For managers seeking out under-researched and undervalued assets, the investment trust sector provides fertile hunting ground, especially now that so many trusts are trading at wide discounts.

This is why Brooks Macdonald Defensive Capital – a multi-asset fund that shuns more traditional areas within equities and bonds – holds half of its portfolio in investment trusts with exposure to areas such as private equity, Vietnamese stocks, structured credit, leasing of ships and aircraft, batteries, renewable energy, mining and property. It also holds convertible bonds, zero-dividend preference shares and structured notes.

Dr. Niall O’Connor, the fund’s manager, said: “We’re trying to go where other people aren’t looking, which gives us an information edge and that’s where we get our alpha from.”

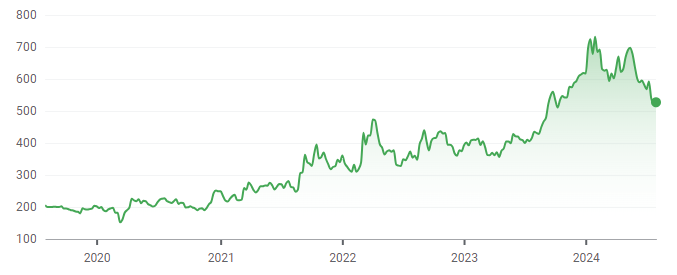

Performance of fund vs sector over 5yrs

Source: FE Analytics

He said his worst nightmare is waking up as an equity income manager and being asked to explain how his view on BP is different to everybody else’s. By contrast, the investment trusts he holds such as Georgia Capital and Yellow Cake have little if any coverage from sell-side analysts.

Below, O’Connor highlighted four esoteric trusts trading on wide discounts.

Georgia Capital

Georgia Capital is a way to gain exposure to one of Europe’s fastest-growing economies led by a pro-business government, he said. Georgia’s GDP grew 7% last year and is forecast to grow by at least 5% this year. The trust owns the country’s largest hospital chain and retail pharmacy chain, alongside renewable energy assets and a growing private education business.

Its largest holding is the London-listed Bank of Georgia, which he described as one of the cheapest banks in the world. Last year, it had a cost/income ratio less than its return on equity, which is something that O’Connor – a former banking analyst – has never seen before.

The trust is trading at a 58% discount and is one of the Defensive Capital fund’s largest holdings.

The interests of management are aligned with shareholders, given that the trust’s chief executive officer is paid exclusively in shares, he said. It has also started buying back its own shares.

The trust is quite volatile, however, and investing in Georgia is not without political risk given its proximity to Russia, O’Connor warned.

Share price performance of trust over 5yrs

Source: Google Finance

Yellow Cake

Yellow Cake invests in uranium, where there is a supply/demand imbalance, given that demand for nuclear energy is increasing but supply is limited. Nuclear power is becoming more economical given the price rises in traditional forms of energy, O’Connor explained.

The trust’s current discount of 20% is “unusually wide”, he continued, and the uranium price is uncorrelated to other financial markets.

Yellow Cake reported strong results for its financial year to 31 March 2024, with its triuranium octoxide holdings rising by 84%. The spot price of triuranium octoxide reached a 16-year high of $107 per pound in February, before falling back to $87 per pound by 31 March, up from $51 per pound 12 months previously. O’Connor believes that fair value is about $90-100 per pound.

Performance of trust over 5yrs

Source: Google Finance

Abrdn Property Income

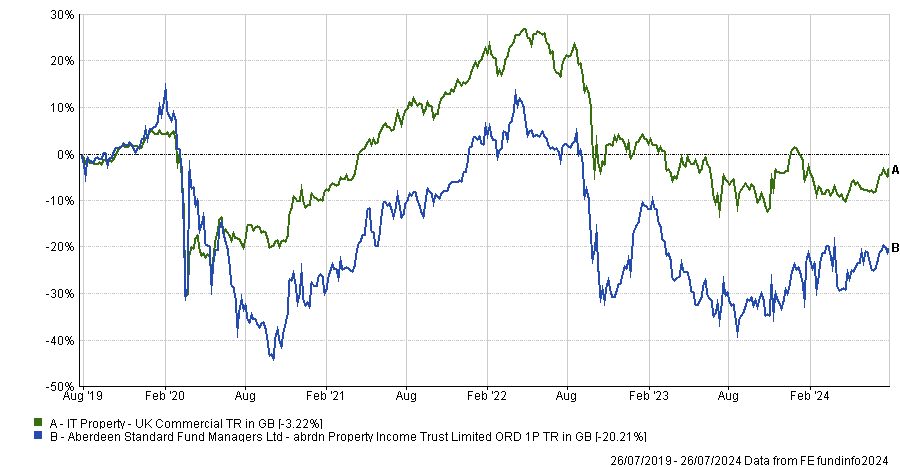

About 30% of the investment companies in which the Defensive Capital fund invests are winding up and returning capital to shareholders. As a case in point, Brooks Macdonald voted in favour of winding up abrdn Property Income in May 2024 and selling its assets.

The trust is trading at a 32% discount to its last reported net asset value (NAV) and has a dividend yield of almost 8%. O’Connor estimates that even if the portfolio were sold at an approximately 14% discount to NAV, it would yield an internal rate of return of nearly 10% per annum, on top of the dividend yield.

Performance of trust vs sector over 5yrs

Source: Google Finance

Riverstone Energy

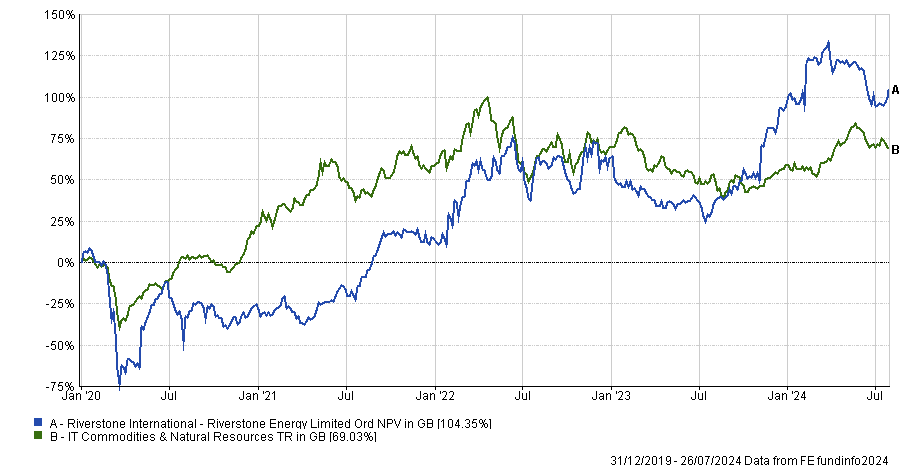

Riverstone Energy invests in North American oil and gas assets. When the oil price collapsed during the Covid pandemic, O’Connor tried to buy shares in the trust at £1.08 but his order was filled at £1.80. That was “the worst trade I’ve ever done,” he recalled, but it turned out to be a “good deal” eventually. Brooks Macdonald participated in Riverstone Energy’s tender offer earlier this year, when the trust bought back a substantial amount of its own shares at £10.50.

Performance of trust vs sector since 2020

Source: FE Analytics

This trust is quite volatile so it is not for the faint hearted, but it is a way to gain exposure to energy assets at a “striking” 43% discount, he said.