Investors have been making extensive use of cheap passive funds to increase their exposure to regional equity markets during the first half of this year, according to fund flow data from FE Analytics.

BlackRock’s iShares range of passive regional strategies proved the most popular with investors, who funnelled £1.4bn apiece into iShares Continental European Equity Index (UK) and iShares North American Equity Index (UK) during the first six months of this year.

They also ploughed £925m into iShares Japan Equity Index (UK), £353m into iShares Pacific ex Japan Equity Index (UK), and almost £200m apiece into iShares Emerging Markets Equity Index (UK) and iShares Emerging Markets Equity ESG Index (UK).

European equities

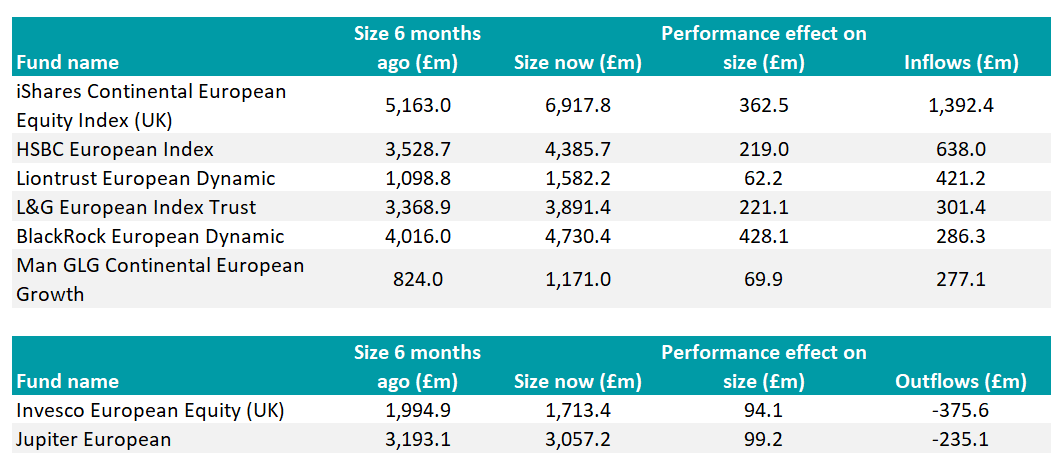

Investors increasing their exposure to Europe ex-UK chose passive funds managed by HSBC Asset Management, Legal & General Investment Management and Vanguard.

The most popular active funds were Liontrust European Dynamic, BlackRock European Dynamic and Man GLG Continental European Growth, which took in £421m, £286m and £277m, respectively.

Of these, only Liontrust European Dynamic beat the average fund in the IA Europe Excluding UK sector over three years, losing less than the others in the 2022 bear market. All three funds beat their peer group over five and 10 years.

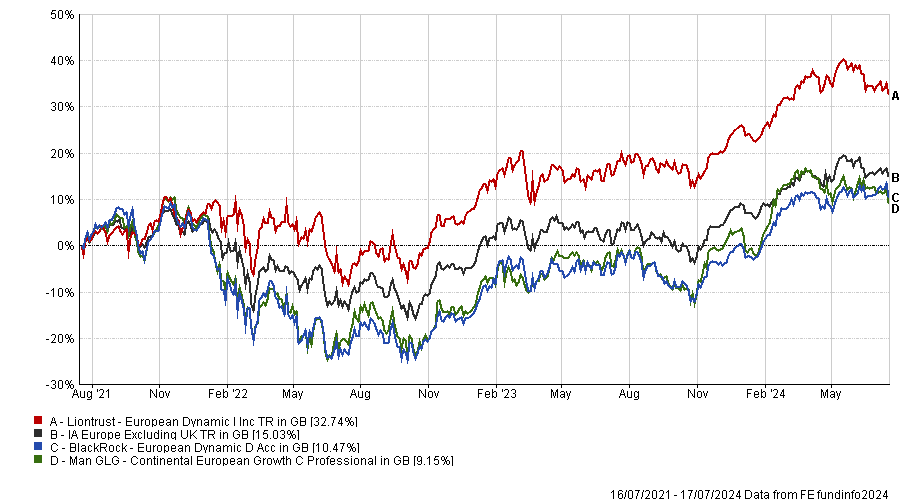

Performance of funds vs sector over 3yrs

Source: FE Analytics

Managed by James Inglis-Jones and Samantha Gleave, the £1.5bn Liontrust European Dynamic fund is a top-quartile performer over three and five years but slipped to the second quartile in the past 12 months.

