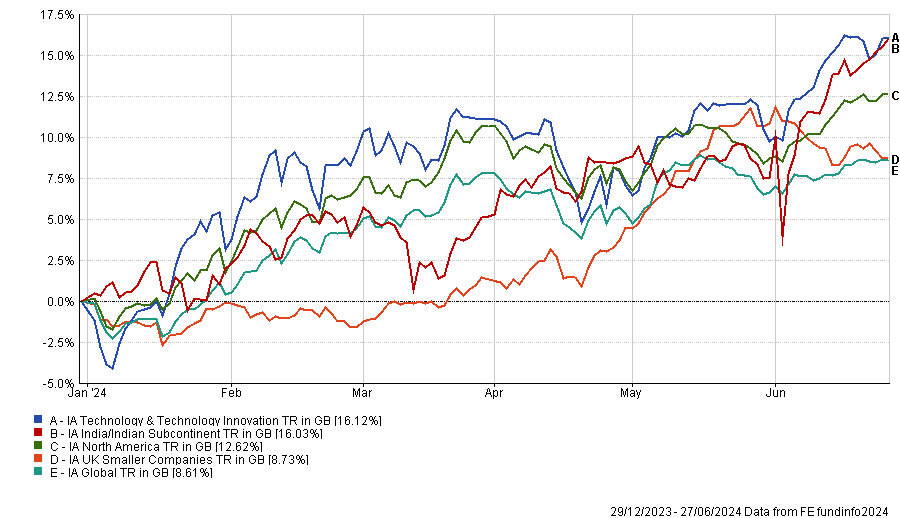

IA Technology & Technology Innovation has been the best-performing Investment Association (AI) sector since the beginning of the year as stocks related to the artificial intelligence (AI) trend, such as Nvidia, have continued to outperform.

Although there are fears that AI might currently be in a bubble, leading to comparisons with the dot-com crash of the late 1990s, some opinions suggest the AI megatrend is just getting started.

But technology is not restricted to AI, with other developing trends in this sector, such as the Internet of Things, cybersecurity and robotics, for investors to get excited about.

Performance of best-performing sectors YTD

Source: FE Analytics

Below, experts suggest funds for investors seeking dedicated exposure to a sector with multiple layers of secular growth, while also warning that such exposure comes with greater risks.

Polar Capital Global Technology

David Holder, senior investment research analyst at Square Mile Investment Consulting and Research, picked Polar Capital Global Technology, which he called an “attractive proposition” for long-term investors.

The fund is managed by Nick Evans, Ben Rogoff, Xuesong Zhao and Fatima Lu, who aim to identify disruptive trends and the companies poised to benefit from them.

AI is the major theme running across the portfolio, with Rogoff describing himself and his colleagues as “AI maximalists”. As a result, more than 90% of the portfolio is exposed to companies the managers see as AI enablers in areas such as cloud computing and semiconductors as well as to beneficiaries and early adopters of AI.

Earnings growth is a key parameter for the managers, as they believe it drives share price appreciation, while they also include macroeconomic considerations in their investment process to help identify new themes within the industry.

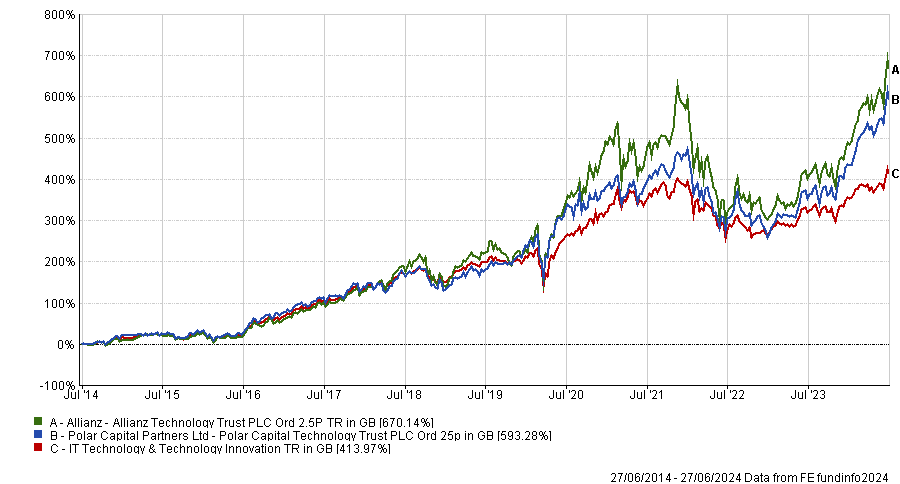

Performance of fund over 10yrs vs sector

Source: FE Analytics

Holder added: “They favour firms with established, profitable business models, high barriers to entry and tight management cost controls, which they believe are poised for rapid growth as they enter mainstream use.

