Stocks markets enjoyed a strong opening half to 2024 but have retreated in recent weeks and were hit by a major rout yesterday, so what is driving this sudden nervousness?

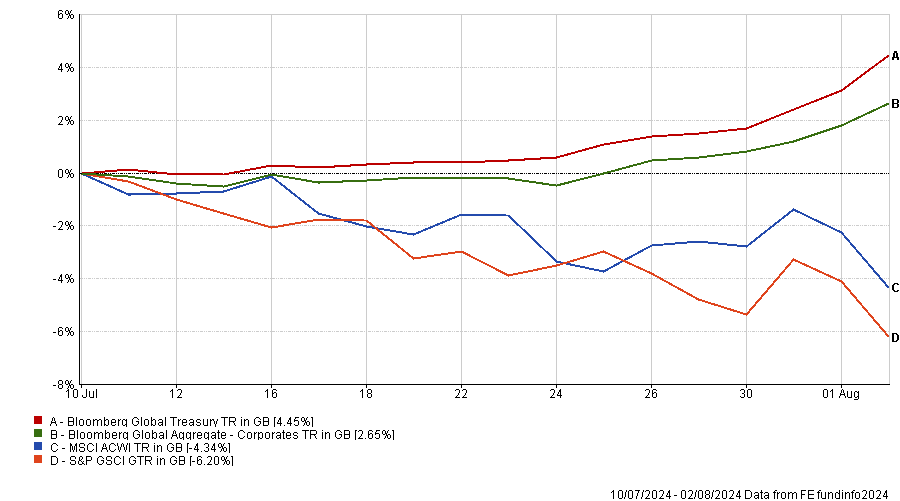

Japanese equities plunged more 12% as Asian equities fell overnight on Monday, leading US and European markets to head downwards when their sessions opened. Although the drop in Japanese stocks was eye-catching, equities have been drifting down since 10 July as shown in the chart below (which doesn’t capture yesterday’s moves).

Many headlines have pointed to investors worrying about a looming US recession as the main cause of the sell-off, although not everyone is convinced by this narrative.

Performance of asset classes between 10 Jul and 2 Aug 2024

Source: FE Analytics. Total return in sterling.

Russ Mould, investment director at AJ Bell, said there are three main reasons why “a market storm is emerging from a seemingly cloudless summer sky” – with worries about a US recession being one of them.

“First, equity, and to some degree bond, markets have priced in the ‘perfect’ scenario of a cooling in inflation, a soft landing in Western economies (and thus corporate earnings) and rate cuts from the Fed, Bank of England and others,” he said.

“Any deviation from that path could therefore lead to trouble – either stickier inflation, economic and earnings disappointment or slower-than-expected rate cuts.”

On Friday, the non-farm payrolls data revealed that US unemployment was rising while, earlier in the week, the purchasing managers’ index data showed US manufacturing is contracting.

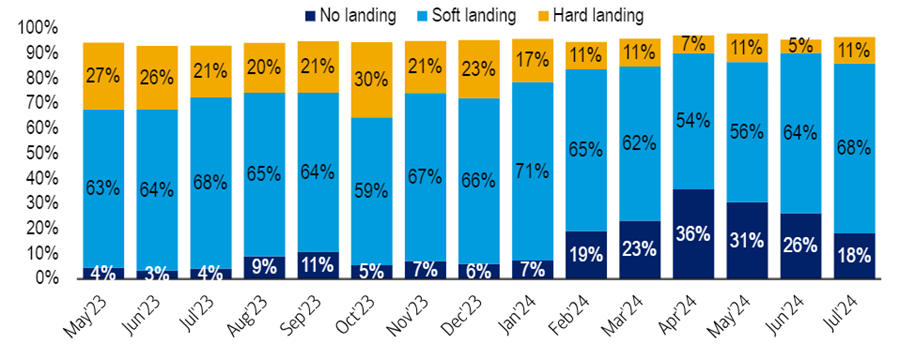

The latest Bank of America Global Fund Manager Survey found 68% of investors think the global economy is heading for a ‘soft landing’ – where activity slows but recession is avoided. This suggests that any concerns about an economic contraction would go against consensus and potentially spark significant portfolio shifts. Just 11% of fund managers were expecting a recessionary ‘hard landing’ at the start of July, Bank of America found.

Mould explained: “A US slowdown is not priced in at all – if anything markets were more concerned about it overheating earlier this year – and those with long memories will remember how frantic rate cuts in 2000-02 and 2007-08 failed to stave off a bear market in stocks, because the economy tipped over and corporate earnings fell far faster than the headline cost of money.”

Most fund managers expected ‘soft landing’ in Jul 2024

Source: Bank of America Global Fund Manager Survey

Mould pointed to the strength of the Japanese yen as another contributing factor to the sell-off. The yen carry trade – shorting a weakening yen, borrowing against it and using that money to go long non-Japanese risk assets – has been a major source of global liquidity but this trade is being unwound as the currency strengthens after the Bank of Japan hiked interest rates.

