“Recent market moves perhaps suggest growth stocks are starting to crack under the pressure of expectations of interest rates staying higher for longer,” he said. “It’s a reminder to investors not to have a portfolio skewed too much in one direction and to consider rebalancing as different areas perform at different rates.”

With this in mind, below are five funds picks that allow investors to cover the global market with a value approach.

Global: Artemis Global Income

Starting with global funds, Morgan pointed to Artemis Global Income. The £1.3bn fund, which is managed by Jacob de Tusch-Lec and James Davidson, is run with a bias towards value stocks for two reasons: the need to generate income and the managers’ contrarian nature, which sees them favour ‘turnaround situations’.

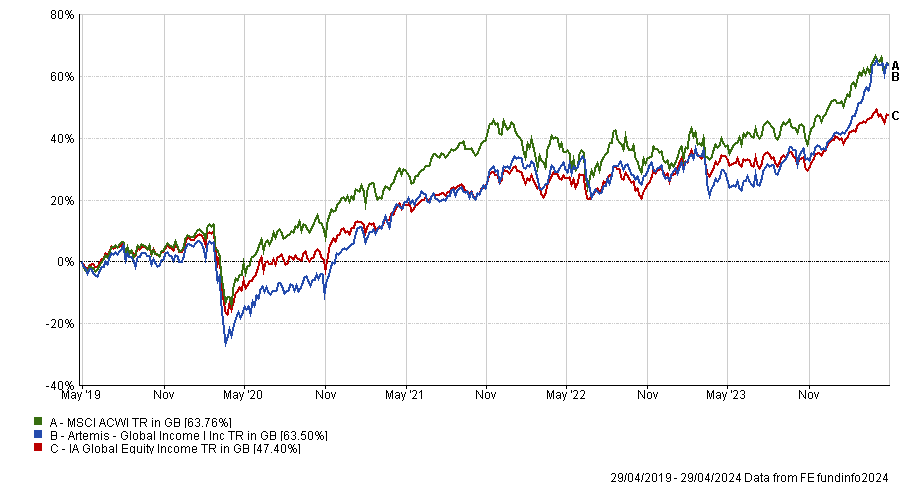

Performance of Artemis Global Income vs sector and benchmark over 5yrs

Source: FE Analytics

“It therefore provides variety and diversification within an income portfolio or an option for growth investors seeking diversification from more tech-orientated global funds,” Morgan added, as the portfolio’s largest sector allocations are to financials and industrials.

Artemis Global Income is currently in the IA Global Equity Income sector’s first quartile over one, three and five years.

UK: Man GLG Undervalued Assets

Turning to UK equities, Morgan likes Henry Dixon and Jack Barrat’s £1.4bn Man GLG Undervalued Assets fund. The managers look for companies whose share prices do not fully reflect the ‘intrinsic’ value of their current balance sheet and believe conventional equity valuation principles focus too much on forecasted future earnings.

Performance of Man GLG Undervalued Assets vs sector and benchmark over 5yrs

Source: FE Analytics

“The fund is comprised of two types of company: those trading below the managers’ analysis of their ‘replacement cost’ and those whose profit streams they consider are undervalued by the market. They aim to sell assets as they come to be priced at what they consider to be fair value and to replace them with fresh ideas in bargain territory,” Morgan explained.

Man GLG Undervalued Assets is in the IA UK All Companies sector’s top quartile over one, three and 10 years but is second quartile over five years. Presently, it has significant positions in banks, property, infrastructure, construction and insurance with energy and mining also featuring.

US: Fidelity American Special Situations

In the US, Morgan chose Fidelity American Special Situations, which favours companies that have gone through a period of underperformance and have relatively little value ascribed to their potential. Manager Rosanna Burcheri, who is FE fundinfo Alpha Manager rated, assesses a variety of company factors, including balance sheet strength, asset backing, resilience of the underlying business model and market position, in her investment process.