Its largest holdings are Novo Nordisk, which has a dominant position in the diabetes and weight loss drug market, and ASML, whose lithography technology is used to mass produce semiconductor chips.

Meanwhile, investors took £376m out of Invesco European Equity (UK) and £235m from Jupiter European.

Invesco European Equity achieved top-quartile performance over three years but slipped to the fourth quartile in the past 12 months and its five-year track record has lagged the sector average.

Jupiter European is fourth quartile over one and three years but FE Alpha Manager Mark Heslop, who has been running the fund with Mark Nichols since 2019, has a stronger long-term track record.

Funds attracting or shedding more than £200m in 1H 2024

Source: FE Analytics

Source: FE Analytics

North America

Given how well the major US benchmarks and their largest sector, technology, have performed this year – and how efficient the US large-cap market is generally believed to be – it is no surprise that investors gravitated towards cost-effective passive strategies.

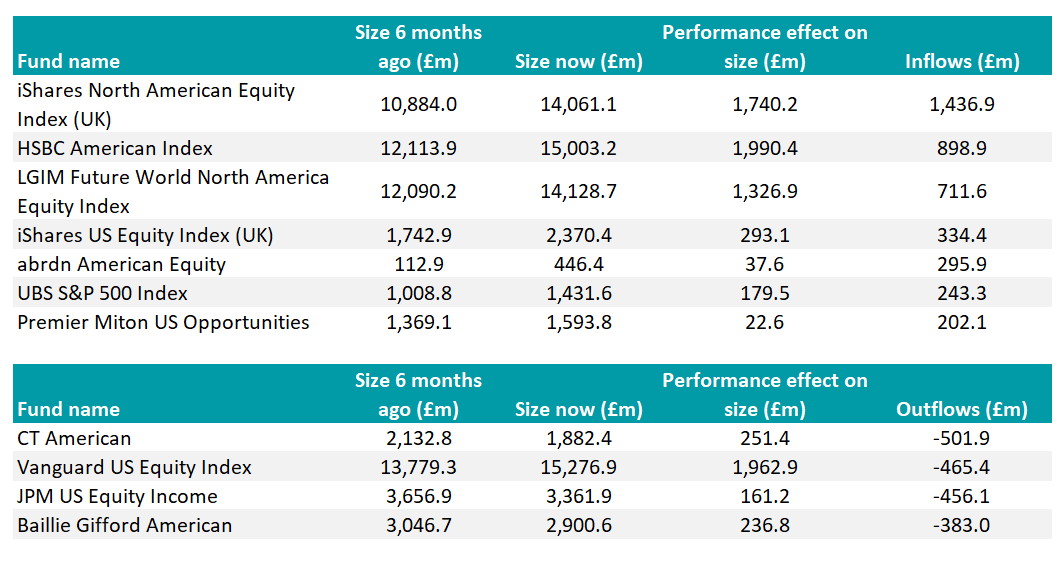

HSBC American Index gained £899m in inflows and LGIM Future World North America Equity Index took in £712m, on top of the £1.4bn flooding into iShares North American Equity Index (UK). However, investors took £465m out of Vanguard US Equity Index.

