Japanese equities rose from the ashes last year, with the Nikkei 225 index reaching levels unseen in 34 years and hitting an all-time high in March 2024.

As a result of this return to form, international investors are coming back into Japanese equities while domestic savers now have incentives to invest in their own stock market.

Yet BlackRock found that investors in Europe, the Middle East and Africa (EMEA) remain significantly underweight Japanese equities.

Performance of indices (in local currency terms)

Source: FE Analytics

According to BlackRock’s research, the average allocation to Japanese equities is 3.6% within the equity sleeve of moderate risk multi-asset funds domiciled in EMEA, or 1.6% of the whole portfolio (based on an average 45% allocation to equities). That compares to Japan’s 5.4% weighting in the MSCI All Country World Index.

However, BlackRock believes that investors should double their allocations to Japanese equities to 7.3% to make the most of their attractive risk/return profile and diversification benefits. Japanese equities have a sub-50% correlation to most other regional stock markets, the manager pointed out.

“Even with the return of foreign investors in 2023, years of persistent selling means that we are only just seeing benchmark allocations returning to neutral in both iShares flow and foreign institutional investor flow," BlackRock stated.

“As Japan’s weighting in indexes rebalances in line with its higher market capitalisation, passive investors will need to continue to buy Japanese equities if they are to maintain their allocations.”

For investors looking to increase their exposure to Japan, BlackRock expects broad passive exposure will be the most popular route and suggested the iShares MSCI Japan UCITS ETF.

For alpha-seeking investors, BlackRock recommended opting for active managers who can exploit the Japanese equity market’s frequent rotations in style leadership: “Funds that combine bottom-up and top-down thematic approaches may be well-positioned to identify the winners from economic shifts. Given that Japan is a highly macro-sensitive market, a balanced and risk-controlled approach is crucial, in the pursuit of stable alpha.”

One reason for BlackRock’s bullish sentiment towards the land of the rising sun is ongoing corporate governance reform.

With the Tokyo Stock Exchange ordering companies with a price-to-book ratio below one to come up with credible plans to improve amidst the threat of a forced delisting, Japanese corporations have been prompted to either return excess capital to shareholders or to invest it.

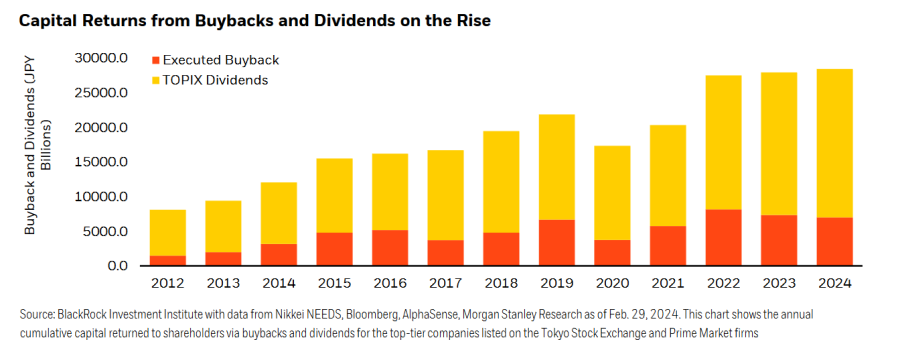

BlackRock explained: “Returning capital through share buybacks also bolsters the asset side of household balance sheets, producing a wealth effect that supports consumption. The sum of buybacks and dividends for 2023 came in at an all-time high of ¥28trn, with projections for 2024 even higher.”

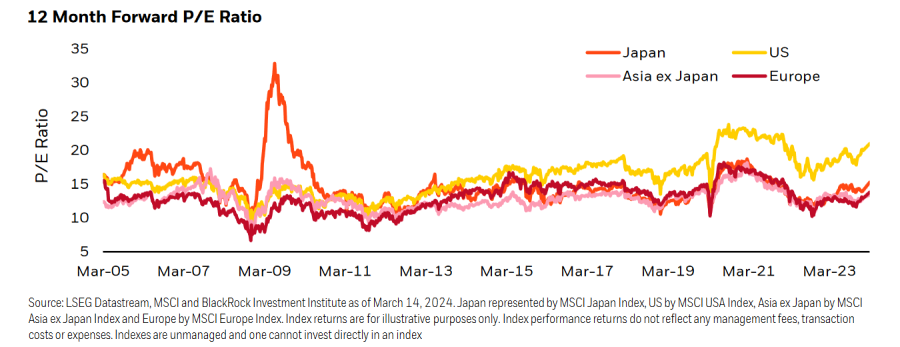

Despite Japan’s recent outperformance and resulting concerns around valuations, BlackRock believes that Japanese equities are still not expensive relative to their own history and to US equities.