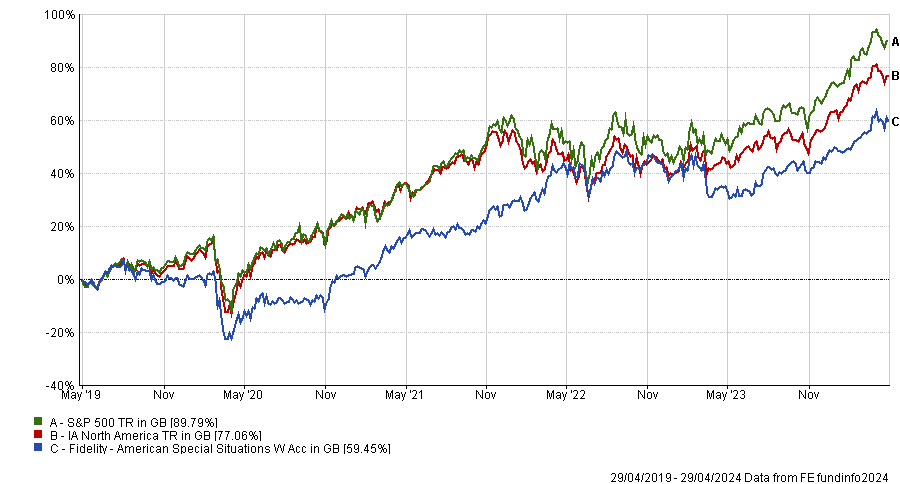

Performance of Fidelity American Special Situations vs sector and benchmark over 5yrs

Source: FE Analytics

The £633m fund is currently in the IA North America sector’s bottom quartile over five and 10 years but climbs into the second quartile on a three-year view. It’s important to remember that much of the recent past has been dominated by the rise of US large-cap tech companies, many of which are growth rather than value stocks.

“Given the value tilt of this fund we would expect it to have trouble keeping up in an environment where the market is being driven by growth stocks – as has been the case in recent years,” Morgan said. “The fund trades at a sizeable discount to the index on all traditional valuation metrics so it makes a good diversifier to a growth- or tech-orientated US fund.”

Asia: Fidelity Asian Values

In Asia, the pick is the Fidelity Asian Values trust, which was highlighted because FE fundinfo Alpha Manager Nitin Bajaj takes inspiration from legendary US investor Warren Buffett’s style of ‘value investing’, or targeting good companies run by trustworthy management teams and buying them at the best possible price.

Performance of Fidelity Asian Values vs sector and benchmark over 5yrs

Source: FE Analytics

Morgan explained that this often leads the trust to smaller companies that are not widely followed by professional investors and areas that are being widely ignored. Meanwhile, Bajaj likes stocks that display some ‘quality’ characteristics as part of his investment mantra of ‘good businesses, good people and good price’.

Fidelity Asian Values is in the IT Asia Pacific Smaller Companies sector’s second quartile over three years, its fourth quartile over five years but its top quartile over 10 years. The £374m trust is running a large overweight to China (which has struggled in recent years) and financials, consumer discretionary and industrials stocks.

Japan: Man GLG Japan CoreAlpha

Morgan’s final value fund pick is Man GLG Japan Core Alpha, which is managed by Jeff Atherton, Adrian Edwards, Emily Badger and Stephen Harget. It is currently top quartile in the IA Japan sector over one, three, five and 10 years although the Charles Stanley analyst noted that it is not suited to all market environments and can experience periods of underperformance.

Performance of Man GLG Japan Core Alpha vs sector and benchmark over 5yrs

Source: FE Analytics

Man GLG Japan Core Alpha usually performs worse compared to its peers and benchmark when reliable earnings are being prioritised by the market over low valuations. However, Morgan said it is a good option for those who want to invest in unloved Japanese companies or diversify away from the growth style more generally.

He added: “The management team believes cyclicality is a strong influence in virtually every sector of the Japanese market and outperformance can be generated by being contrarian and exploiting extremes of valuation through buying stocks that are unloved and selling them when they become more popular.”