The European Central Bank (ECB) will, in all likelihood, cut interest rates next week, becoming the first major central bank to ease its monetary policy.

This move is likely to support European equities, which have suffered from the poor economic outlook for the continent as a result of the Russian invasion of Ukraine, spiralling energy costs and a slowdown in global manufacturing.

Tom Stevenson, investment director at Fidelity International, said: “Many of the headwinds for Europe are now turning into tailwinds. Inflation has fallen back rapidly towards the ECB’s target. This will enable the central bank to lead the way when it comes to interest rate cuts this summer. Monetary policy is now pulling in the same direction as supportive fiscal policy.

“Against this improving backdrop, European shares are not expensive. They trade at a significant valuation discount to their US peers. Any shift away from Wall Street could benefit Europe.”

Below, experts suggest funds that investors may want to consider to benefit from the upcoming ECB rate cuts.

BlackRock European Dynamic

Amaya Assan, head of fund origination at Square Mile Investment Consulting and Research, recommended BlackRock European Dynamic.

This fund’s unconstrained approach enables FE fundinfo Alpha Manager Giles Rothbarth to adjust the portfolio strategically, taking advantage of the current economic backdrop and the opportunities it offers.

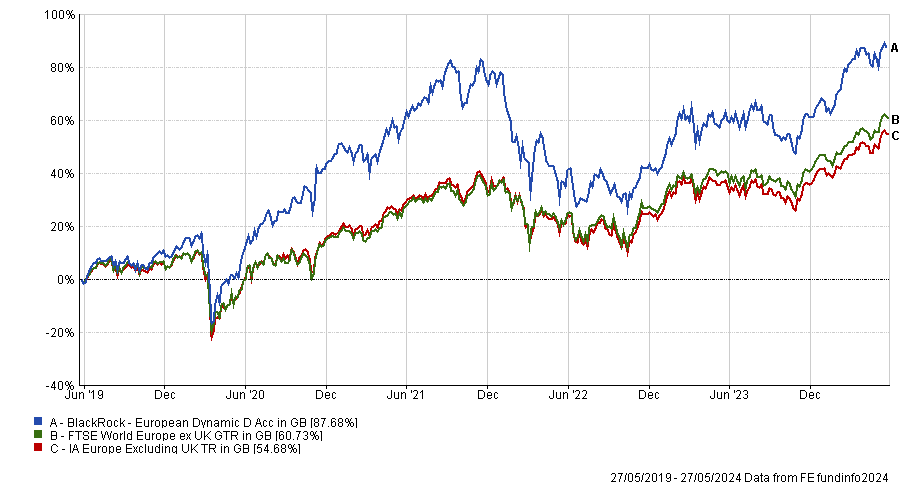

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

Assan said: “Given the flexible approach employed by the manager, the portfolio is currently tilted to be overweight cyclicality which should be a beneficiary of a falling interest rate environment.

“The manager has identified areas such as construction, where volumes are recovering from their worst levels in over a decade and share prices are likely to benefit from falling rates, having been hit hard in the prior rising interest rate environment.”

Comgest Growth Europe ex UK and Schroder European Recovery

Tom Stevenson proposed two options for investors: a fund focusing on growth and another one following a contrarian approach.

For growth, Stevenson pointed to Comgest Growth Europe ex UK, which has a quality bias and boasts some well-known names among its top 10 holdings such as Novo Nordisk and LVMH.

“The managers look for companies with established brands or unique products or technology,” he explained.

