A sell-off in technology companies dominated the headlines last week, but FE fundinfo data shows some parts of the market were hit even harder than the so-called Magnificent Seven and their peers.

The Magnificent Seven – Alphabet, Apple, Amazon, Meta Platforms, Microsoft, Tesla and Nvidia – have led the market for some time. But Tesla and Alphabet reported their earnings last week and disappointed lofty expectations, leading a sharp sell-off.

FE Analytics shows the Nasdaq 100, the tech-dominated US index, fell 2.1% in sterling terms over the whole week. But this number is flattered by some days of positive returns and the index tanked close to 5% over three sessions.

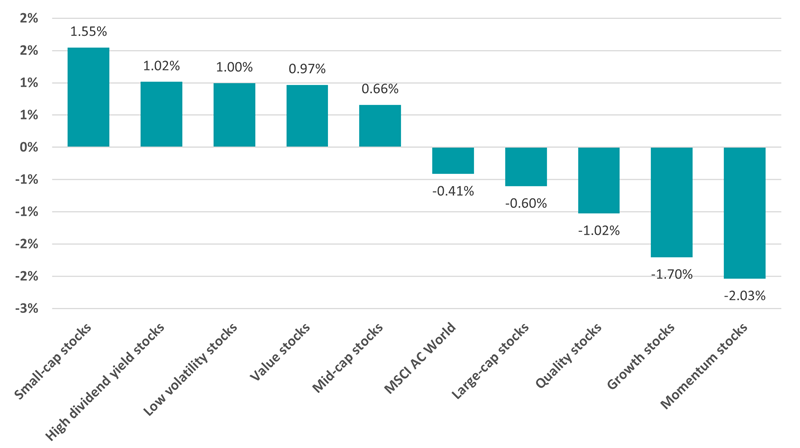

A fall of the exact same magnitude was seen in the MSCI ACWI Information Technology index, which was the worst performing industry of the week, while the momentum and growth style were the weakest investment factors.

Performance by investment factor over week commencing 22 Aug 2024

Source: FinXL. Total return of MSCI indices in sterling between 22 Jul and 28 Jul 2024

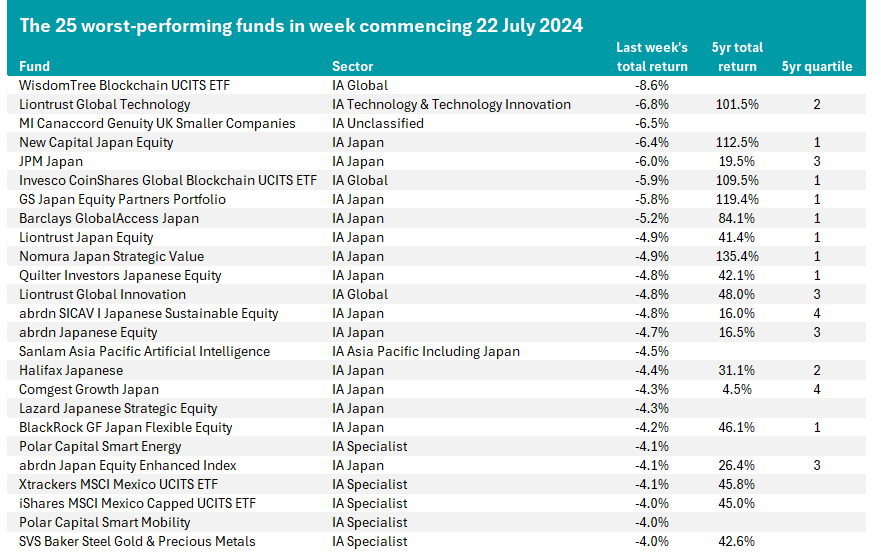

Against this backdrop, one-third of funds in the Investment Association universe made a negative return last week but it should be little surprise that tech funds were among the hardest hit.

WisdomTree Blockchain UCITS ETF made the worst return, after falling 8.6%. The ETF tracks the performance of companies primarily involved in blockchain and cryptocurrency technologies.

Cryptocurrencies, one of the more volatile parts of the market, were caught up in last week’s sell-off, as investors soured on tech.