Funds attracting or shedding more than £200m in 1H 2024

Source: FE Analytics

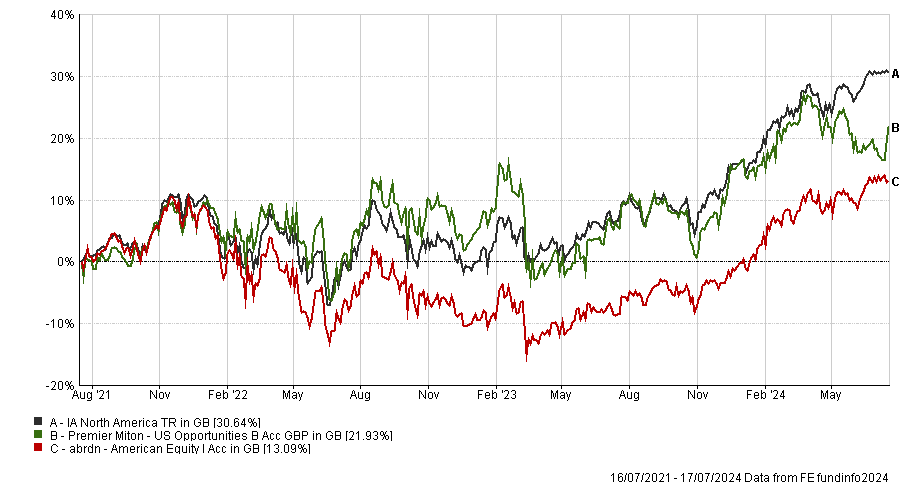

Just two actively managed funds received more than £200m in inflows: abrdn American Equity and Premier Miton US Opportunities. Both funds lagged their peer group average over three years, as the chart below shows.

Performance of funds vs sector over 3yrs

Source: FE Analytics

Three active funds suffered significant outflows: CT American (shedding £502m), JPM US Equity Income (£456m) and Baillie Gifford American (£383m). The latter spiked during the Covid recovery but then gave back most of its gains, as the chart below illustrates.

Performance of funds vs sector and benchmark over 5yrs

Source: FE Analytics

Japan

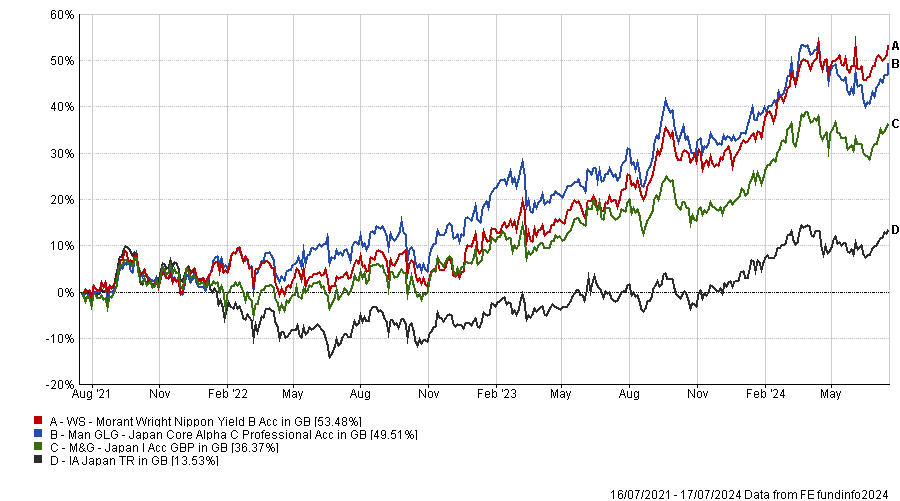

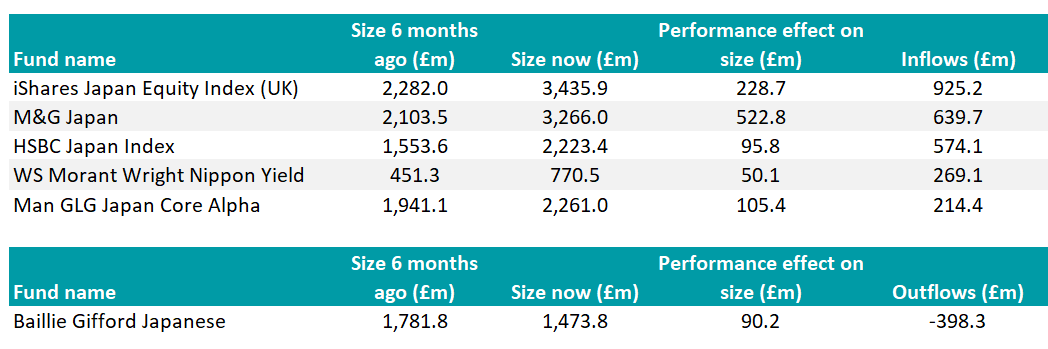

Investors bought into Japan’s equity rally, selecting M&G Japan, Man GLG Japan Core Alpha and Morant Wright Nippon Yield – complemented by passive strategies from iShares and HSBC.

