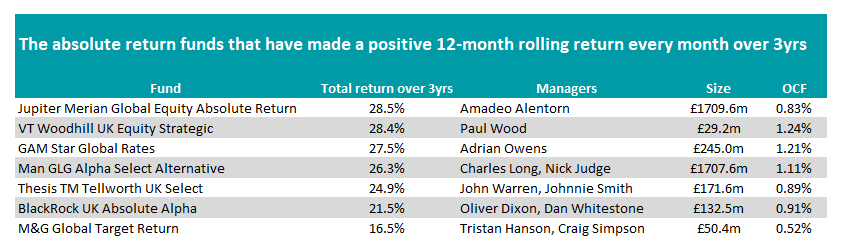

Targeted absolute return funds aim to give investors the smoothest ride possible, making a positive return while mitigating volatility. But in the past three years just seven of the 78 funds in the IA Targeted Absolute Return sector have consistently achieved positive gains, according to data from Trustnet.

We looked at the 12-month track record for these funds in each of the past 24 months – the same metric used by the trade body Investment Association to compare the funds’ performance.

Source: FE Analytics

Two behemoths of the sector appeared in the list. First is the £1.7bn Jupiter Merian Global Equity Absolute Return fund managed by Amadeo Alentorn.

A market neutral long/short portfolio, the managers invest in 466 global companies using the team’s systemic equities approach, which tilts the portfolio between different investment styles depending on the trends within the market.

This is coupled with 318 short positions, which are used to mitigate the volatility of market and gives the managers more ways to generate returns. It has been the best performer of the group, returning 28.5% over the past three years, as the below chart shows, and has the second-lowest fees with an ongoing charges figure (OCF) of 0.83%.

Performance of fund vs benchmark over 3yrs

Source: FE Analytics

The other giant of the sector on the list is the £1.7bn Man GLG Alpha Select Alternative fund managed by Charles Long. It invests primarily in UK stocks but, like the Jupiter fund, takes advantage of short positions to add alpha.

With an OCF of 1.11%, the portfolio is more expensive than its Jupiter rival and performance has lagged slightly, with the fund returning 26.3% over the past three years.

The second best performing fund on the list over the period was VT Woodhill UK Equity Strategic managed by Paul Wood, which made 28.4%, just 10 basis points below the Jupiter fund.

With £29.2m in assets under management it is by far the smallest in the group and has the highest fees, with an ongoing charges figure of 1.24%.

It is a UK equity fund, with top holdings including Shell (7.5%), AstraZeneca (7.1%) and HSBC (5.8%). Wood dampens volatility by hedging the portfolio, including being able to “fully hedge” the fund, protecting investors from downside risk. The fund has been hedged in 75% of its days since inception, according to the fund’s factsheet.

GAM Star Global Rates, run by FE fundinfo Alpha Manager Adrian Owens, was in third position with a total return of 27.5%. Unlike the strategies above, it focuses on investing in the currency and fixed income markets with no allocation to equities.

Conversely, TM Tellworth UK Select, run by Alpha Manager John Warren and Johnnie Smith, as well as BlackRock UK Absolute Alpha, headed by Oliver Dixon and Dan Whitestone, also made the list. Both are long/short strategies focusing on the UK stock market.

Analysts at RSMR recommended both funds. On the former, they said: “The fund has been managed in a pragmatic, risk aware manner, allowing returns with no market correlation since moving to Tellworth. The accurate monitoring of potential factor risks has been important to this outcome and the team has generated alpha through stock selection.”

On BlackRock UK Absolute Alpha, they noted: “The fund is run by a specialist long/short hedge fund manager who has developed a strong record in this specialist space. His flexible approach to beta (market exposure), varying net long and net short positions has also added value.

“The manager’s experience, together with the strength of the BlackRock research platform, suggest this fund should be capable of delivering positive returns in most market conditions.”

M&G Global Target Return – run by Tristan Hanson and Craig Simpson – made the lowest return of the group but still achieved the feat of making consistently positive returns on rolling 12-month periods.