“They adopt a bottom-up approach to stock selection and attend up to 1,000 company meetings each year as well as industry conferences to ensure they keep abreast of the rapidly changing technology landscape.”

Investment trusts

Dan Coatsworth, investment analyst at AJ Bell, also commended the fund managers and their investment strategy.

However, he pointed to the investment trust version of the fund, Polar Capital Technology Trust, as it is trading at a roughly 10% discount.

Dzmitry Lipski, head of fund research at interactive investor (ii) also pointed to Allianz Technology Trust, which has been managed by Mike Seidenberg since 2022.

Similar to Polar Capital Technology Trust, Allianz Technology Trust trades at a discount of approximately 10%. Both funds are also similar in terms of fees, each charging around 0.80%.

Performance of investment trusts over 10yrs vs sector

Source: FE Analytics

Recently, a panel of experts indicated a preference for Allianz Technology Trust as it holds more off-benchmark positions and because the team is based in Silicon Valley, California, where the action takes place.

Targeted approach

Lipski also pointed to iShares Automation & Robotics ETF for more adventurous investors seeking exposure to a specific area of the technology sector.

The exchange-traded fund (ETF) tracks the STOXX Global Automation and Robotics index, composed of companies that generate significant sales from robotics and automation across developed and emerging markets.

The five largest country weights are the USA, Japan, Germany, Taiwan, and the UK, while top holdings include Nvidia, SAP, Workday, Keyence and Autodesk, among others.

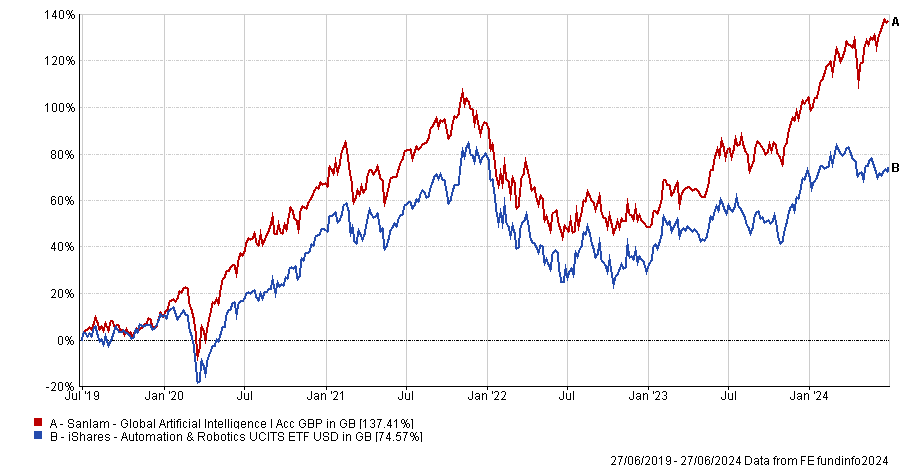

Performance of funds over 5yrs

Source: FE Analytics

For investors who specifically focus on AI, Sheridan Admans, head of fund selection at TILLIT, mentioned Sanlam Global Artificial Intelligence. This fund not only invests in the theme but also incorporates AI into its investment process.

Admans said: “By leveraging a bespoke AI tool developed in partnership with Orbit Financial Technology, fund managers can uncover valuable investment opportunities across a diverse range of sectors.”

About half of the portfolio is composed of technology companies, with the remainder invested in stocks from other sectors that utilise AI to enhance their products or services.

Stick to global

Experts also emphasised that it is possible to capture the effects of technological development while benefiting from diversification through global growth funds.

