Shrewd investors keep a vigilant eye on their funds’ returns to make sure that their active managers are justifying their fees by delivering solid results above their benchmarks.

A high alpha score (a measure of outperformance) is usually interpreted as a sign that a skilful manager is at the wheel and driving returns, rather than just being along for the ride alongside the rest of the market.

For this research, Trustnet selected funds investing in Asia with a complete five-year track record, measured their alpha scores over 61 year-long periods from January 2018 to December 2023, and averaged them – showing which funds have consistently achieved above-average returns and are therefore delivering more bang for your buck.

In the IA China sector, the fund that was most successful at beating its index was Matthews China Small Companies. With an average alpha of 16.35, this $208m strategy isn’t widely available in the UK, but can be accessed on the 7IM, AJ Bell and Transact platforms.

Co-managed by Andrew Mattock and Winnie Chwang, it returned 24.4% in the past five years, against steep losses of -29.7% for the MSCI China Small Cap index.

Source: FinXL

FSSA All China came in second place, with an average return of 6.63% above its index, the MSCI China All Shares.

The fund has a bias to mid and small-cap companies and is focused on secular growth businesses which trade at attractive valuations.

Rayner Spencer Mills Research (RSMR) analysts consider this fund “one solution to access both onshore and offshore Chinese equity markets”.

“Performance since launch has been strong, driven by stock picking and the fund has delivered outperformance in the majority of down periods in the market,” they said.

“The fund’s record, combined with the overall strength of the China team at FSSA, justify an RSMR rating with the strong research resource on China equities likely to continue to deliver good returns going forward.”

A steep step below, with half the average alpha, was the Allianz All China Equity fund, which is another good option for investors who want access to both mainland and offshore Chinese companies.

RSMR described it as a one-stop-shop fund to gain exposure to China “with a greater emphasis on the domestic economy and consumption story than traditional offshore China mandates”.

Struggling the most at beating their benchmarks were the Invesco PRC Equity and the GAM Star China Equity funds, which were relegated to the bottom of the table.

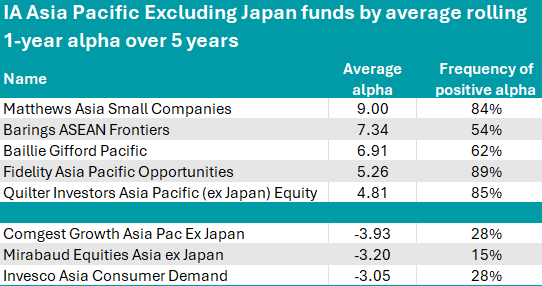

Another fund from Matthews Asia was the best performer within the IA Asia Pacific Excluding Japan sector. Managed by Vivek Tanneeru, the Matthews Asia Small Companies strategy led the table, albeit with a lower average alpha than its Chinese sibling (9 instead of 16.35). It achieved a FE fundinfo Crown Rating of five.

Source: FinXL

At 7.34, the high-conviction bottom-up mandate Barings ASEAN Frontiers came second best.

“The fund is an interesting satellite choice for investor portfolios, offering exposure to economies in the region with a still undeveloped and fast growing consumption story,” RSMR analysts said.

“The assets managed in the strategy allow scope to exploit opportunities in under researched mid and small-cap names. The experience of the managers, combined with a strong investment process, make the fund a useful addition to investor portfolios.”

Close behind was the popular £3.3bn Baillie Gifford Pacific, which has outperformed the MSCI AC Asia ex Japan index by an average 6.9% since 2018.

This is another “very distinctive” portfolio, according to RMSR researchers. Managers Roderick Snell and Ben Durrant focus on buying companies early and holding them for the long term, so that they can accelerate revenue growth by scale and network effects.

“An approach such as this is always likely to result in lumpy performance and the team is not trying to deliver consistent incremental index outperformance on a year by year basis,” RSMR said.

Comgest Growth Asia Pac Ex Japan, Mirabaud Equities Asia ex Japan and Invesco Asia Consumer Demand were unable to add value on top of their indices and had negative alpha of -3.9, -3.2 and -3.1, respectively.

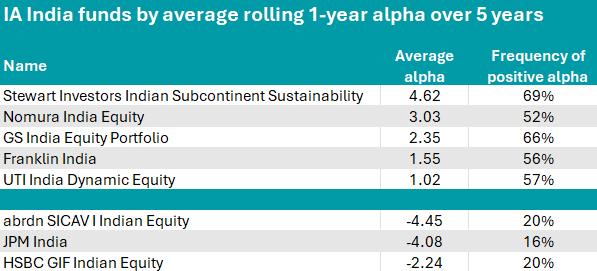

Moving over to India, active investment decisions only paid off for one-third of Indian equity funds in this study.

Stewart Investors Indian Subcontinent Sustainability, Nomura India Equity and GS India Equity Portfolio were the best performers.

Source: FinXL

FE fundinfo Alpha Manager David Gait helms the Stewart Investors fund, which was highlighted by Square Mile analysts for its absolute return mindset and for the team’s “passionate belief that the monies entrusted to them should be invested in the highest quality companies run by responsible management teams”.

“They pay particular attention to the owners and management teams in charge of such companies as they believe that a firm's ability to deliver longterm sustainable returns is closely correlated with the company's management culture,” the analysts said.

“The impact of business practices on the local community and environment is important, but the team will consider a range of factors such as the quality of a company's financial positioning and sustainability of cash flows.”

The Nomura fund is much larger, with $1.8bn of assets under management. Manager Vipul Mehta has been at the company since 2004 and in the past five years doubled investors’ money, while in the same timeframe, the average peer returned 80%.

Active decisions enabled the fund to exceed its benchmark by 3% on average in each of the rolling 61 year-long periods measured.

For abrdn SICAV I Indian Equity and JPM India, stock picking was detrimental to the funds’ performances, with negative average alphas of -4.45 and -4.08, respectively.

Finally, leading the IA Japan sector with an average alpha of 7.03 was Fidelity Japan, which was also able to maintain a positive alpha in 60 of the 61 periods in consideration.

Source: FinXL

Managed by Min Zeng, the five crown-rated strategy made investors 85% over the past five years, compared to 40.7% for the sector as a whole.

Outperforming the Russell Nomura Mid-Small Cap index by an average of 6.7%, M&G Japan Smaller Companies was the second fund to make the list. Alpha Manager Carl Vine has been in charge since September 2019. During his tenure, the fund has outperformed the average peer by 48 percentage points.

In third position was another fund with a small-cap focus, Janus Henderson Horizon Japanese Smaller Companies, led by Alpha Manager Yunyoung Lee. It had an average alpha of 4.05.

Struggling to keep up with the competition, FTF Martin Currie Japan Equity and Invesco Responsible Japanese Equity Value Discovery remained at the foot of the table.

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds, balanced and adventurous funds, European funds.