Private equity firms have capitalised on low valuations in the UK stock market to acquire a spate of small- and mid-cap companies, prompting concerns about the ‘smid’-cap sector shrinking.

However, FE fundinfo Alpha Manager Ken Wotton disagrees, believing M&A to be a cyclical phenomenon unlikely to persist at the current pace.

Besides, mergers and acquisitions constitute one of the strategies he uses to create value for Strategic Equity Capital, the investment trust Wotton has managed since 2020.

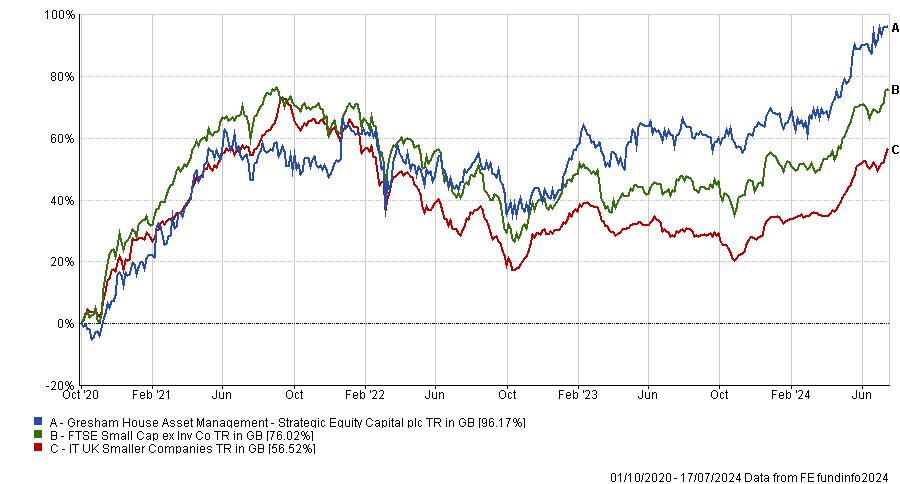

Performance of fund since Wotton’s appointment vs sector and benchmark

Source: FE Analytics

Below, Wotton explains why at least 75% of his fund is held in just 10 companies and how he sometimes intervenes to prevent M&A transactions.

Could you explain your investment strategy?

We describe it as taking a private equity approach to investing in public markets. When we invest in a company, we expect to hold it for three to five years, and because of that time horizon, we think of ourselves as owners of the business rather than holders of shares.

We do more due diligence than the typical public market investor. We try to build high conviction investment cases on the individual holdings.

We take a very concentrated portfolio approach and typically have around 20 holdings in the fund, with 75% to 80% of the value of the fund in the top 10. The next 10 holdings are toehold stakes where we look to potentially increase our investment in the future.

Because we take larger equity stakes in the companies we back, we have a platform for active engagement with their management teams and boards, enabling us to add more alpha.

What characteristics do you look for in a business?

We want to find businesses that are growing. Ideally, they are benefiting from structural growth drivers in their market or have self-help levers allowing them to gain market share even if the overall market isn't growing.

We're also looking for businesses that are profitable, have good margins and can turn profits into cash. Typically, they don't have much financial gearing, because we're trying to find low-risk situations.

We also want to back high-quality management teams. We might complement that by introducing non-executive directors who have the right skills and capabilities to help our investee companies.

There are certain sectors we avoid. We don't invest in oil and gas, mining, banks or real estate. That’s because we want businesses that are not overly impacted by external cyclical factors.

Why should investors buy your trust?

It provides an idiosyncratic, low correlation play on UK small-caps. The businesses we hold are not well researched, not well known and the market they operate in is less efficient.

Because UK small-caps are currently out of favour, we think there's a structural discount for businesses that have the size we're targeting. If we can apply our resources and expertise to find the right companies, there's an opportunity to get a really attractive return.

We try to help our companies tell their stories more effectively and do certain things to get recognised. Even if they are not re-rated, we can make returns through earnings growth and cash generation.

The M&A market is an alternative option for value realisation. Because of the stakes we take in our businesses, we have influence over that and can typically enable an M&A transaction to happen if we think it's a good price. However, we will stop the transaction from happening if the price is bad.

We don't want all our companies to be taken over, but it is an option for value creation.

Several UK small-cap companies are being taken over by private equity firms; does that worry you?

Not really, M&A is a part of life when investing in smaller companies and it's always been a feature of the fund. More than a quarter of the names we've ever owned have ended up being taken out.

We're at a point in the cycle where the disconnect between equity valuations and private markets is such that there's an arbitrage opportunity, which is attractive to private equity and corporates, but that won’t stay around forever.

We were in the opposite situation three years ago. In fact, 2021 was the biggest year for initial public offerings (IPOs) in the UK in a decade. Private equity and venture capital funds IPO-ed their businesses rather than buying businesses from the market. That’s why I think it's a cyclical phenomenon.

What have been your best and worst performing stocks over the past 12 months?

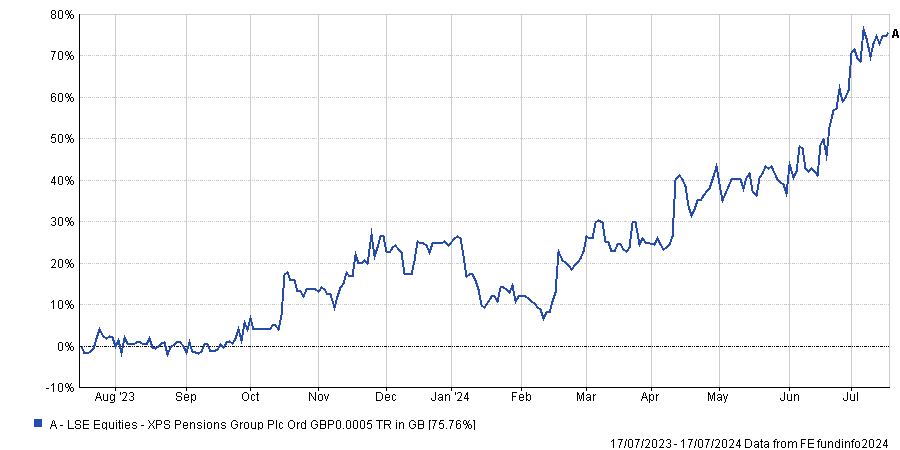

Our best performer has been XPS Pensions Group, which is an actuarial consultancy business and pensions administrator. It's our largest holding and has all the financial characteristics that we like.

It operates in a non-cyclical market because regardless of whether the economy is growing, trustees of pension funds require actuarial valuations and advice on how to comply with regulation.

Over the past 12 months, the share price has performed very strongly because XPS Group has had a series of upgraded forecasts and accelerating earnings growth.

Performance of stock over 1yr

Source: FE Analytics

The worst performer has been R&Q Insurance Holdings, which is a specialist insurance business.

Its historic business model was balance sheet-based. The company made money by acquiring books and legacy liabilities from other insurers or corporates and then running off those books more profitably.

R&Q Insurance Holdings has been switching to a fee-for-service model, akin to the fund management industry. It means getting third-party capital to acquire these books of business through fund vehicles and then getting a fee for managing them. That's a better quality of earnings and less capital intensive business model.

Unfortunately, some issues in the legacy part of the business came to the fore and caused a profit warning, which has inflicted stress on the balance sheet.

Performance of stock over 1yr

Source: London Stock Exchange

What do you do outside of fund management

I am into electronic music, so I like DJing.