Performance of funds vs sector over 3yrs

Source: FE Analytics

The Tokyo Stock Exchange’s reforms are targeting companies trading at a price-to-book value below one, and to find them, investors need to look at mid-caps, said Rob Starkey, a multi-asset portfolio manager at Schroder Investment Solutions. That is Morant Wright’s “hunting ground”, he added.

Value managers such as Man Group are also well placed to find cheap companies that will benefit from corporate governance reforms, he argued. Schroders uses Morant Wright Nippon Yield and Man GLG Japan Core Alpha in its multi-asset and model portfolio solutions.

Baillie Gifford Japanese was the only fund in this region to see significant outflows, with investors pulling £398m in reaction to poor performance.

Funds attracting or shedding more than £200m in 1H 2024

Source: FE Analytics

Asia Pacific

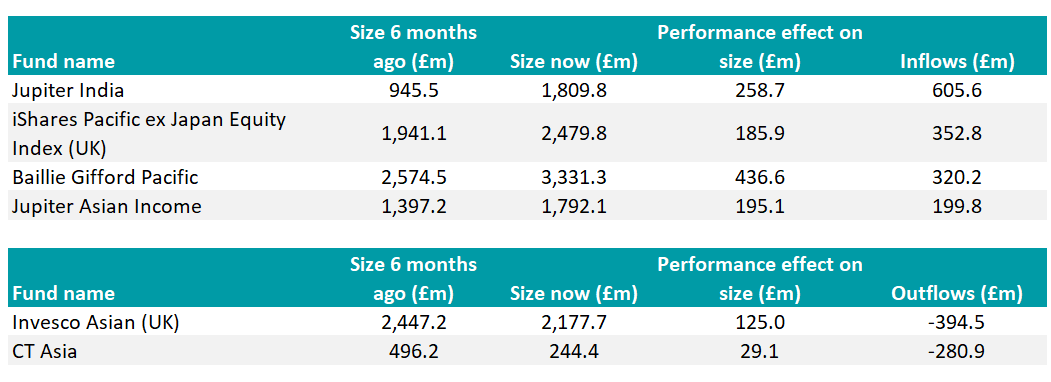

For their Asian equity allocations, investors put £320m into Baillie Gifford Pacific for growth and gave £200m to Jupiter Asian Income for stellar performance plus dividend yields, whilst also allocating to passive strategies from iShares and abrdn.

Jason Pidcock’s £1.9bn Jupiter Asian Income fund is a top-quartile performer over one, three and five years, beating its peers by avoiding China completely and favouring Australia, Taiwan and India.

Jupiter India was also popular with investors seeking exposure to one of the world’s best performing markets. It took in £606m during the first half of this year.