Invesco CoinShares Global Blockchain UCITS ETF was another of the funds making the highest losses last week. Meanwhile, more conventional tech funds or portfolios with a bias to tech such as Liontrust Global Technology, Liontrust Global Innovation, Sanlam Asia Pacific Artificial Intelligence, Polar Capital Smart Energy and Polar Capital Smart Mobility were also at the bottom of the performance rankings.

James Henderson, co-manager of the Henderson Opportunities Trust, Lowland and Law Debenture, said: “In every bull market there come tests, and this is one of them.

“We’ve had a period during which the Magnificent Seven have been dragging investors’ cash from elsewhere. Some managers have been selling down other parts of their portfolios to buy more of these holdings. That’s usually what happens towards the end of a cycle. Valuations were becoming harder to justify, and a correction was inevitable – the question is how far it will go.”

However, there is another area of the market that fell even harder than tech last week: Japan. While the Nasdaq lost 2.1% in sterling terms, the Topix was down 2.8%

This is reflected in the list of last week’s 25 worst performers, which can be seen below. It should be kept in mind one week is a very short time frame to look at performance, so we’ve balanced this by providing the five-year total return and quartile ranking, where available.

Source: FE Analytics. Total return in sterling between 22 Jul and 28 Jul 2024

Some 15 of the 25 hardest-fit funds reside in the IA Japan sector and all but three of its 102 members made a loss. Some of these – such as New Capital Japan Equity, GS Japan Equity Partners Portfolio and Nomura Japan Strategic Value, are up in excess of 100% over the past five years.

Japan has been one of 2024’s strongest markets, as investors were attracted by ultra-low interest rates, an improving economy and the weak yen, which boosted the competitiveness of its export sector.

However, the yen has recently strengthened against the dollar as currency traders speculate on whether the Bank of Japan is considering pushing interest rates higher.

Speaking on Thursday last week, Hargreaves Lansdown head of equity funds Steve Clayton said: “Japan was not so long ago celebrating regaining the highs that it last attained in 1989, but last night’s 3.3% plunge took the Nikkei into technical correction territory, with the index having retreated over 10% from the highs reached just a few days ago.

“Japan’s losses have been quite widely spread, with major losers in the last week as diverse as Hitachi, Kawasaki Heavy Industries and Softbank, all dropping by double digits.”

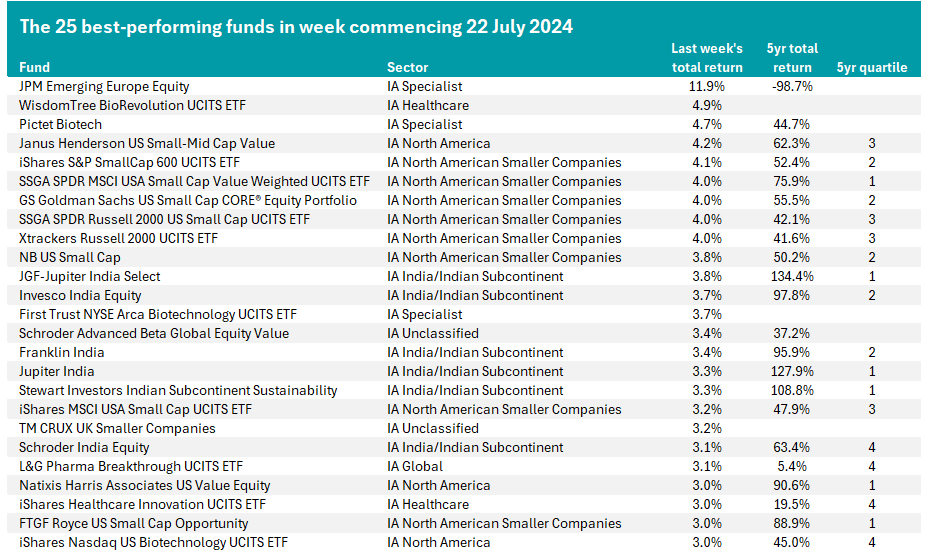

However, not every part of the market lost money last week so the final table shows those making the highest total returns.

Source: FE Analytics. Total return in sterling between 22 Jul and 28 Jul 2024

The dominant theme here is the strong performance of US small-caps, which investors appear to have been rotating into as they move away from tech stocks.