Stocks plummeted yesterday after a crash in Japanese equities spread to global markets, leaving areas such as Japan, emerging markets, the UK and tech stocks nursing heavy losses.

Market commentators attributed the sell-off to worries about a US recession, rising Japanese interest rates and the stronger yen, and lofty tech stock valuations. Although markets have rebounded today, experts warn that volatility might continue to flare up for some time to come.

Stephen Innes, managing partner at SPI Asset Management, said: “This wasn't just any market dip; Japan witnessed its second-largest stock plummet ever, sending shockwaves through global markets and whipping up a storm of volatility usually reserved for catastrophic events.

“Having navigated numerous market downturns, I can say that insights become clearer post-crisis. When you identify the cause and effect, the worst is often over and the cleanup begins. Yet, each meltdown can still shock those who’ve never weathered a major downturn.

“A defining trait of these self-perpetuating market crises is the vicious cycle where sell-offs amplify volatility, which in turn cripples the market’s risk management abilities, feeding back into more declines. That’s precisely our current scenario – a loop of rising volatility and shrinking risk capacity that challenges even the most seasoned traders. Just look at yesterday’s VIX surge; the fear gauge truly takes no prisoners.”

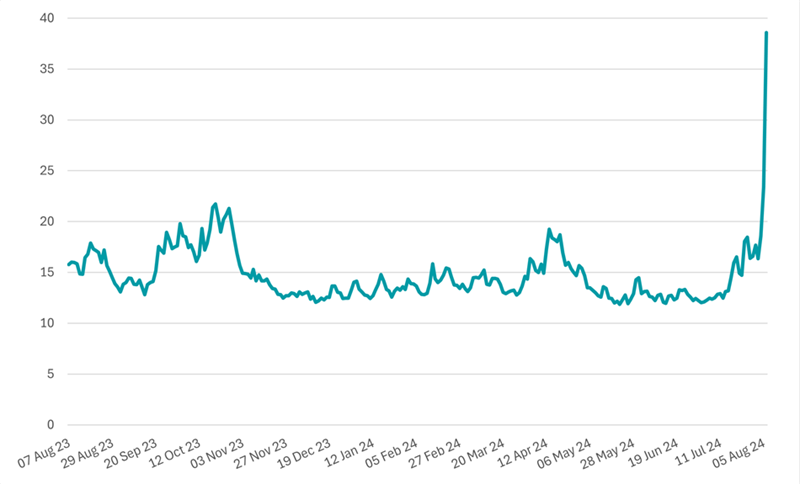

The VIX over 1yr

Source: CBOE

The above chart shows how the VIX, which measures the implied volatility in the S&P 500, has been climbing over recent weeks but spiked yesterday as markets routed. At one point, it reached 42 points – its highest since markets tanked at the start of the 2020 pandemic.

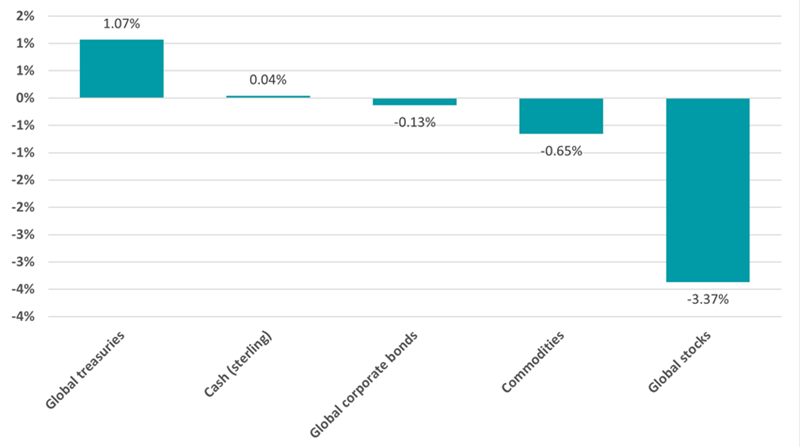

Performance on 5 Aug 2024 by asset class

Source: FinXL. Total return in local currencies.

How did this play out among asset classes? Global equities were the focus of the selling with the MSCI AC World index dropping 3.4% over Monday’s session. With investors worried about the health of the economy, it was natural that they would pull back from risk assets.

Conversely, investors moved into government bonds yesterday – the classic safe haven when stock markets sell off and beneficiaries if the US cuts rates to deal with recessionary risks.

