Murray International and JPMorgan Global Growth & Income have built a strong following over the years and are, as such, the two largest investment trusts in the IT Global Equity Income sector.

However, the two trusts built their reputations under very different circumstances.

Murray International is managed by abrdn’s Bruce Stout, who will retire at the end of this month and is being replaced by Martin Connaghan and Samantha Fitzpatrick. Stout made a name for himself during the global financial crisis, when the trust outperformed its peers and the broader market by focusing on high-quality companies and valuations.

Since 2014, however, Murray International’s performance has been subdued, placing it in the bottom quartile of its sector over the past 10 years.

JPMorgan Global Growth & Income has established its reputation through consistency; it has outperformed its benchmark in nine of the past 10 calendar years and is by far the best-performing global equity income investment trust of the past decade. This strength has enabled the trust to absorb several competitors in recent years, such as Scottish Investment Trust, JPMorgan Elect and JPMorgan Multi-Asset Growth & Income, and to issue new shares at a premium.

Performance of trusts over 20yrs and 10yrs vs sector and benchmark

Source: FE Analytics

These contrasting experiences imply a different approach to investing: Murray International operates as a conventional income portfolio, while JPMorgan Global Growth & Income takes a more flexible approach. In the event of an income shortfall, the trust’s capital reserves are used to top up the dividend – a practice that enables JPMorgan to invest in companies with a lower yield but greater prospects for long-term capital growth.

David Johnson, analyst at QuotedData, said: “Because of their different approaches to dividends, JPMorgan Global Growth & Income is able to invest in a much broader range of lower-yielding companies such as tech firms. Therefore, it has been able to offer investors exposure to non-dividend payers while still offering a 4%-ish yield.

“Murray International, on the other hand, has a more conventional income portfolio, investing in high-dividend payers. This means that it has historically had a strong bias to value stocks, while JPMorgan Global Growth & Income has been much more malleable, currently having a growth-stock bias, including a large allocation to US technology.”

He warned, however, that JPMorgan Global Growth & Income’s flexibility to invest broadly may make the constituents of its portfolio – and therefore its performance – less predictable.

Its shares have been less volatile than Murray International’s, but that may be because JPMorgan Global Growth & Income tends to trade fairly close to NAV, Johnson added.

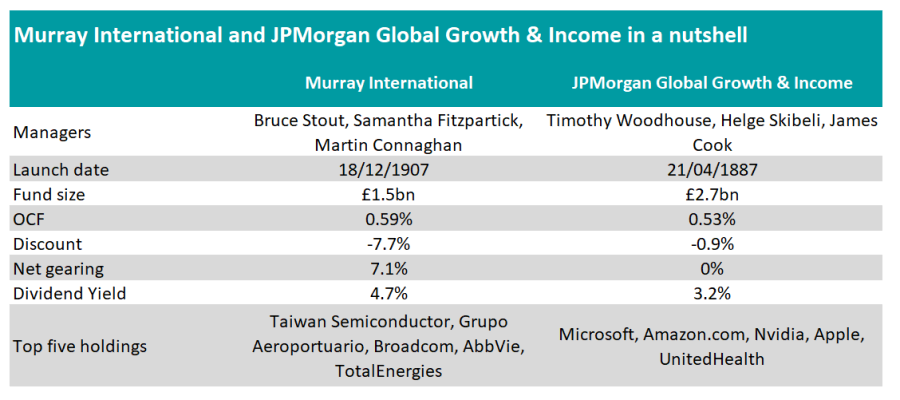

According to FE Analytics, JPMorgan Global Growth & Income is currently trading on a 1.3% premium and has had a volatility of 15.4% over the past five years. By comparison, Murray International’s trades on a 7.7% discount and it has experienced a volatility of 19% over the same period.

Although the aforementioned factors may seem to favour JPMorgan Global Growth & Income, investors should note that it currently has a lower yield of 3.2%, compared to Murray International’s yield of 4.7%.

Moreover, the fact that JPMorgan Global Growth & Income tends to trade close to NAV or even at a premium means it is particularly exposed to derating risk, according to Mick Gilligan, head of managed portfolio services at Killik & Co.

“Because of the derating risk (the discount was as wide as 15% back in 2016) investors should take an extra-long term view with this one,” he cautioned.

Which trust should you pick?

Albeit belonging to the same sector, the two investment trusts are distinct propositions that cater to different types of investors.

For instance, JPMorgan Global Growth & Income has a stronger track record of providing a balanced combination of capital growth and income. Therefore, it would be a more suitable option for investors seeking a blend of these two elements.

Gilligan added: “JPMorgan Global Growth & Income has more of a growth bias and should be attractive to investors that believe interest rates have peaked and are likely to decline in the months ahead.”

Conversely, Murray International is likely to be a better fit for investors who prefer a value-focused approach and a more conventional income strategy, where dividends directly reflect portfolio income generation, according to Emma Bird, head of investment trusts research at Winterflood.

“In addition, Murray International trades on a considerably wider discount, so is more likely to appeal to investors looking for a value opportunity,” she added.

Source: FE Analytics

Nonetheless, Bird’s preference is for the JPMorgan investment trust, due to its “impressive long-term performance record”, which she expects to continue.

“With a market cap of £2.7bn, the fund offers a large, liquid, low-cost vehicle, with an ongoing charges ratio of just 0.50%, the lowest in the Global Equity Income peer group,” Bird said.

“In our opinion, the fund’s enhanced dividend policy, which targets an annual payment of at least 4% of the previous year-end NAV, makes good use of the investment trust structure, and the fund currently provides an historical yield of 3.4%.”

Johnson favours JPMorgan Global Growth & Income as well. He also mentioned sector peer Invesco Global Equity Income, which he said now follows a very similar approach, following a recent restructuring.

However, Gilligan picked Murray International, which is his preferred trust in the sector. His choice is primarily due to the larger discount, but also partly because value stocks look particularly cheap relative to growth stocks.

“Murray International has a value style and so is better suited to investors that are less optimistic about the path of interest rates. It is also attractive for investors that need a growing income, given its record of dividend increases and scope to continue them,” he concluded.