The asset manager is also unconcerned about the $475bn holdings of the Bank of Japan (BoJ) in domestic assets.

“It seems unlikely to us that the BoJ would start unwinding these positions at such a pivotal moment in Japan’s economic turnaround. Our base case is that following the cessation of the BoJ’s ETF purchasing programme, it will look to gradually unwind its positions over the coming years or even decades.”

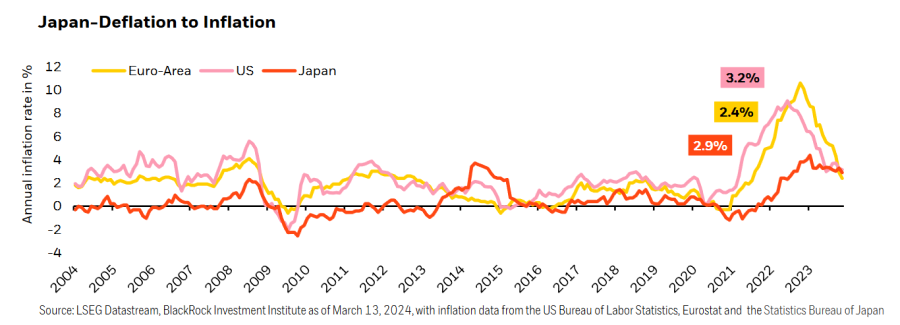

Another reason for the asset manager’s enthusiasm on Japan is the country’s macro-environment, as the BoJ is the only major central bank to have stuck to its expansionary monetary policy, driving its currency lower and attempting to embed higher inflation after decades of price stagnation.

“Now the question becomes whether the BoJ will be successful in creating a virtuous cycle between wages and prices. Signs of a meaningful structural shift are becoming more apparent as the pass-through between wages and prices strengthens, as evidenced in the most recent annual wage negotiations.

“Given such a meaningful move towards a more inflationary environment, the BoJ has ended the world’s last negative interest rate by hiking for the first time since 2007. In addition to setting the short-term rate between 0-0.1%, it also ended the yield curve control program and ceased purchases of ETFs,” the firm noted.

“BlackRock Investment Institute views this shift as a hard-won return to inflation and thinks the BoJ is unlikely to now sabotage this progress by aggressively tightening policy.”

The BoJ’s exit from the long-running negative interest rate policy may bring about an appreciation in the yen and drive volatility higher.

Yet BlackRock is comfortable with this prospect, explaining that the market has already priced it in, that the BoJ had pledged to keep monetary policy accommodative and that US rates are likely to stay higher for longer anyway.

“Most importantly, the end of negative interest rates isn’t reflective of an inflation fight. Instead, we believe it’s reflective of inflation success. With inflation showing signs of embedding closer to the 2% target, we think nominal interest rates are likely to be higher than they were during the period of deflation. We expect real rates to remain negative in Japan, in contrast to other markets.”

Therefore, the asset manager encouraged investors to look at unhedged exposures to Japanese assets and to search for opportunities away from large-cap exporters.

Finally, domestic investors also have a role to play, as their large savings could provide a structural tailwind for equities.

BlackRock explained that sustained inflation and a steepening yield curve should reduce demand for cash and low-yielding government bonds and nudge savers into the stock market. The Nippon Individual Savings Account, a tax-free investment programme that came into effect in January 2024, is a further incentive.

According to data from the BoJ, private individuals in Japan held nearly $14trn in assets at the end of March 2023. Cash and savings comprised 54%, but equities only 11%.

“Getting to comparable levels seen in the European Union of nearly 33% of individual assets in shares could see more than $1.7trn flowing into equities in coming years,” the manager estimated.