Losing a few pounds just before the summer might be good for the beach but not necessarily for funds, especially if they are left skinnier by unsatisfied investors deciding to cash in and walk away.

FE fundinfo fund flows data covering the second quarter of 2024 shows a skinnier UK and an ever-fatter pool of global funds – particularly index trackers.

Between April and June, investors reinstated their preference for global passives over actively managed domestic strategies, further cementing a trend that seems more and more impossible to counter.

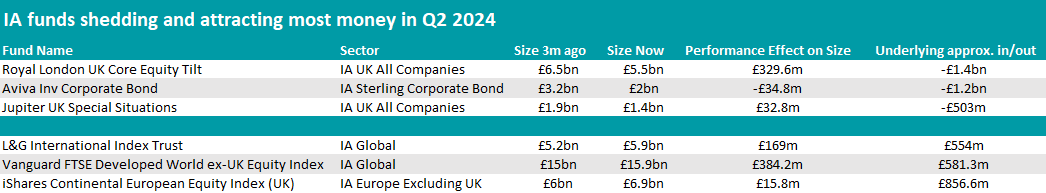

Below, we reveal the IA funds that have seen the largest market movements in the second quarter of 2024.

All the main losers across the key Investment Association sectors – those that have seen redemptions greater than £500m – had a focus on the domestic market.

Two were in the IA UK All Companies sector – Royal London UK Core Equity Tilt and Jupiter UK Special Situations – and one, Aviva Inv Corporate Bond, in the Sterling Corporate Bond sector. However for at least two of these, idiosyncratic reasons rather than broader market considerations might have moved the needle.

On the opposite side of the spectrum, three other funds gained inflows greater than £500m, all of which were passively managed. Two invest globally and one in Europe, as the table below shows.

Source: Trustnet

The biggest outflow was that of Royal London UK Core Equity Tilt, from which investors withdrew £1.4bn.

Before August 2021, the strategy was called Royal London FTSE 350 Tracker, but then it changed its mandate to include a carbon control strategy into the process and now aims to maintain a carbon intensity that is at least 10% lower than its benchmark, the FTSE 350 index, whilst also considering a company’s ability and willingness to transition and contribute to a lower carbon economy.

Since then, the fund’s size has shrunk by 17%, with the steepest drawdowns happening between February and June 2023 and in May this year. A spokesperson for the fund said this was an internal move, with the money leaving the fund being retained in the firm’s other ranges.

Square Mile analysts rate the fund, basing their conviction upon “the suitability of the index tracked, the management group's commitment to operating passive strategies, the size of the fund, the fund's cost and its good historic record of tracking the index”.

“Alongside this, we are confident in the team’s ability to improve the responsible investment and ESG credentials of the fund, particularly given the strong responsible investment team at Royal London,” they said.

Turmoil around the managing team of Jupiter UK Special Situations has lost the fund £503m, as manager Ben Whitmore is set to leave the firm and to be replaced by FE fundinfo Alpha Manager Alex Savvides by the autumn.

Square Mile has suspended its rating of the fund as the passing of the baton takes place and so has RSMR. While experts were torn as to whether to stick with the fund or not, investors were more resolute to pull money out – since the beginning of the year, assets under management (AUM) dropped more than 35% from £2.2bn to the current £1.4bn.

