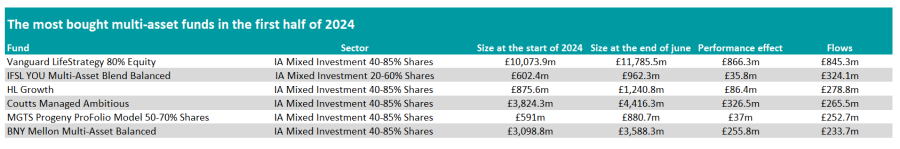

Only six multi-asset funds across the IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares and IA Flexible Investment sectors received more than £200m of inflows in the first half of the year.

Vanguard LifeStrategy 80% Equity was by far the most sought-after multi-asset fund during that period, with investors pouring £845.3m into this popular low-cost passive investment solution.

In addition to inflows, the fund's performance in the first six months of the year enabled it to grow its assets under management by £866.3m

Vanguard LifeStrategy 80% Equity now boasts a size of £12bn, making it the second-largest fund in the IA Mixed Investment 40-85% Shares sector after its stablemate, Vanguard LifeStrategy 60% Equity.

IFSL YOU Multi-Asset Blend Balanced came in a distant second, with investors adding £324.1m to the fund.

It was the only multi-asset fund outside of the IA Mixed Investment 40-85% Shares sector to attract more than £200m of inflows.

Source: FE Analytics

Investors also contributed between £200m and £300m to HL Growth, Coutts Managed Ambitious, MGTS Progeny ProFolio Model 50-70% Shares and BNY Mellon Multi-Asset Balanced.

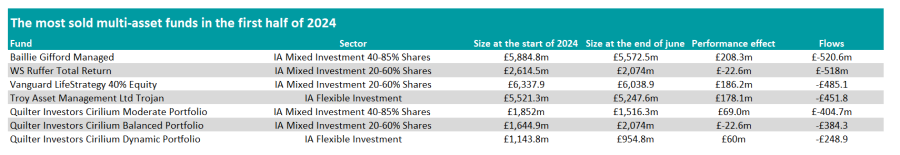

At the other end of the spectrum, Baillie Gifford Managed shed the most in client assets, as investors withdrew £520.6m.

The fund sits in the top quartile of the IA Mixed Investment 40-85% Shares sector over 10 years, but it is the sector’s worst performer over three years.

Like most Baillie Gifford funds, it follows a distinctive growth style that thrived in the post-global financial crisis era but suffered when inflation and interest rates began rising in the second half of 2021.

WS Ruffer Total Return also shed more than £500m in the first half of the year.

Ruffer took a bearish view on equity markets that did not materialise, which dragged on its performance.

However, the fund’s five-year returns were better, placing it in the top quartile of the IA Mixed Investment 20-60% Shares sector.

Trojan, which focuses on capital preservation, lost £451.8m in the first half of this year, as its low allocation to equities proved detrimental.

Deputy manager Charlotte Yonge explained her wariness toward equities at the beginning of the year, noting that they were not priced for the recession she was expecting.

The fund has a significant tilt toward fixed income but also holds gold, which has surged due to election uncertainties in 2024, wars and economic instability. As a result, the fund’s performance helped to compensate for the outflows.

Source: FE Analytics

Investors also withdrew £485.1m from Vanguard LifeStrategy 40% Equity, the largest fund in the IA Mixed Investment 20-60% Shares sector.

Finally, three funds from Quilter Investors shed more than £200m in the first half of the year.