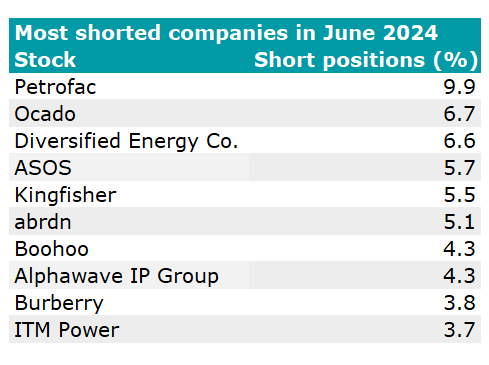

Grocery delivery company Ocado was the UK’s second-most shorted stock in May and June 2024, while energy facilities operator Petrofac has been the country’s least popular stock since late last year.

Ocado thrived while consumers were stuck at home during lockdown with share price gains of over 77% in 2020, but it has struggled since then as people returned to doing their supermarket shopping in person.

Ocado was the worst performing stock in the FTSE 100 in 2022, sinking 63.2% and making a net loss of £501m. Its downward trajectory has more or less continued since then, despite a few rallies that proved short-lived, culminating in the online grocer dropping out of the FTSE 100 last month.

The share price took a further blow in June 2024 when Ocado revealed that Canada’s second-largest food retailer, Sobeys, had ended its exclusivity deal and paused plans to open a robotic warehouse.

Ocado’s share price vs FTSE All Share over 5yrs

Source: FE Analytics

Short-sellers profiting from Ocado’s demise include BlackRock, AHL Partners, Arrowstreet Capital, D1 Capital Partners, Gladstone Capital Management and Systematica Investments, according to data disclosed to the Financial Conduct Authority last month.

Dan Coatsworth, investment analyst at AJ Bell, said: “There is always a ‘will it, won’t it’ element in trying to second guess what Ocado is doing strategically. On paper, the business model is focused on winning more grocery clients to power its online shopping warehouses, while also trying to improve the performance of a joint venture with Marks & Spencer.

“In reality, progress has been lumpier than gravy in a school canteen. Ocado always seems to struggle to sustain momentum.”

Elsewhere, hedge funds continued to bet against power companies and clothing retailers, with Petrofac, Diversified Energy Company and ITM Power all featuring amongst the UK’s 10 most shorted stocks alongside ASOS, Boohoo and Burberry.

Source: Financial Conduct Authority

Short sellers closed out some of their positions against Hargreaves Lansdown, however, as the investment platform’s share price surged on the back of a bid from a consortium of private equity funds led by CVC Capital Partners.