Investor demand for tech companies has skyrocketed in recent years and so have the multiples at which they trade, prompting valuation-aware managers to come out with dire warnings of dangerous hype surrounding artificial intelligence (AI).

As prices rose, so did rumours of a tech bubble that is about to burst, and experts started to say that the Magnificent Seven – the best-performing tech companies of the 2020s – could only go sideways from now on.

However, for Chris Rossbach and Katerina Kosmopoulou, managers of the J. Stern & Co. World Stars Global Equity fund, nothing could be more wrong.

In fact, Rossbach declared: “We are not in a tech bubble of any kind”.

“There are always going to be parts of the market and industries that are overvalued, but if you look at markets overall, the valuations don't seem to be excessive. Particularly in tech, they're not excessive at all.”

Semiconductor-darling Nvidia is trading on a 2025 price-to-earnings (P/E) ratio as high as 30x, but to Rossbach, that is actually “very reasonable” due to its size, scale, future prospects and the growth that it delivers.

This is particularly relevant as the managers keep an attentive eye on value and only invest in companies when prices are judged to allow for significant capital growth over five to 10 years or more. Nvidia is the top holding in the portfolio, representing 8.3% of the fund’s assets under management (AUM).

Alphabet, the parent company of Google and a leader not only in internet searches but also cloud computing, is the fifth-largest holding (4.4% of AUM) and is trading on 18x P/E, again a fair price to Rossbach.

“In fact, Alphabet is trading below the S&P 500 average multiple, so it's even below the market for the quality company that it is,” Rossbach continued.

“Big tech companies are reasonably valued compared to their prospects, and rising interest rates haven’t created a bubble but rather left many companies behind, such as many consumer, healthcare and industrial companies. We're very far away from having any kind of valuation issue,” he concluded.

The fact that mega-cap tech stocks have driven the market to its current highs does not worry Rossbach or Kosmopoulou either, because these companies’ growth is sustained. Kosmopoulou, who started her career at the time of the dot-com bubble in the early 2000s, said that is the key difference between now and then.

“Companies now are generating huge amounts of cash flow and are investing in things that effectively generate returns today. Back then, you had investments into the network, but with no visible return in sight. That's a key difference as you look back 20 years on,” she said.

Innovation and growth do not necessarily have to come from large caps either, Rossbach continued.

“One way innovation takes place is through small, innovative companies that get acquired at very high valuations by much larger companies, and these large companies can continue to prosper,” he said.

“But there's always the possibility of a disruption, especially as we get into the use cases for AI and the metaverse. It is entirely possible that some of the smaller companies will get to scale. The trillion dollar level is going to take a little bit of time, but we absolutely see many that could get into the $500bn range.”

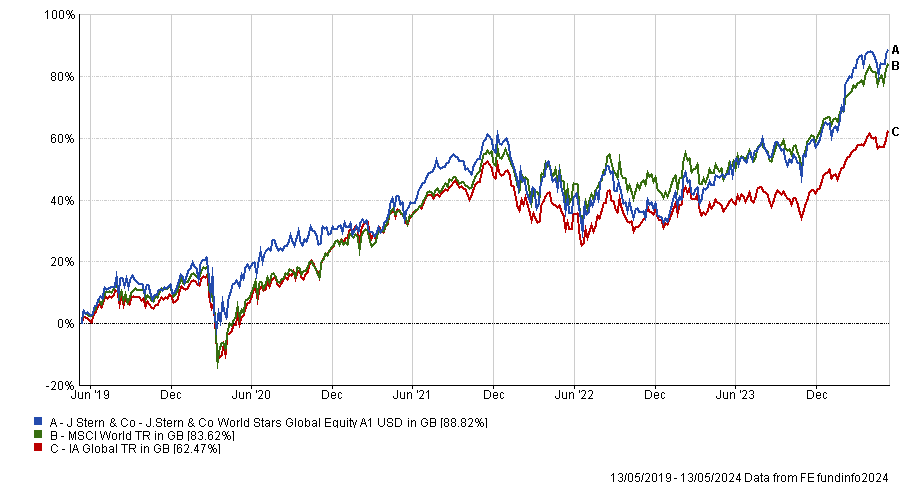

Performance of fund against sector and index over 5yrs

Source: FE Analytics

The J. Stern & Co. World Stars Global Equity fund has recently turned five and since its inception, it has been in the top-decile of the IA Global sector, maintaining its outperformance record over the past five, three and one years.

It follows a benchmark-independent process which favours companies with pricing power and strong competitive positions in growing markets.