Investors should ensure their bond funds are taking on duration in the current market, according to FE fundinfo Alpha Manager Richard Woolnough, who believes this could be the “final chance” to “deploy cash” in the trade.

It is the second time this opportunity has presented itself in the past year. The first time investors should have considered adding duration was in October 2023, when US 10-year Treasuries surged to 5% on the back of higher-than-expected inflation. This caused investors to rethink their interest rate predictions from several rate cuts in 2024 to much fewer.

“Back then, the surge in yields – and subsequent decline – occurred rapidly, leaving many investors behind,” said the manager of the M&G Optimal Income fund.

Since that sharp market movement, investors have largely sat in cash, he noted, hoping for more favourable entry points, but now is the time to take action.

“While the market doesn't often offer second chances, it seems that investors may have another opportunity this time around,” said Woolnough.

His rationale for adding more duration has three parts. The first is that rate cuts have “almost been priced out”. He suggested that markets have been changing between the “extremes” of many rate cuts to none at all, rather than following a more logical path.

“While the Fed has maintained a consistent message, market participants have been mainly erratic, shifting from expectations of ‘higher for longer’ rates to forecasts of multiple rate cuts in 2024-25,” he said.

Currently, markets are back on the ‘higher for longer’ train, with almost no cuts priced in this year. While this could change, “most of the negative news has already been factored into the market”, Woolnough said.

Second, the recent US inflation upside surprises have “spooked some investors” into believing that strong price rises could be back on the cards.

However, he is unconcerned by this as money remains tight both at a government and an individual level, meaning the opportunities to increase prices will be lower.

“At present, money supply is still contracting and it would seem that we are now moving into an environment of ‘too little money chasing too many goods’,” the M&G Optimal Income manager said.

This should be disinflationary – something that is positive for long-duration assets – and although inflation may prove “sticky”, Woolnough said there was “no need to be overly concerned”.

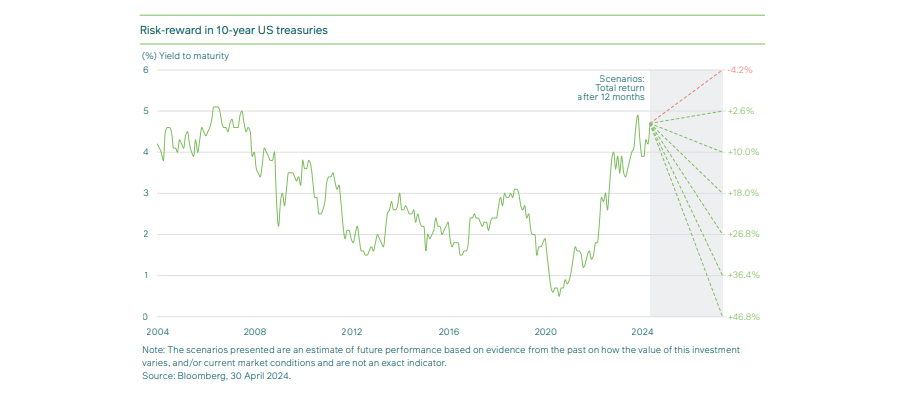

The final argument is based around risk and reward. The downside risks of owning long-duration government bonds “appears limited”, he said, while they potentially offer double-digit returns going forward.

This is shown in the chart below, which uses M&G’s internal scenarios of expectations for total returns of 10-year US government bonds.

“In summary, we believe the opportunity to deploy cash and increase duration in investment portfolios has re-emerged as a result of a unique rates-inflation dynamic, one that has largely come from the central bank response to the Covid pandemic of 2020-21,” said Woolnough. “This may be the final chance for investors to take advantage of the situation, however.”