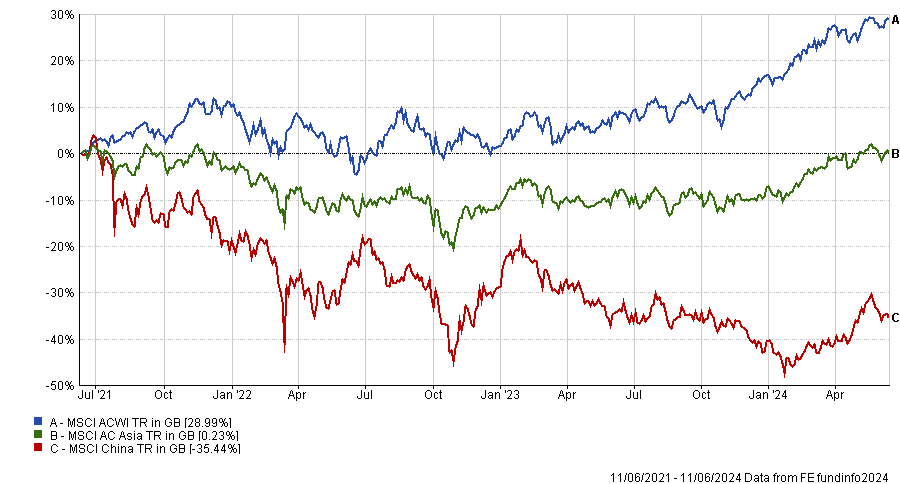

The Chinese equity market has been on a downward trajectory since early 2021 and despite short rallies in late 2022 and early 2023, and again this year, overall, the country has been mired in a savage three-year bear market. Consequently, the relative performance of Asian and emerging market equity funds has hinged upon their exposure to China.

Some funds such as Jupiter Asian Income have pulled out of China altogether while other managers have been ramping up their allocations as the stock market has gotten cheaper and cheaper. Managers at Matthews Asia, Federated Hermes and Fidelity International fall into the latter camp.

China vs Asian and global equities over 3yrs

Source: FE Analytics

Matthews Asia has been overweight China for three years in its Emerging Markets Sustainable Future and Emerging Markets Small Companies strategies. Portfolio manager Vivek Tanneeru said that after the sell-off in 2021, some Chinese companies became available at “very attractive multiples”, which is why he went overweight through stock selection.

The $3bn Federated Hermes Asia ex-Japan fund has stuck with China for even longer. Deputy manager Sandy Pei said the strategy has been overweight China and Hong Kong for as long as she can remember – apart from a brief period at the end of 2020 and in the first quarter of 2021 when the fund was underweight. The current allocation of 17% is close to the fund’s 20% cap on single country exposure.

The small-cap focused Fidelity Asian Values trust has an even higher allocation, with 31% in China and an additional 9% in Hong Kong-listed stocks as of 30 April 2024, the most it has ever allocated to those markets.

All three managers are overweight due to stock-specific opportunities. Pei said that “after a three-year bear market, everything is cheap in China”. Valuations are attractive across the board, encompassing both high quality and low quality stocks.

“We’re willing to pay £100,000 for a Ferrari but we’re equally happy to pay £5,000 for a Ford, so long as we’re getting a bargain,” she explained. “In China today there are lots of £100,000 Ferraris and £5,000 Fords.”

For instance, Tencent is the highest quality company in China and is trading on a valuation of 14-15x earnings, she said, as well as paying dividends and buying back its shares.

Pei also pointed to solid fundamentals. Last year Chinese companies achieved earnings per share growth of 15% yet the stock market de-rated due to negative sentiment. This year, she expects earnings to continue growing and hopes the stock market will not suffer any further de-rating. Many companies have strong balance sheets and cash flows, she said, and dividend yields provide downside protection.

Pei acknowledged that trade sanctions are an issue for some companies but said the market is broad, diversified and cheap, so fund managers can cherry pick companies with good risk/reward characteristics in areas where they wish to take on exposure.

Tanneeru agreed. He is “staying out of areas where there is obvious friction between the US and China”, but “embracing opportunities that come about because of these trade frictions”, such as China’s efforts to develop a localised supply chain.

He thinks that small and mid-sized companies focusing on mainstream technologies such as semiconductors will not be a focus for sanctions (which he expects to target large companies with cutting-edge technologies) and will have ample opportunities to grow their revenues.

Tanneeru views sustainability as an alpha generator in Asia and said China is at the front and centre of addressing climate change. The country has an 80-90% market share in the solar power supply chain and half of the world’s wind power capacity.

In electric vehicles, Chinese companies have taken over from Tesla to dominate the market, he said, and the world’s largest battery company resides in the country. China also has a colossal network of high speed trains which have been reducing emissions.

Asia is a world-leader in innovation and intellectual property, he continued, accounting for about two-thirds of global patent filings for the past few years. And in healthcare, “Chinese companies are among the world leaders in cutting-edge innovative cancer therapies”.

He also believes there is “discovery alpha” in finding Asian small and medium-sized companies, given 47% of the stocks in his target universe are not covered by sell-side research.

Tanneeru, who manages Matthews Asia’s Emerging Markets Sustainable Future, Emerging Markets Small Companies, Emerging Markets Discovery, Asia Small Companies and Asia Sustainable Future strategies, said his funds outperformed in 2020, 2021 and 2022 through diversified exposure to companies in different industries and factors.

The past year or so has been more of a struggle, when some stock selection decisions underperformed and China suffered a particularly sharp sell-off at the end of last year. “China accounted for well over 100% of the underperformance drag,” he said, given that performance was positive in other countries.

Going forward, China offers attractive growth compounding opportunities and attractive valuations, Tanneeru said, although he expects China’s recovery to be gradual.