What do investments focused on the green economy and those buying into artificial intelligence (AI) have in common? They are both due to generate disappointing returns going forward, according to Django Davidson, portfolio manager at Hosking Partners.

In Hosking’s global equity strategy, Davidson’s goal is to deploy a capital-cycle approach to find hidden gems and at the same time avoid market bubbles. His verdict on green investments and AI – both are bubbles and best avoided.

The green capital deployment cycle fits the bubble description, said the manager, as it's been driven by predictions of future demand, government regulation and diktats, generating a very significant supply response.

“It all goes back to that idea of demand stories and supply facts. Investors in the green energy transition sector have been sold a cake-and-eat-it story: you can have higher returns and do good for the planet,” he said.

“But as per capital cycle theory, when management teams raise money and deploy it in the stock market, seeing valuations of two to five times the invested capital, the result is capital misallocation.”

While it goes without saying that we all want future generations to inherit a planet in the best shape it can be, capital cycle investors such as Davidson are “hardwired” to be highly sceptical of demand-based stories such as this.

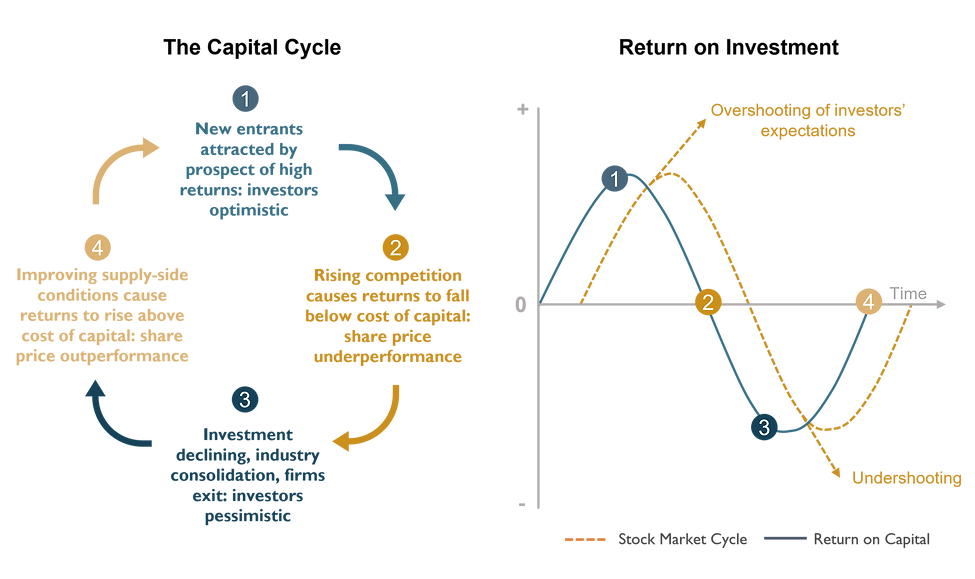

The main point that he made is that, with all else being equal, the more cash goes into an industry, the lower returns will be for that capital within that industry due to more competition, which drives down prices and lowers returns.

Cash is then pulled out, which leads to pessimism and consolidation. Then the newly-reset supply side sets up a more exciting supply-side venture and returns improve, he explained.

To further illustrated his point, the manager used the chart below, where the blue line represents the industry return on capital and the yellow line is the stock market's interaction with the underlying return on capital.

The capital cycle and returns on investment

Source: Hosking Partners

“The stock market is terrific at amplifying these cycles all the way up and on the way down and management teams are the great accomplices in this tool,” Davidson said.

“If you can deploy $1 of capital and have it valued at two or three or four times that, the incentive is to deploy capital.”

Following this model, the manager is predicting woes for three areas in particular – electric vehicles (EVs), offshore wind, and AI.

An example of the capital-cycle approach in action is what’s happening in the EV space, which Carlos Tavares, chief executive officer of automaker Stellantis, called “a bloodbath” by looking at Tesla car prices and the competitive response in China.

This is also something that has concerned Douglas Scott, co-manager of the Aegon Global Equity Income fund, who said if there was one member of the US’ ‘Magnficent Seven’ that would be under pressure it would be Tesla.

“China has 100 electric car companies. It’s a big number. China is not going to displace Microsoft or Amazon. Nvidia would be very difficult given the position it is in. Google no. Apple maybe a little bit.

“[Tesla has] 100 competitors out there and a product that the man in the street can’t afford. They just can’t afford $50,000 for a car. If you give them something similar for $20,000 they’ll take it.”

Davidson noted Chinese manufacturer BYD sells its Seagull model for even less than this – just $10,000 in China, referring to it as the “Volkswagen Polo of the EV world”.

“Even if we put on 100% tariffs, that is still $20,000 – pretty good value compared to what the original equipment manufacturers are offering,” he said.

“It's highly likely that the very significant proportion of the capital deployed into the EV space is going to see a prolonged period of lower returns as per capitals cycle theory. That's why we can see these car parks of Chinese EVs clogging up European ports,” the manager concluded.

A similar misallocation of capital went on in offshore wind companies such as Danish energy company Oersted, which was a symbol of the European green transition and at its peak was valued at 13 times sales.

That was “a terrific environment” for Oersted to raise capital, according to the manager, with the subsequent 75% fall in share price “demonstrating the value destruction that can happen because of these demand-led, futurology investment waves”.

Stock price of Oersted A/S over the past year

Source: Google Finance

That’s what investors should prepare for in the AI space as well. In fact, the increase in the level of capital being deployed by the cloud hyper-scales is “extraordinary” – a perfect run-up to disappointment.

In 2019, the invested capital of the four large hyper-scalers in cloud computing was $180bn; by the end of this year, with rolled-forward capex plans, it will be $75bn, the manager explained.

“More capital, with all else being equal, means lower returns, even in AI. Now, the response to that will be: ‘but it's a great market, there aren't very many hyper-scalers, and they'll be able to effectively collude on pricing’. I don't believe that,” Davidson said.

“I would also point out that in China, no one makes any money with cloud. It's working well for the large US companies today, but there is no preordained structure that means you must make a lot of money in this industry.”