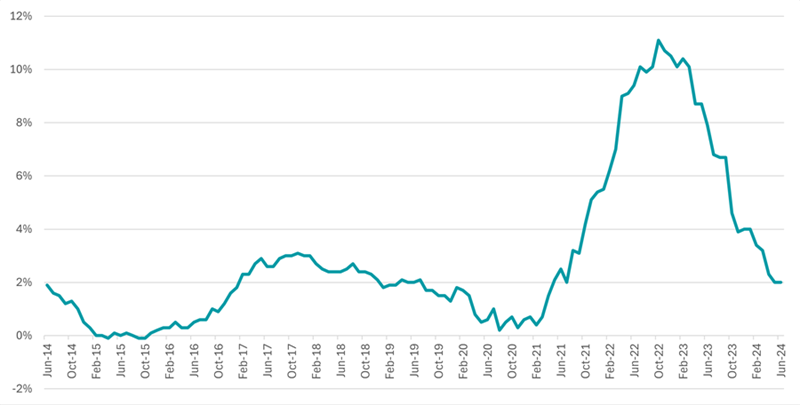

Headline inflation in the UK flatlined in June, with consumer prices up 2% from the previous year.

This matches last month’s figures, when inflation hit the Bank of England’s target for the first time in three years. However, this stability may be disappointing, as expectations were for a softer print below the 2% target.

Laura Suter, director of personal finance at AJ Bell, said: “A fall to 1.9% had been predicted but didn’t materialise, putting the decision about a potential interest rate cut on 1 August finely in the balance.

“The odds are around 50:50 as to whether we will see the first rate cut from the Bank of England next month – a move that would be welcomed by the public and the new government alike.”

UK CPI inflation over 10yrs

Source: Office for National Statistics

Moreover, services inflation overshot the Bank’s target, remaining steady at 5.7%, while core inflation (excluding food and energy) came in at 3.5%.

Derrick Dunne, chief executive of YOU Asset Management, commented: “The trouble with these measures is they are more embedded areas of price shifts in the economy which can reinvigorate the headline rate were they to stay higher for a longer period of time.”

A further indicator of whether the Bank of England may start its rate-cutting cycle will be tomorrow’s employment data, which is forecast to show a slight decline in wage growth from 6% to 5.7%.

While there are questions about whether the Bank will cut rates at all this year, Dunne believes it will have to balance inflation figures with the pressure on households with mortgages.

He said: “In all likelihood rates will come down, even if the labour market continues to show signs of strength tomorrow. It just might be a slower path than was expected at the beginning of the year.”