Funds attracting or shedding more than £200m in 1H 2024

Source: FE Analytics

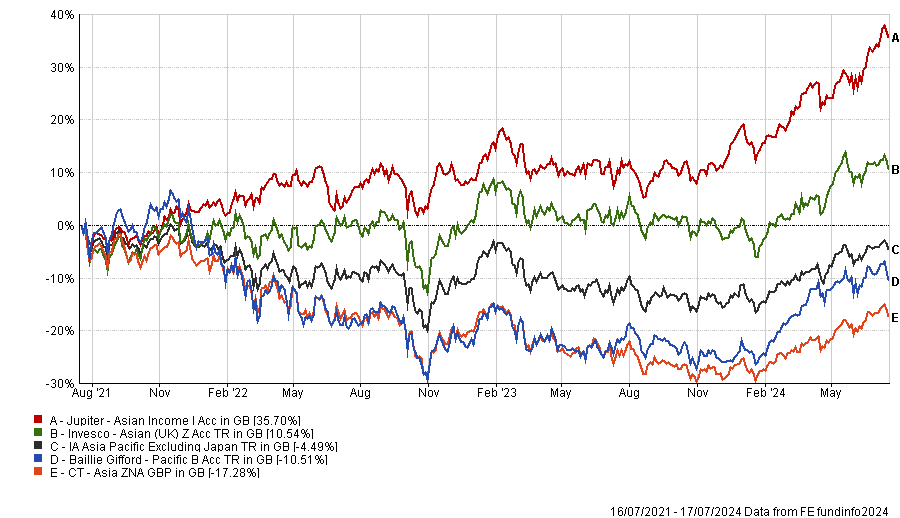

At the other end of the spectrum, investors took £395m out of Invesco Asian (UK) and £281m from CT Asia.

Performance of funds vs sector over 3yrs

Source: FE Analytics

Emerging markets

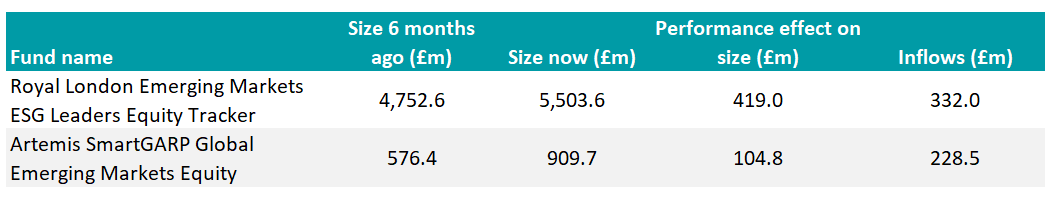

Investors chose a combination of active and passive funds for emerging markets. Royal London Emerging Markets ESG Leaders Equity Tracker was the most popular strategy, bringing in £332m.

Artemis SmartGARP Global Emerging Markets Equity was the top choice amongst actively managed funds, gaining £229m. No funds had outflows over £200m.

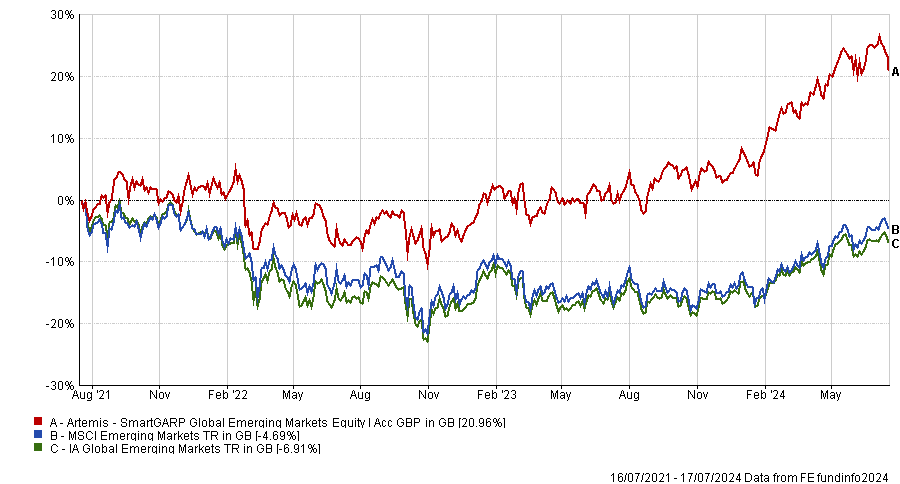

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Artemis has combined its portfolio managers’ stock-picking abilities with quantitative tools to generate “phenomenal performance”, Starkey said.

Investors were undeterred by the resignation of former fund manager and leader of the SmartGARP strategy Peter Saacke, who left the firm at the end of June to become a maths teacher.

Funds attracting or shedding more than £200m in 1H 2024

Source: FE Analytics