The third reason highlighted by the AJ Bell investment director is the fact that US equities have rallied much faster than GDP growth, corporate earnings or cash flows over recent years and are starting to look expensive – and potentially ripe for a correction.

Of course, there are differences of opinion. George Lagarias, chief economist at Forvis Mazars, said he is not convinced that worries about a US recession are driving the sell-off. He pointed out that history suggests bad macroeconomic data leads to higher rate cut expectations, which tends to fuel a market rally rather than a pullback.

“The equity markets have corrected initially on the same limited tech-focused basis they had rallied in the past few months and then more broadly, due to technical factors and during a period which traditionally features low trading activity, at least from humans,” he added.

“While they may well continue to correct in the next few days or weeks, we don’t see a fundamental case for a broader equity re-rating.”

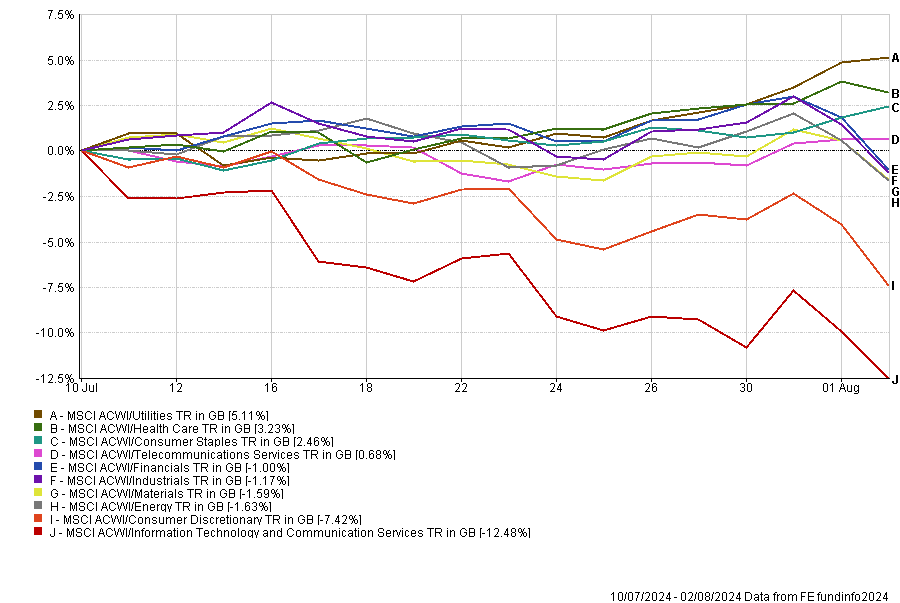

Lagarias noted that the market decline since 10 July has mainly been focused on the so-called Magnificent Seven, especially Nvidia, Microsoft and Amazon.

Performance of MSCI ACWI sectors since 10 Jul 2024

Source: FE Analytics. Total return in sterling.

Nvidia – which has been the darling of the market for some time thanks to supplying chips critical for the artificial intelligence revolution – is down more 20% since 10 July. However, it is still double its value at 2023 year-end and trading 40x its forward earnings, despite this fall, Lagarias said.

“While US large-caps are down 5%, ex-the Magnificent Seven they are only down 0.75%. Notably, the FTSE 100 hasn’t moved significantly,” he added.

“As of Monday 5 August, we are seeing evidence of spillover in the wider market (the Nikkei down 12.5%, US futures down 3%). However, this is precisely the point where we’d expect the Fed to affirm it’s ‘Put’, one way or another.”

The Fed Put referred to is the belief held by investors that the Federal Reserve will intervene to support markets if their prices drop to a certain level.

Michael Langham, economist at abrdn, is another who thinks concerns about a US recession might be overdone.

“We think the macro backdrop isn’t as terminal as markets are indicating. Strong labour supply growth in recent years has helped to cool the labour market and layoffs remain low in the US. In Asia, the upturn in tech exports and still buoyant domestic demand shouldn’t set alarm bells ringing yet for policymakers,” he said.

“We expect the Fed to begin easing in September, which should provide the runway for cutting cycles in parts of emerging Asia, and likely further stimulus in China could also have some positive spillovers, softening any slowdown in the region.”

On what to do next, investors are equally split.

Lindsay James, investment strategist at Quilter Investors, sees opportunities, noting that market moves in the US and Europe seem to be “well within” the range of normal volatility while companies have just posted a “generally positive” second quarter earnings season.

“Ultimately this period of outsized volatility against what remains a reasonably solid economic backdrop should present a buying opportunity for long-term investors,” she said.

But Peter Berezin, chief global strategist at BCA Research, was much more bearish, saying investors should be underweight stocks and overweight government bonds. In equity portfolios, investors should be tilted towards defensive sectors such as consumer staples, utilities and healthcare, he argued.

Berezin reiterated a warning he put out last month: “Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.”