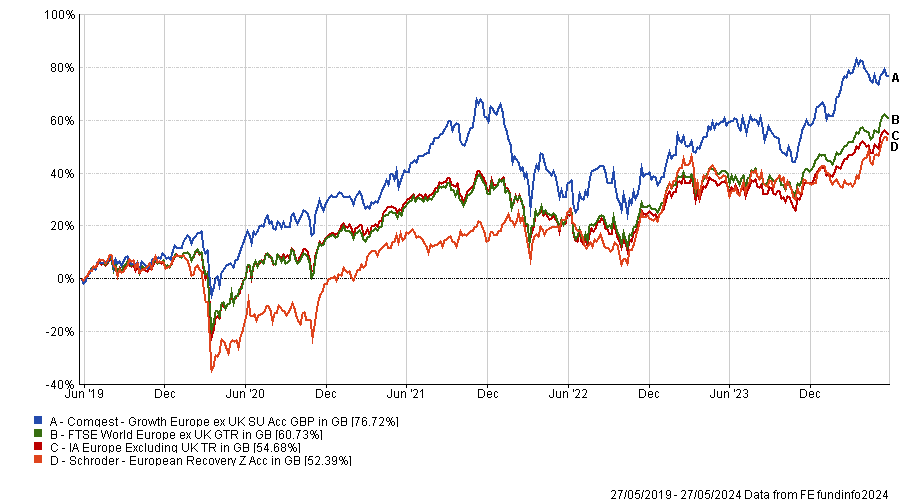

Performance of funds over 5yrs vs sector and benchmark

Source: FE Analytics

Schroder European Recovery takes a different approach, as the managers invest in companies they believe to be undervalued relative to their long-term earnings potential. Current holdings include the likes of Sanofi, BNP Paribas and Allianz.

Premier Miton European Opportunities

Small- and mid-cap stocks are theoretically more sensitive to changes in interest rates and should, therefore, particularly benefit from the ECB rate cut.

As a result, Sheridan Admans, head of fund selection at TILLIT, highlighted Premier Miton European Opportunities, managed by FE fundinfo Alpha Managers Carlos Moreno and Thomas Brown as well as Russell Champion. The fund offers exposure to European mid-caps with high-quality growth characteristics, he said.

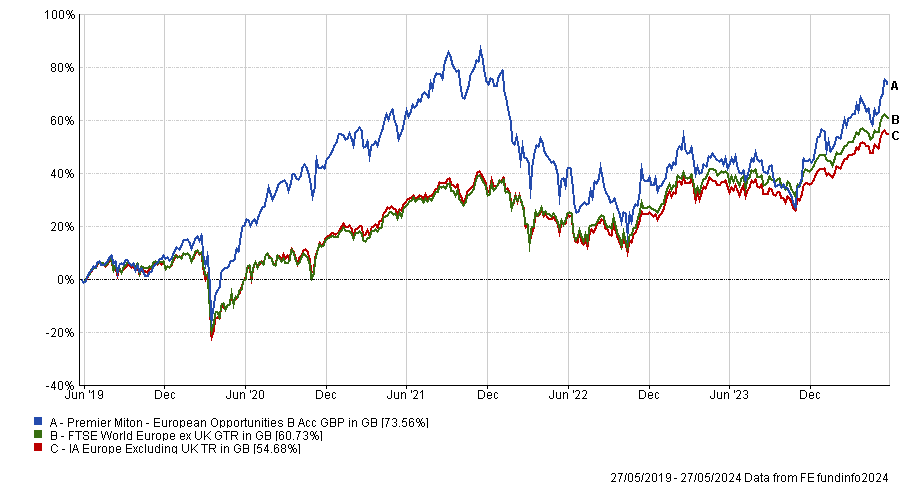

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

“The managers particularly look for companies with high returns on capital. They believe this is a key metric determining quality, sustainable returns and long-term growth. This fund has a clear focus on stocks that can deliver long-term compound growth,” Admans explained.

“The team is lean and the managers are involved in every aspect from idea generation and research to decision-making.”

Montanaro European Smaller Companies Trust and JPMorgan European Discovery Trust

For investors comfortable with exploring opportunities lower down the market capitalisation scale, Admans also suggested Montanaro European Smaller Companies Trust.

“The managers are small company specialists and run a fairly concentrated portfolio with a quality growth, bottom-up investment approach,” he said.

Admans also highlighted the focus on environmental, social and governance (ESG) factors in the trust’s investment process.

Performance of investment trusts over 5yrs vs sector and benchmark

Source: FE Analytics

Alternatively, investors could consider JPMorgan European Discovery Trust, which was tipped by Billy Ewins, fund research analyst at Quilter Cheviot, for its “solid, well-resourced team”, enhanced by JPMorgan Asset Management’s “strong research capabilities”.

Ewins said: “The trust is a differentiated offering and unique to other funds, many of which tend to bias to larger companies today.

“However, just because it is a small-cap investment trust, does not mean it doesn’t have exposure to leading brands, with several of the companies having a strong consumer presence, such as Italian coffee machine manufacturer DeLonghi.

“Crucially, however, the trust is well diversified and has exposure to other exciting business areas which are less reliant on the consumer, including geosciences in the shape of Dutch company Fugro.”