Like the Magnificent Seven in the US, the Granolas have come to dominate the European stock market, but the recent correction across the Atlantic should be a warning of what could happen in concentrated markets closer to home.

This group of 11 companies now represents more than 20% of the European equity market – similar, astonishingly, to the combined weight of Energy, Basic Resources, Banks, Financial Services and Automobiles.

The list comprises GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, Sanofi and SAP – global leaders in pharmaceuticals, beauty and food.

Just like the Magnificent Seven, the Granolas have been responsible for a large proportion of market returns. And their solid stock price performance has been justified by strong earnings growth.

But they might not be as healthy for investor returns going forward as that acronym suggests.

These companies are now looking richly valued with an average price-to-earnings (P/E) ratio of 25x and are perhaps a little too well-loved by investors.

The Artemis SmartGARP process screens and filters thousands of companies to identify for closer assessment those that have the most attractive fundamentals at the best price. Most of these have been overlooked by investors. The process combines top-down and bottom-up factors including growth, value, momentum and sentiment.

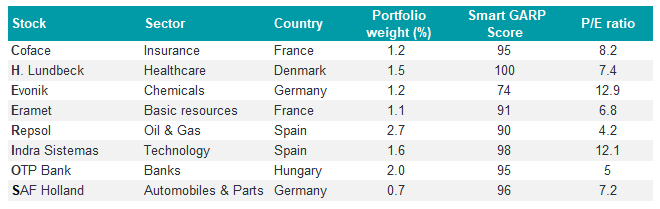

As a result of that analysis, the Artemis SmartGARP Europe fund owns just three of the Granolas – an 18% underweight position. But it has kicked out an alternative list that we think lovers of breakfast cereal acronyms might benefit from investigating: the Cheerios.

Coface is one of the top three trade credit insurers in the world serving 100,000 companies worldwide. This is a highly concentrated market with strong barriers to entry. Despite very limited exposure to its domestic market, the recent sell-off in French stocks has left the valuation of the shares looking particularly attractive, trading on a P/E of 8.2x and producing a dividend yield of 10.2%.

Lundbeck develops and commercialises specialised products for the treatment of brain diseases, giving it a strong competitive advantage within neurological and psychiatric disorders. Supported by patents, it has a global presence with the potential to increase its presence in emerging markets, where there is growing demand for healthcare solutions.

Evonik is a diversified German chemical company with a relatively high share of specialties in its portfolio. It operates in four divisions and is a leading producer of the feed ingredient methionine. With industrial businesses having shown an ability to bounce back meaningfully in past earnings recoveries, Evonik has one of the most resilient earnings profiles, and we have started to see very positive analyst sentiment towards the company.

Eramet is a French metals and mining company. The group is a major low-cost producer and leader in alloy metals, particularly manganese and nickel, as well as minerals sands. Manganese is geared to global steel volumes, under pressure since Covid. The ongoing weakness in Chinese property and near-term supply additions in a few of Eramet's products has led to the company’s cheap valuation.

Repsol is a Spanish integrated oil & gas company with search, exploration, drilling and extraction activities across the globe. The group has a sizeable and high-quality downstream portfolio and is a leading player in setting bold GHG emission reduction targets, with potential to develop low-carbon investments. Sentiment towards the stock is negative, resulting in a very compelling valuation, despite a strong macroeconomic tailwind.

Indra Sistemas is a Spanish technology company that provides IT services to industries such as defence, air traffic management and transport. It has market-leading positions in a number of segments with strong order pipelines. The business scores particularly well on analyst sentiment and share price momentum, whilst also trading at a discount to the market and its sector.

OTP Bank is a leading regional banking franchise in Hungary and in Central and Eastern Europe. The bank was hit by the negative impacts of the Russian invasion of Ukraine, but moderating impairment charges and successful recent merger and acquisition activity have driven a strong recovery in earnings. OTP has been deploying excess capital to enter new markets and improve its position in existing markets.

SAF Holland is a leading global supplier of components and systems equipment for trailers and trucks. This is an attractive market segment, particularly the high-margin after-market. SAF Holland has opportunities to benefit from market share gains and strong growth opportunities in emerging markets. The stock is seeing positive earnings revisions trends yet trades on a compelling valuation.

Cheerios is a whole grain cereal, low in fat and calories, but it also includes sugar – there is always a downside! The same goes for investments but if the returns from these eight stocks are as sweet as we hope they will be in the coming years, few shareholders will complain.

Paras Anand is chief investment officer of Artemis. The views expressed above should not be taken as investment advice.