Some investors have shunned the defence sector, considering it to be incompatible with their environmental, social and governance (ESG) principles. Yet it has been brought back to the fore following the outbreak of the war in Ukraine and conflict in the Middle East.

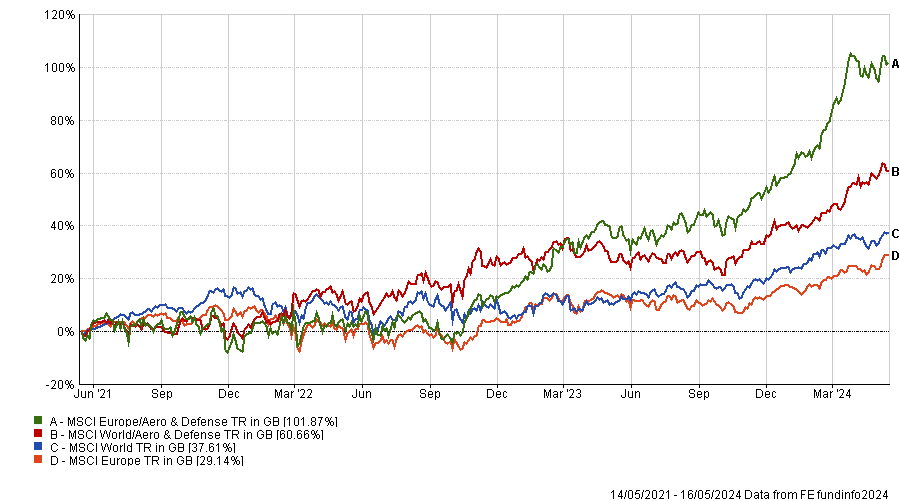

Purely from a stock market perspective, investors who ignored defence stocks have incurred a significant opportunity cost, as the sector has performed exceptionally well over the past three years, especially in Europe.

Performance of indices over 3 years

Source: FE Analytics

After such a strong show of force, the question for investors now is whether defence stocks will continue to push forward.

Graeme Bencke, co-manager of Amati Global Innovation, believes defence stocks have the potential to go higher from here, but said the initial wave is already behind us.

“Many of these companies traded on quite low valuations in the past as defence spending had stagnated, but multiples have expanded with the increase in demand as geopolitical tensions have increased,” he explained.

“This re-rating process drove the sharp rise in share prices, and price development from here will be more reliant on revenue and earnings growth.”

David Coombs, head of multi-asset at Rathbones, agreed and sees some additional tailwinds which could drive long-term returns in the years ahead.

He said: “The doctrine and needs of militaries are changing rapidly because of technological advances and the new fronts they open up. New threats require new solutions, and while large defence contractors are mostly known for the big machines they have produced in the past, a much more meaningful part of their business is now focused on cybersecurity and digital warfare.

“A kicker to this need for military investment is the potential for Donald Trump to win a second term as US President and the war in Ukraine, which both seem likely to push European members of NATO to spend more on defence.”

Alec Cutler, manager of Orbis Global Balanced, went a step further, as he believes that whoever wins the US election this autumn, the US protection guarantee is gone, which means Europe will need to ramp up its defence spending anyway.

How are managers playing the defence theme?

Defence is a broad industry made of a wide range of distinct segments. Therefore, Bencke stressed the importance of focusing on areas where spending is most likely to grow over the coming decades.

He said: “While military spending is somewhat opaque, most governments produce defence strategy-related papers outlining the direction of travel for investment.

“Outside of specific large programmes, like the US 30-year submarine fleet renewal or the 'Future Long Range Assault Aircraft' replacing the Blackhawk helicopter, there are some clear areas of attention. Most of these make intuitive sense when we think about the potential threats. Better anti-aircraft and missile defences, counter-drone weapons, improved battlefield communication and control, for example.

“However, some others are perhaps less obvious but also seeing considerable growth in funding. The nature of conflicts between powers has changed over the past decade with a much greater threat from cyber-espionage and cyber-attacks on military and civilian infrastructure. Improved intelligence gathering and secure communications means increased spending on space-based initiatives, although much of this is classified.”