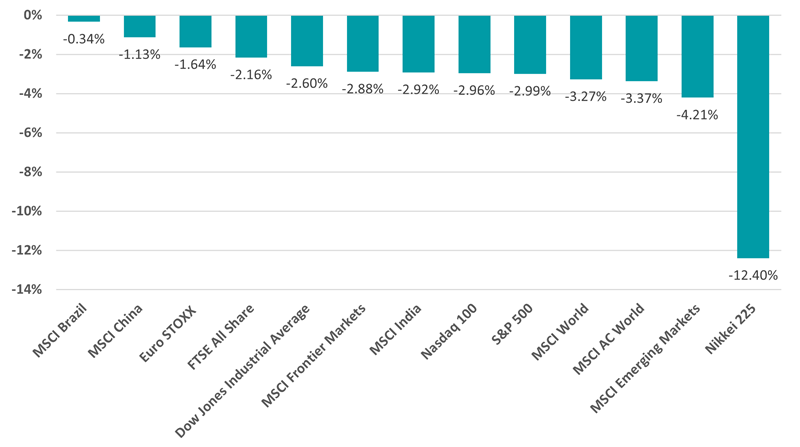

Performance on 5 Aug 2024 by geography

Source: FinXL. Total return in local currencies.

Japan fell hardest of the major regions, as yesterday’s headlines made clear, with the Nikkei 225 plunging 12.4% in its worst fall since 1987. The unwinding of the Japanese carry trade, whereby investors borrow in yen to reinvest in higher-yielding assets, impacted global liquidity and caused the sell-off to spread first to Asian markets then globally.

Emerging markets tended come off worse than developed markets, although Brazil and China – which have been sold down heavily recently – escaped with muted losses. The FTSE All Share lost 2.2%.

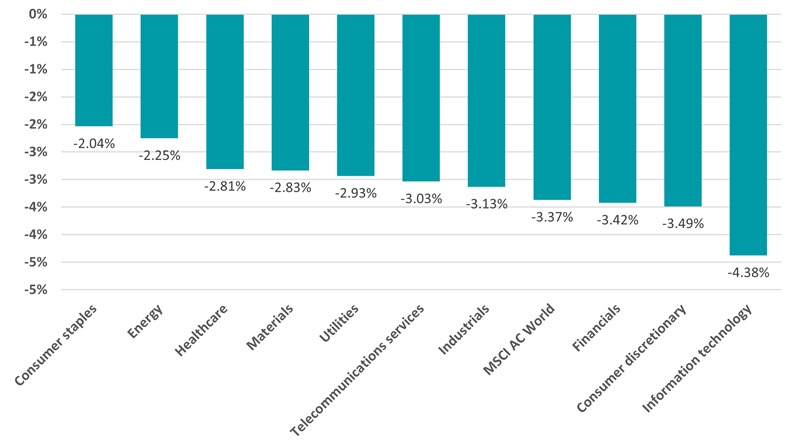

Performance on 5 Aug 2024 by industry

Source: FinXL. Total return in local currencies.

Tech stocks were another area that bore the brunt of yesterday's selling, reflecting the meteoric rise in recent years and more recent concerns over the profitability of the artificial intelligence (AI) revolution.

All of the ‘Magnificent Seven’ – the group of AI-linked stocks that made specular gains in 2023 – were down in the 5 August sell-off. Nvidia dropped furthest, falling 6.7%, while Apple lost 4.8% and Alphabet shed 4.6%.

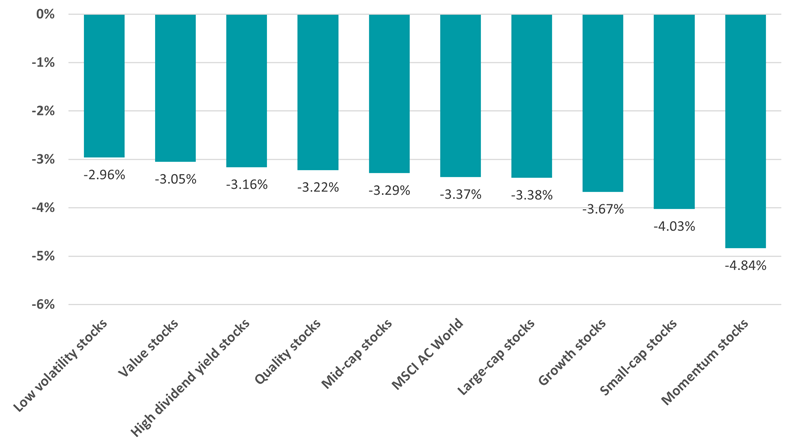

Performance on 5 Aug 2024 by investment factor

Source: FinXL. Total return in local currencies.

