Small funds face fewer liquidity constraints than larger strategies, enabling them to explore less liquid opportunities.

Emerging market equities typically have a lower liquidity profile than developed markets, so a case can be made for choosing smaller funds.

However, higher fees are a common feature of smaller funds because they lack the scale to spread costs across a large pool of investors.

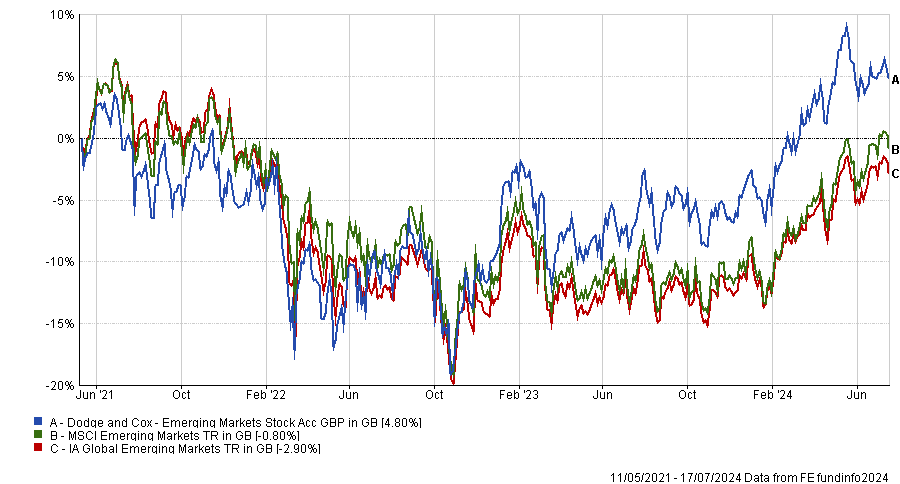

As such, Trustnet has found nine active funds in the IA Global Emerging Markets sector with less than £100m in assets and fees under 1%.

Source: FE Analytics

The cheapest small fund in the IA Global Emerging Markets sector is the $73.2m (£56.4m) Ashoka WhiteOak Emerging Markets Equity fund, which charges 0.55%.

The fund is relatively new, having been launched in 2022, building on the success of Ashoka India Equity, and is also available as an investment trust.

Manager Prashant Khemka and his team use a valuation framework called ‘OpcoFinco’, which enables them to analyse companies through the prism of return on investment capital and then to quantify the value of return on incremental capital.

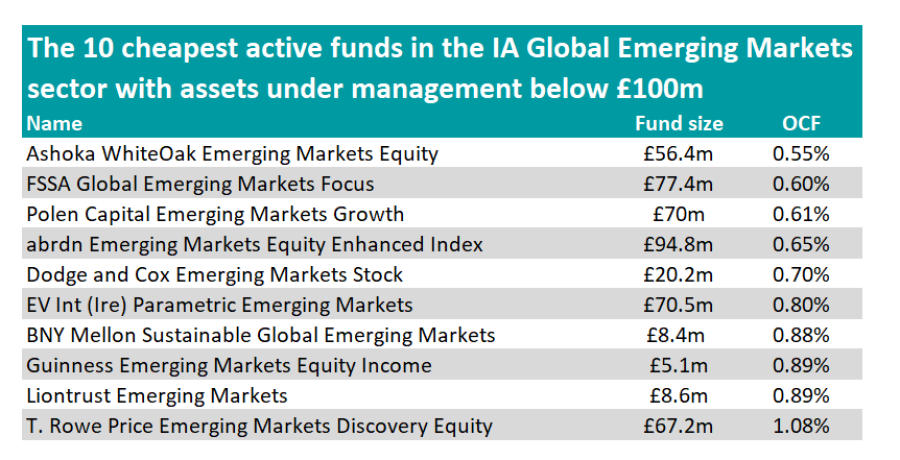

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Next is the £77.4m FSSA Global Emerging Markets Focus fund, managed by Rasmus Nemmoe and Naren Gorthy, which charges 0.60%.

The fund follows a similar process to its peers in the FSSA range, employing a bottom-up approach with an absolute return mindset and an emphasis on quality and stewardship.

Analysts at Rayner Spencer Mills Research said: “The team looks for founders and management teams that have high governance standards and are well aligned with minority shareholders. These will be strong franchises with the ability to deliver sustainable and predictable returns comfortably in excess of the cost of capital.“