As a result, Bencke holds MOOG – a provider of highly accurate electric actuators and bearing systems – which he believes is poised to benefit from space, aircraft and missile-related spending.

He also pointed to Leonardo DRS, which should profit from mobile air defence spending through its M-SHORAD platform, as well as providing new electric propulsion systems for the navy.

Another stock Bencke highlighted is technology consultancy firm Booz Allen Hamilton, which is involved in cyber defence and also assists developments with US agencies such as the CIA and FBI.

Jacob de Tusch-Lec, co-manager of Artemis Global Income, finds European defence companies attractive in spite of their recent strong performance, as Europe still has plenty of catching up to do.

“Defence is like insurance. You don’t like paying it until you need to make a claim. Since 1992 and the collapse of the Soviet Union, the world has enjoyed a massive peace dividend and the benefits of globalisation. With that has come a huge under-investment in defence," he said.

“If you look at Europe today versus 30 years ago, we’ve got fewer than 4,500 tanks compared with nearly 19,000 then. You can’t build 15 thousand tanks in a few weeks. We’ve also got half the ground attack aircraft and submarines we once had. On top of this, a lot of materials have been sent to Ukraine.”

Therefore, de Tusch Lec is bullish on Düsseldorf-based Rheinmetall, which he expects will benefit from a big demand inflection that might last for a decade.

He added: “It’s currently sitting on an order backlog of €38bn, that is five times the size of what it sells in a year. Replenishing munitions inventory is not going to happen overnight.”

Closer to home, Cutler likes BAE Systems and Rolls Royce. The former is well-positioned in warships, has content in many of the leading weapon systems such as the US stealth fighter jet F-35 and has a large share of US research and development contracts.

As for Rolls Royce, he believes it should benefit from long-term contracts, such as the one to supply new engines for the US B-52 aircraft fleet, providing the UK company with non-cyclical cash flows.

He also mentioned some defence companies in Asia, such as Mitsubishi Heavy in Japan, Hanwha Aerospace in Korea and Hindustan Aeronautics in India, because tensions are also heating up in that part of the world.

Performance of stocks over 3yrs

Source: FE Analytics

As for Coombs, he has long owned US-listed Lockheed Martin and French defence and aerospace company Thales to “mitigate the risks of a more stressed geopolitical age”.

“Both Thales and Lockheed Martin have a comprehensive suite of cyber capabilities, supported by elements of artificial intelligence, machine learning and automation to deal with the complexities of today’s deployments,” he said.

“These technologies also have civil uses, beyond the military ones that drive their creation. For example, Lockheed Martin is using its artificial intelligence capabilities and hardware to support firefighters dealing with wildfires by connecting land, air and space-based sensor and monitoring, which help predict and mitigate the spread of wildfires.”

Are defence stocks compatible with ESG?

The rapid increase in geopolitical tensions and the ensuing need for higher military spending have sparked debate on whether defence stocks are compatible with ESG principles.

For Bencke, while warfare is “abhorrent and anachronistic”, it nevertheless remains a reality.

“Sadly, the words of the Roman general Vegetius are as true today as when uttered over 1600 years ago – ‘if you want peace, prepare for war’,” he said.

“We would not endorse or invest in weapons or practices which breach modern conventions on warfare, but sadly the industry remains important for the defence of our democratic way of life.”

De Tusch-Lec agreed, adding that the legacy of the war in Ukraine is that individual countries need to revisit their priorities.

He said: “Nations are having to think about those areas at the bottom of Maslow’s pyramid of needs – the essentials in life like food, water and security. From that perspective, defence stocks are compatible with ESG and as investors we obviously avoid those companies which have links to cluster bombs or land mines.”

However, Coombs does not believe defence stocks are compatible with ESG and Rathbones does not hold them in their sustainable multi-asset funds, in which ESG is more linked to values rather than financial risk.

Finally, Cutler believes that peace is an imperative starting point to implement ESG ideals, but that defence is a necessary evil to create those conditions.

He concluded: "Peace through strength is at the base level of a society's hierarchy of needs. Peace is a have-to-have, without which higher order desires relative to the environment, society and governance will never achieve sustained traction.”