If you travel to some parts of the US, you’ll see massive construction projects going on in many cities such as Columbus, Ohio and Phoenix, Arizona. From a distance, they look like football stadiums but actually, they’re six times as big as that.

What you’re looking at are new chip plants being built with government support as part of the nearshoring trend set off to revolutionise supply chains and decrease dependence from China. Intel is currently building in Columbus and TSMC in Arizona, as Markus Hansen, portfolio manager at Vontobel’s quality growth boutique, explained.

Hansen is investing in a number of stocks that should benefit from the nearshoring trend and, in his opinion, will do well come rain or shine as they are losing the element of cyclicality they used to have. Below, he highlighted four stocks that fit this trend.

Vulcan Materials: With its cyclical side disappearing, the core quality business grows

We begin in the US, where Vulcan Materials makes crushed stone, or in technical terms, aggregate. Aggregate goes into two major things: roads and construction projects.

As such, the company is benefiting both from the nearshoring trend and from the “massive infrastructure programme” taking place in the United States.

Performance of stock over the past year

Source: Google Finance

“Instead of outsourcing chips production to Asia or manufacturing in cheap countries, the Inflation Reduction Act has encouraged American technology firms to bring those back to the US, which is why you see Intel and TSMC building these huge sites,” the manager said.

“But roads and infrastructure are also key – not just from and to the new plants but beyond. Infrastructure used to be pretty bad in the whole country and that's changing. This whole bulk of spending is going to be a 10 year process, which Vulcan will benefit from.”

Traditional roadbuilding has become a much more significant part of the business because roads have to be maintained every year, which is “a nice sustainable growth business over time”.

“The stock is going from what people used to perceive as a cyclical business to more of an actually predictable growth-type businesses,” Hansen said.

“The construction side is a cyclical business, but the company is reducing its exposure there. With the cyclical part disappearing, the core quality business grows.”

Ashtead: Its new app is changing a fragmented industry

Listed in the UK, Ashtead is an example of an industrial company whose business is mostly in the US – under the name Sunbelt – and will also benefit from the construction bonanza. It makes rental equipment for construction, maintenance and services.

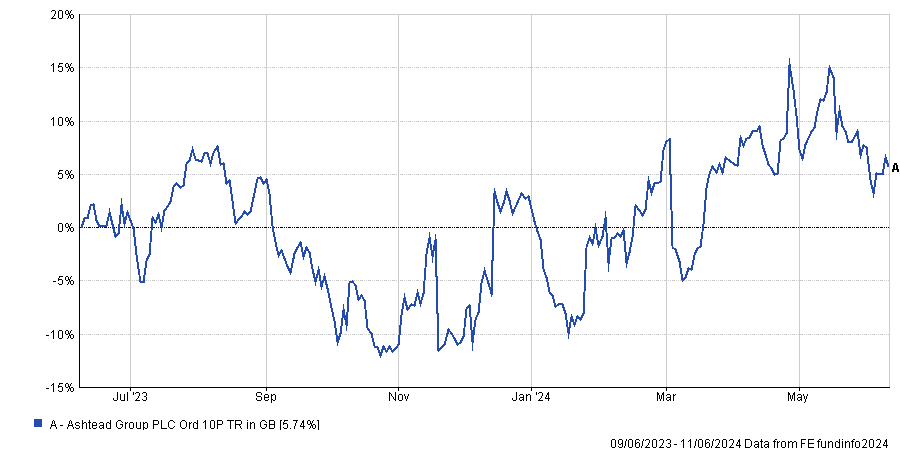

Performance of stock over the past year

Source: FE Analytics

Generally, builders don't own their equipment but rent it, and that used to be a very fragmented industry. Sunbelt bought up these renters over time and created a franchise network. Today, they operate through an app, removing the need for subcontractors.

“Sunbelt has about a 15% market share and is looking to get that to north of 20%, because there’s still a big pie, which is still very fragmented to bring in,” Hansen said.

This part of the business has some cyclical elements to it, but the manager is excited about the developing services and maintenance side.

“The beauty of that is that, if the economy collapses tomorrow, offices will be empty but landlords are still required by law to maintain things like air conditioning, lighting, electrical and fire systems,” he said.

“So as that becomes a bigger portion of the business, we get more predictability in the earnings stream.”

Vinci: Its construction business is a fantastic cash cow

For an example of a European business, Hansel picked French concessions and construction company Vinci, which operates a toll road and an airport business, but the manager was more enthusiastic about its road construction activity, which he defined “a fantastic cash cow”.

Performance of stock over the past year

Source: Google Finance

“Once you build a road, you constantly have to maintain it, and generally, once a municipality has signed with a company, you have that contract for the rest of eternity,” he said.

ASML: Its order book is going to look pretty formidable

Remaining in Europe, for a much more recognisable name, the manager highlighted ASML, the leading manufacturer of machines that make silicon wafers.

As the only company that has the extreme ultraviolet lithography (EUV) technology, it was already the top player in the sector. But, according to Hansen, now it's an even better beneficiary.

Performance of stock over the past year

Source: Google Finance

Every chip manufacturer in the West has been told they cannot use Chinese technology in their chip plants, so now there's only one provider – ASML.

“The order book is going to look pretty formidable and it has very strong pricing power,” the manager said. “The stock has done well, so it's not that the market doesn't see this, but the predictability of the order book has improved dramatically and therefore it can carry a higher rating for longer now, because it’s just sitting in a great spot.”