Coming out as the best manager of the decade is not easy, doubly so when you change companies and have to start afresh halfway through the period.

Yet it would be hard to argue that FE fundinfo Alpha Manager Mike Scott has not achieved this feat. His current fund, the £637m Man GLG High Yield Opportunities portfolio, has been the best performer in the IA Sterling High Yield sector since its launch in 2019.

Before that, he managed the Schroder High Yield Opportunities which, under his tenure from 2012 to 2018, was the best performer in the sector.

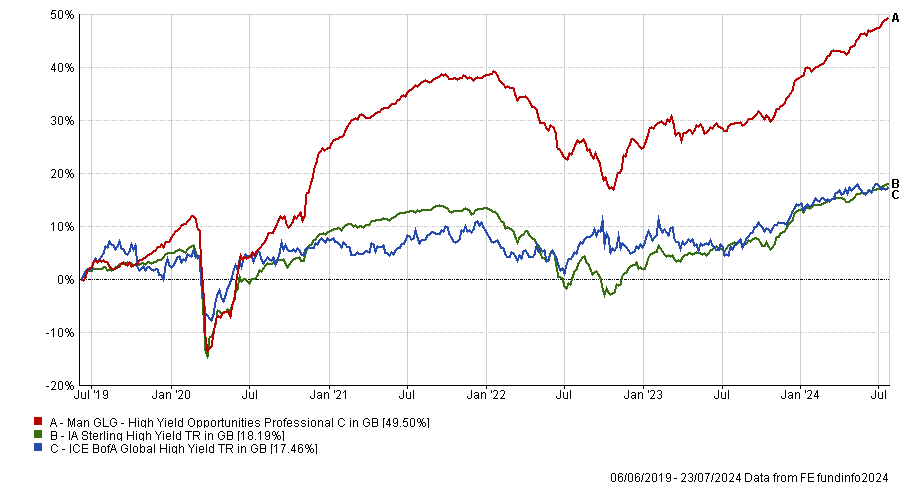

Performance of fund vs benchmark and sector since launch

Source: FE Analytics

Taking two funds to the top of the charts is impressive, yet it might not be the draw some would expect, given the asset class he invests in. Indeed, it is difficult for investors to like the high-yield sector at the moment – even by Scott’s own admission.

For example, in the US, high-yield spreads are trading in their lowest decile versus their own history – in other words, they are providing investors with little compensation for taking the extra credit risk. Across the globe, some 60% of the high-yield bond market is trading at spreads below 300 basis points.

“That means 60% of the market is not paying you for through-the-cycle risks in high yield,” he explained. “I can absolutely guarantee you that you’re going to see cheaper times for that 60% of the market.”

However, this is masking a huge amount of dispersion underneath the surface, Scott said.

Where many investors go wrong with high-yield is they look at rating buckets and miss idiosyncratic opportunities, the manager explained. “From a headline perspective, maybe BBs are expensive compared to BBBs but that doesn’t tell you anywhere near what’s actually going on, on a granular basis beneath the surface,” he said.

“If you just looked at the market from a top-down perspective or a rating bucket perspective, you would probably stop there. I think that’s absolutely the wrong approach to take because we see some really significant value that’s opening up in segments of the market. These may be areas that have seen fundamental repricing given the current market backdrop but that’s providing opportunities for us to exploit.”

There are 1,500 names in the high-yield universe all with unique drivers of risk, yet the largest 50 names comprise 26% of the ICE BofA Global High Yield index. Those issuers are the “most over-indebted and over-owned with the worst fundamentals”, he said.

“This is why I believe in not having the straitjacket of a benchmark.” Instead, he is moving into “under-covered areas of the market where we can find really unloved, undiscovered situations”.

European real estate is one such area. Commercial real estate in general was hurt by rapid interest rate hikes but Scott has found several issuers in Eastern Europe with extremely strong fundamental backing and “cycle-wide valuations” that are “entirely mispriced”.

In major cities in Poland, Slovakia and Czechia, vacancies are low-single-digit, even in offices and retail, and revenue growth is in the low to mid-teens. Collateral values have been more resilient than elsewhere, he added.

Eastern European countries raised rates faster than Western Europe and started cutting them earlier, which has strengthened the investment case.

Elsewhere, European financials have been a focus for his fund since the first quarter of last year. When Credit Suisse collapsed and the US regional banking crisis unfolded, investors shunned the whole financial services sector. Financial companies in other parts of the world that were unaffected by these events offered a huge amount of value, he said.

Scott invested in high-yield bonds issued by traditional mortgage lenders in Spain and Portugal, where all mortgages are floating rate, and to a lesser degree Greece and Cyprus.

He also invested in UK challenger banks in niche lending markets such as buy-to-let and second lien mortgages. These banks have conservative underwriting practices and won’t be loss making in an economic downturn, he said.

Scott thinks that pressure on issuers will grow as tighter monetary policy and higher borrowing costs work through the economy. Default rates rose then plateaued but they could pick up again as more companies are forced to refinance at higher rates, he predicted.

Against that backdrop, he has a preference for cash-generative businesses with strong pricing power and inelastic demand, where the bonds are backed by hard assets, such as supermarkets.