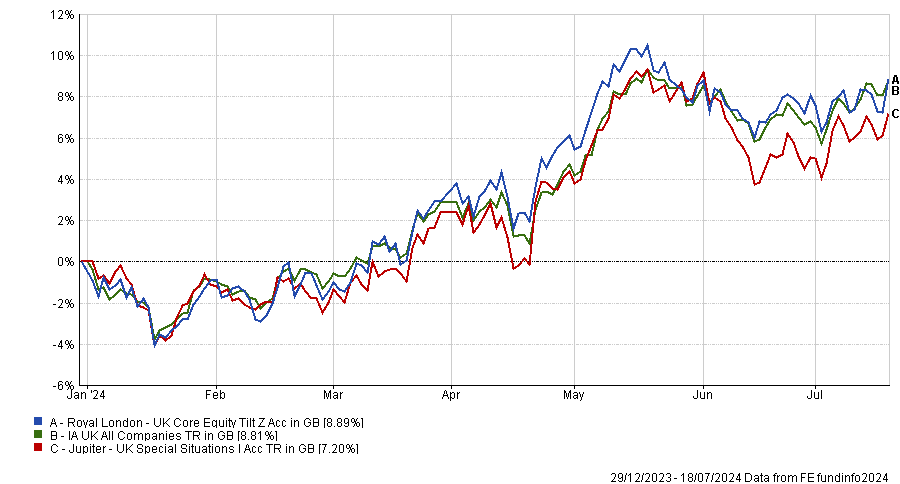

Performance of funds against sector over the past year

Source: FE Analytics

Turning to funds that attracted more than £500m, unsurprisingly two of the three that made the list were in the IA Global sector – and all were index trackers.

The £15.9bn giant Vanguard FTSE Developed Europe ex-UK Equity Index gained £581.3m from keen investors while also building up £384.2m from performance – the best result of all funds listed here.

The vehicle has the maximum FE fundinfo Passive Crown rating of five and is highlighted by FE Investments analysts for its fully physical process with lending – meaning that it replicates the performance of its benchmark, the FTSE AW Developed ex UK Net index, by direct ownership of all the underlying securities and compensating for the trading costs through stock lending.

Another fund that convinced investors was the L&G International Index Trust, another product physically replicating an index, the FTSE World (ex UK), but that does not engage in stock lending.

RSMR analysts said: “The lack of securities lending in retail facing products is a standout feature of LGIM passive products. The team believes that it should minimise retail customers’ exposure to additional risks and keep their index funds as transparent and easy to understand as possible,” they said.

“This fund can be used as a core holding across a range of client risk profiles.”

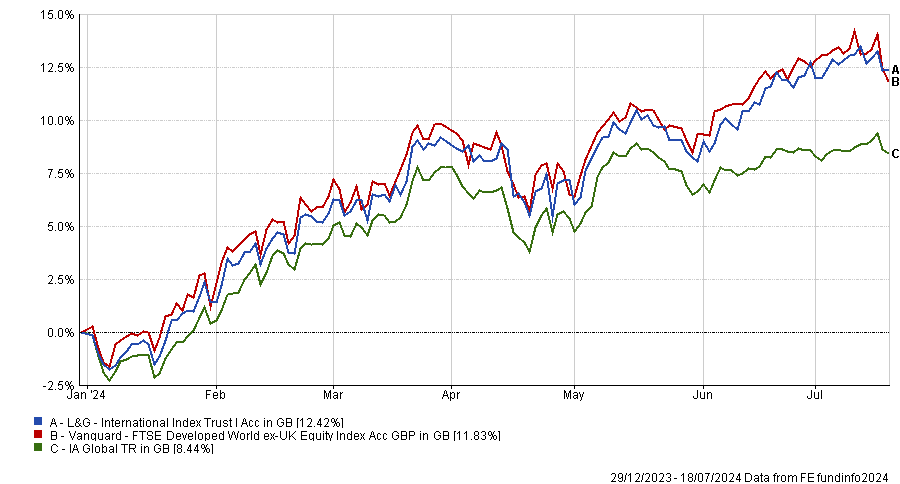

Performance of funds against sector over the past year

Source: FE Analytics

Finally, the fund that gained the most in investor’s faith was iShares Continental European Equity Index (UK).

It tracks the European market as defined by the FTSE World Europe ex UK index, and with Europe being tipped as the market that could overtake the US, investors piled in with north of £850m.

Square Mile analysts praised it for the suitability of the index tracked, the management group's commitment to operating passive strategies, the size of the fund, the fund's cost and its good historic record of tracking the index.