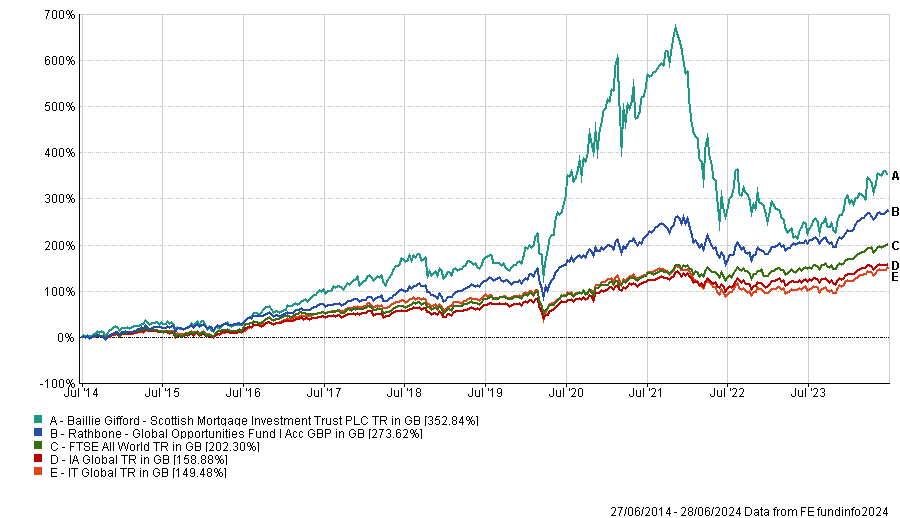

For instance, Lipski and Admans both highlighted Scottish Mortgage’s emphasis on technology-driven businesses.

Admans said: “This long-term strategy is particularly attractive for investors looking to capitalise on transformative technological advancements and disruptive innovations.

“By including private technology companies that are typically inaccessible to retail investors, Scottish Mortgage offers unique exposure to some of the most dynamic and forward-thinking enterprises globally.”

Performance of funds over 10yrs vs sectors and benchmark

Source: FE Analytics

Tom Stevenson, investment director at Fidelity Personal Investing, picked Rathbone Global Opportunities Fund, which counts Nvidia and Microsoft as its top two holdings. This positioning reflects the belief of managers James Thomson and Sammy Dow that AI could drive half of all incremental GDP growth over the next decade.

Stevenson said: “The companies they invest in can be of any size, although their sweet spot is mid-cap growth stocks in the developed markets. The managers’ speciality is spotting these businesses before they become household names.”

Admans also highlighted Blue Whale Growth. The fund focuses on quality large- and mega-cap companies with a long-term growth trajectory.

Technology accounts for 41% of the portfolio, while North America – the home of the world’s leading tech companies – makes up 75% of the geographic allocation.

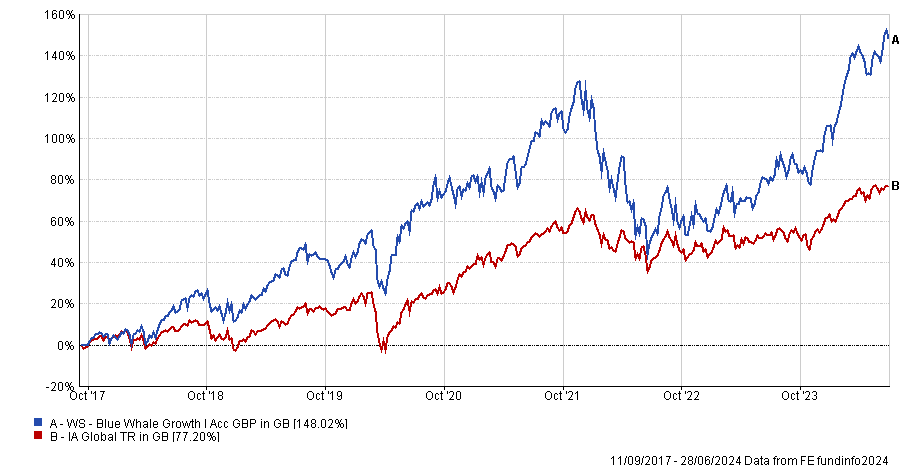

Performance of fund since launch vs sector

Source: FE Analytics

However, Lipski reminded investors that the technology sector is dominant in indices, meaning that passive and benchmark-aware active funds will already be heavily exposed to the sector.

He concluded: “Investors looking for technology exposure should therefore take into account not only their specific objectives and attitude towards risk, but also the type of strategy they are buying and given its unique importance, their view on FAANG stocks.”