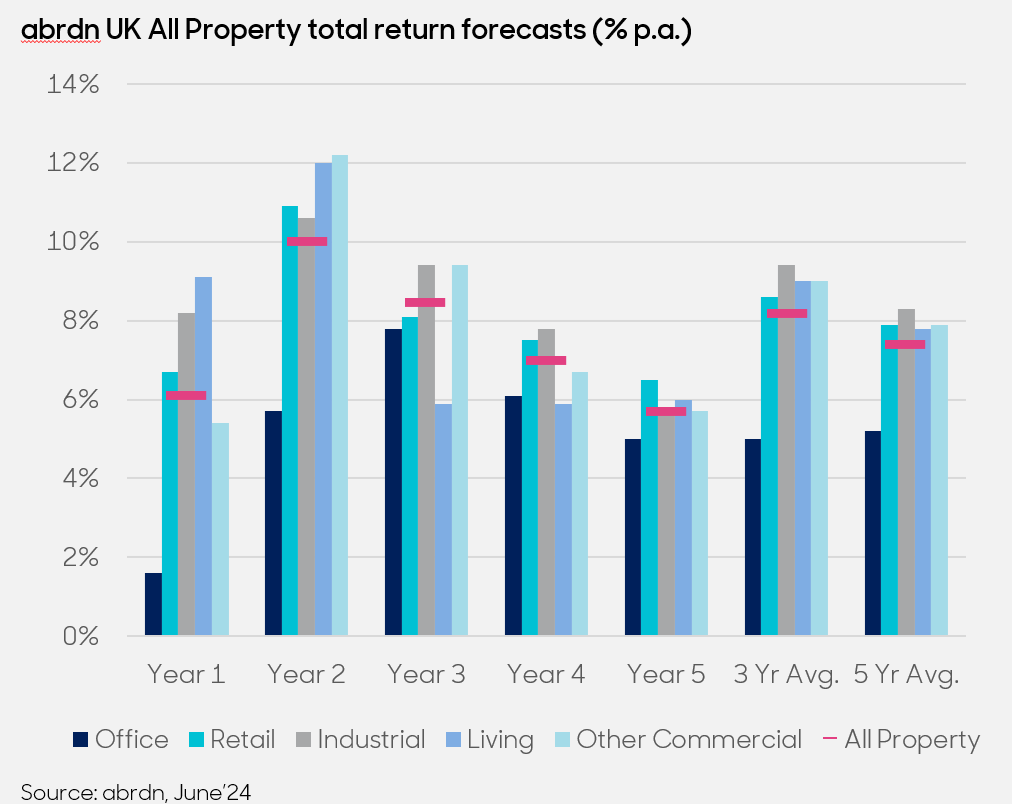

The UK is building towards a property market recovery, abrdn concludes in its latest forecast, predicting average returns of 8% per annum for UK real estate over the next three years.

This recovery has been prompted by the Labour party’s General Election victory, which has led to the UK becoming a country of relative stability in a complex wider political environment, abrdn said.

As a result, abrdn has upgraded its investment view on real estate to neutral after being underweight for two years, concluding that the UK is set to lead a real estate recovery on a global scale.

Anna Breen, global head of real estate, said: “We believe this real estate cycle is very different to previous ones, as rental income from property has not been challenged in the way it was before. That means the recovery for future-fit buildings should be faster – boosted by lack of high-quality supply.”

abrdn identified prime real estate as having the most growth potential. The average yield on prime UK property is now at its highest level in a decade at 5.7%, up from 4.2% in 2022, surpassing the current 4.1% yield from UK government bonds.

However, Breen warned that “not all sectors are made equal”. The manager is overweight residential, retail and industrials, but remains cautious on office space.

Even within specific sectors such as retail, the firm’s forecasts varied. For instance, retail parks rose to third place in the abrdn’s latest rankings, up from 33rd in March 2020. However, the firm remains negative on high street shops and shopping centres, which have faced challenges stabilising their cash flows after consumers switched to shopping online during and after the Covid pandemic.

There is wide dispersion between regions as well. While UK real estate is recovering, Asia Pacific has struggled due to a real estate depression in China as well as rising interest rates in Japan.