Japan’s Nikkei 225 index fell 12.4% on Monday 5 August after sliding 6.65% last week in yen terms.

The market’s nosedive is part of a global sell-off after disappointing US economic data last week triggered recessionary fears. Japanese equities were also hurt by a strengthening yen after the Bank of Japan raised interest rates last week and investors scrambled to unwind the carry trade.

James Salter, chief investment officer and manager of the Zennor Japan fund, said: “We have been warning that a stronger yen currency would initially cause indices to fall. The recent stock market losers have included banks, insurance, autos and technology companies. These are all overcrowded trades.”

He expects the yen to strengthen further: “This will lead to a bifurcated market where I suspect the winners of the last year bounce short-term but thereafter struggle. Many of these names are yen sensitive and exposed to the global economic cycle.”

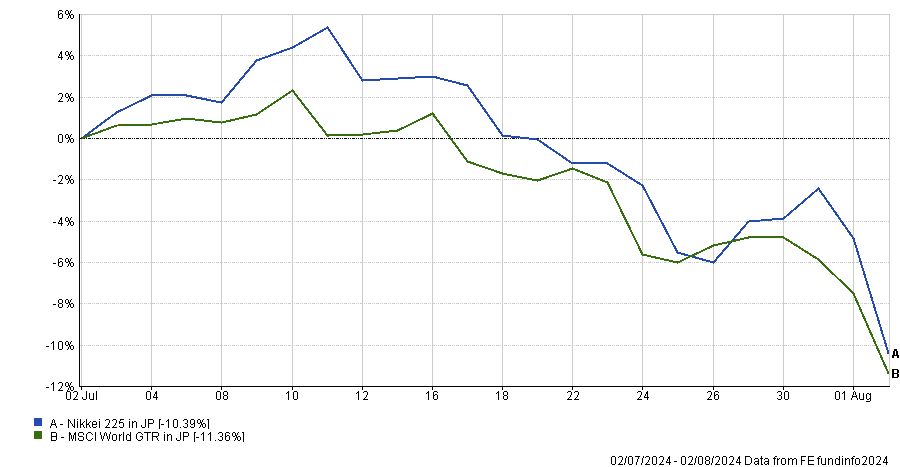

Performance of Nikkei 225 and MSCI World in yen terms over one month

Source: FE Analytics, data to Friday 2 Aug 2024

On 31 July, the Bank of Japan raised interest rates to 0.25% from zero to 0.1% and committed to halving its monthly bond purchases from ¥6trn to ¥2.9trn by early 2026.

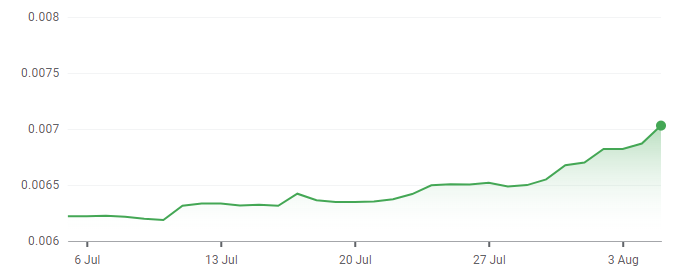

This hawkish move puts the Bank of Japan in opposition to the Bank of England, European Central Bank and the US Federal Reserve, narrowing the interest rate differential that has severely weakened the yen. As a result, the yen climbed almost 5% against the dollar last week.

The yen/dollar exchange rate over one month

Source: Google Finance

Yen strengthening has a huge knock-on effect on global liquidity due to the carry trade. Investors had been borrowing in the low-yielding yen to invest in higher-yielding currencies – a trade they are now rushing to unwind.

As AJ Bell investment director Russ Mould explained: “The Japanese currency has been a major source of global liquidity, as major market players have shorted it, borrowed against it and used that money to go for long risk assets around the globe.

“The yen is rallying, as massive short positions against it are closed out, to drive the currency higher still and force yet more liquidation by the shorts, to create a circle every bit as vicious as it had previously been virtuous.”

Currency and interest rate moves are only part of the picture, however. Stephen Innes, managing partner of SPI Asset Management, pinned Japan’s woes squarely on US economic weakness.

“Asian markets are buckling up for a rough ride, still reeling from last Friday's seismic shifts in the global financial landscape. The trigger? A US employment report that missed the mark so badly didn't just drop jaws – it dropped stocks and bond yields while sending volatility and rate cut expectations through the roof,” he said.