Momentum was the investment factor that sold off the most. Momentum investing has led the market for some time but investors have been drifting away from these stocks since early July; the style is known for staging dramatic reversals when strong runs come to an end.

Small-cap stocks were also hit hard. Investors had been rotating into small-caps in recent weeks but sold them on yesterday’s recession worries as they tend to more cyclical (tied to the strength of the economy) than large-caps.

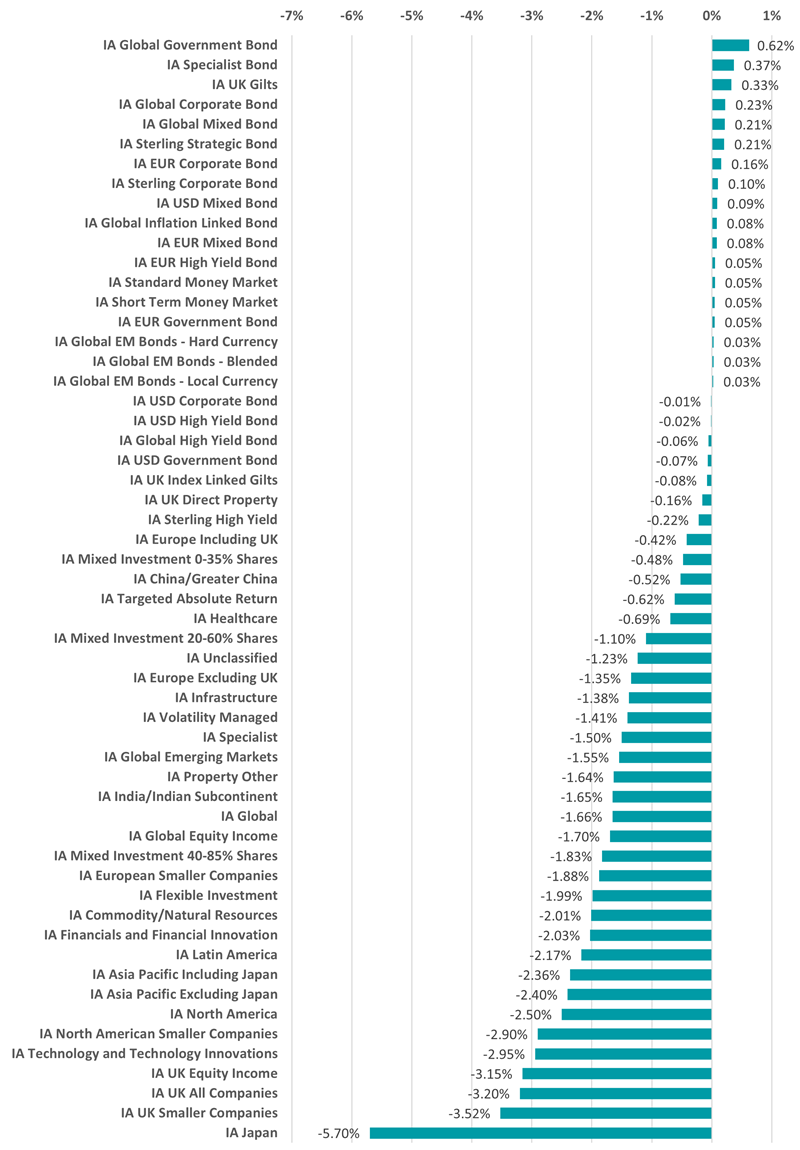

Performance on 5 Aug 2024 by Investment Association fund sector

Source: FinXL

It should be little surprise that the IA Japan sector felt the most pain in the sell-off, with the average fund down 5.7% - someway off the 12.4% drop in the Nikkei but painful nonetheless.

What might be more surprising is the fact that the three UK equity sectors – IA UK Smaller Companies, IA UK All Companies and IA UK Equity Income – were hit with a heavier average loss than the IA Technology and Technology Innovations sector.

Source: FinXL

In all, 84.4% of the funds in the Investment Association universe made a loss on 5 August. There were 20 sectors were every fund made a loss, including IA Japan, IA UK All Companies, IA UK Equity Income, IA UK Smaller Companies, IA Technology & Technology Innovation, IA North America, IA North American Smaller Companies and IA Global.

The 20 worst-performing funds all focusing on Japanese equities, with the biggest faller being Amundi MSCI Japan. Indeed, most of the 50 funds with the biggest losses are Japanese funds, with the exception of a few Korean and Taiwanese equity funds and one tech fund.