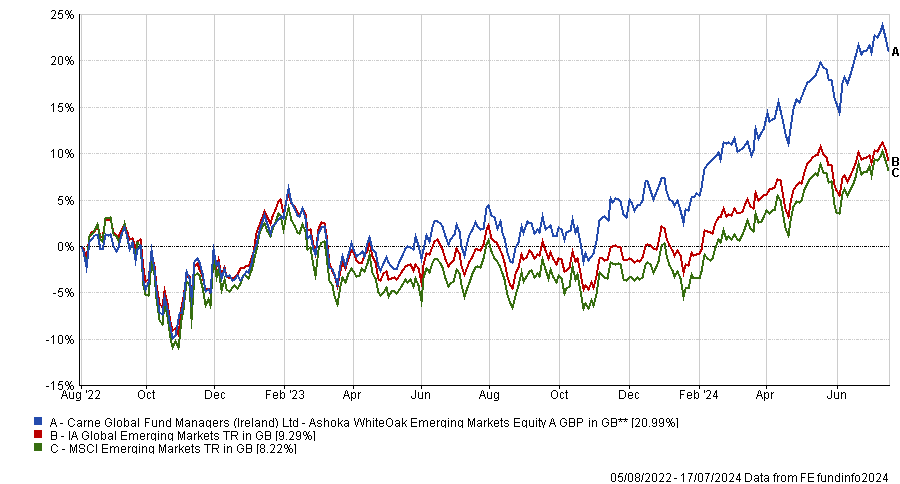

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

The fund sits in the second quartile of the IA Global Emerging Markets sector over five years and has been a top-quartile performer over three years.

In third place is the $90.8m (£70m) Polen Capital Emerging Markets Growth fund, which levies 0.61%.

Another inexpensive minnow is the £20.2m Dodge and Cox Emerging Markets Stock fund. It follows Dodge & Cox’s house style of investing in stocks that appear to be temporarily undervalued by the market but have a favourable outlook for long-term growth.

It is also overweight small- and mid-caps relative to the benchmark and boasts an active share of 78.8%.

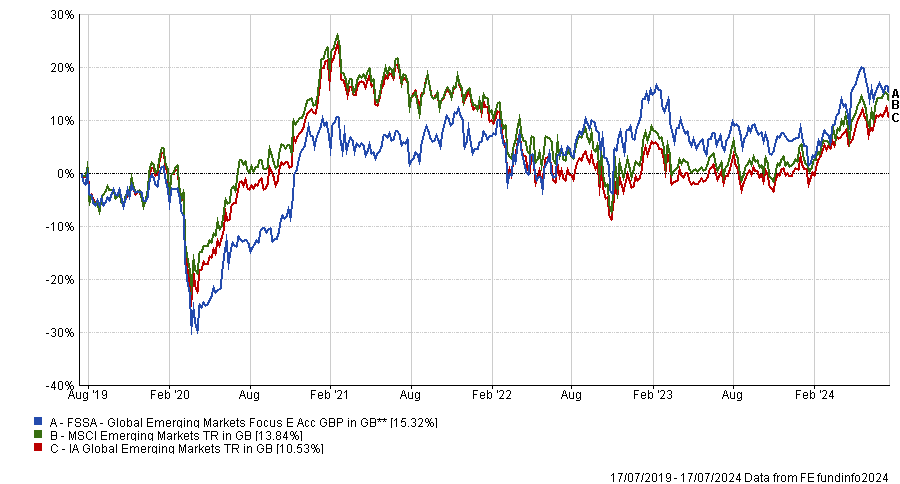

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

While the fund has a short track record, having been launched in 2021, it sits in the top quartile of the sector over three years.

Finally, the £5.1m Guinness Emerging Markets Equity Income fund stands out in the list due to its income mandate.

Managers Edmund Harriss and Mark Hammonds aim to provide investors with exposure to dividend-paying businesses across emerging markets.

They focus on companies with a market cap of at least $500m (£385.4m) that have proven their ability to achieve higher returns on invested capital, are well positioned to continue doing so and are capable of growing their dividends.

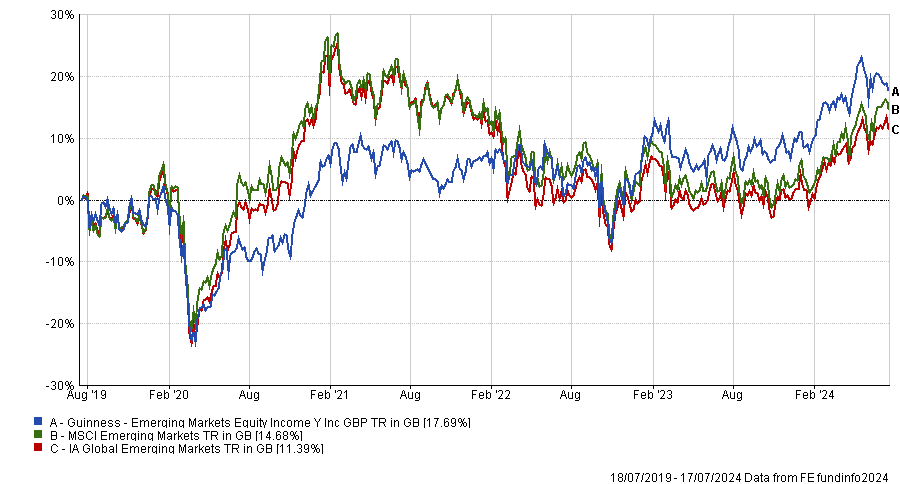

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

The fund sits in the sector’s second quartile over five years but is a top-quartile performer over three years.