Despite its relatively complex product, it would be difficult to deny how fast Nvidia has risen to prominence, with brand value having increased by almost 178% in a year, according to recent research by Kantar.

This has made Nvidia the sixth most valuable brand in the world, as well as one of the largest companies by market cap globally, just beneath McDonalds, said Mobeen Tahir, director of macroeconomic research and tactical solutions at WisdomTree.

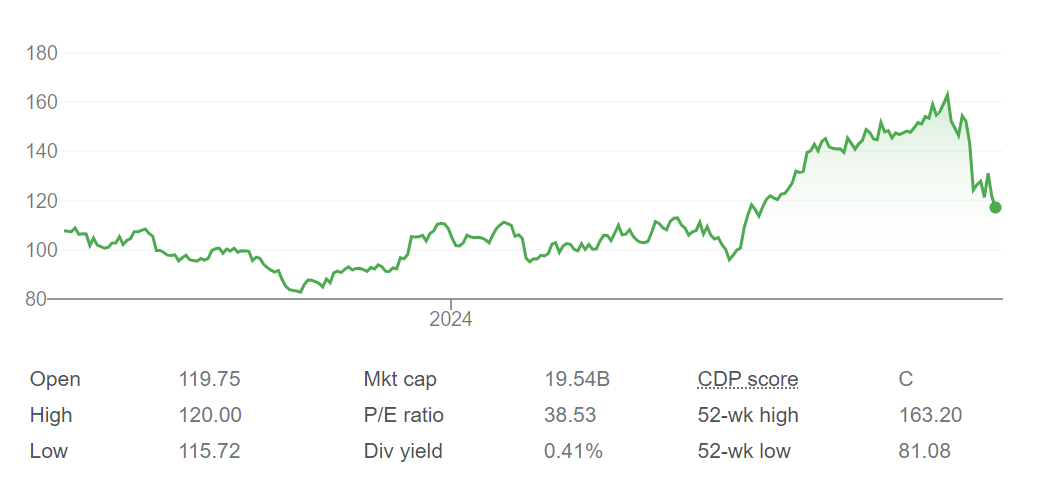

However, investors in Nvidia suffered considerable losses in recent weeks, when the company recorded one of its worst performances on record, shedding 27% of its market value since 10 July. This left Nvidia’s share price at just $99 on 7 August, down from $135 on 10 July.

Share price of Nvidia over 1mth

Source: Google Finance

While few companies could match Nvidia’s meteoric rise last year and during the first half of 2024, it is not “alone in its field”, Tahir said, and arguably, the past month serves as a reminder to investors not to put their eggs all in one basket. To that end, he drew attention to five other US-based companies in the semiconductor sector.

Qualcomm

The first of these companies is Qualcomm, producer of Snapdragon Seamless, a device designed to allow users to switch their data between their devices much more easily.

The firm counts Apple and Samsung as some of its core customers, which has resulted in a rising share price of 39% in the past six months.

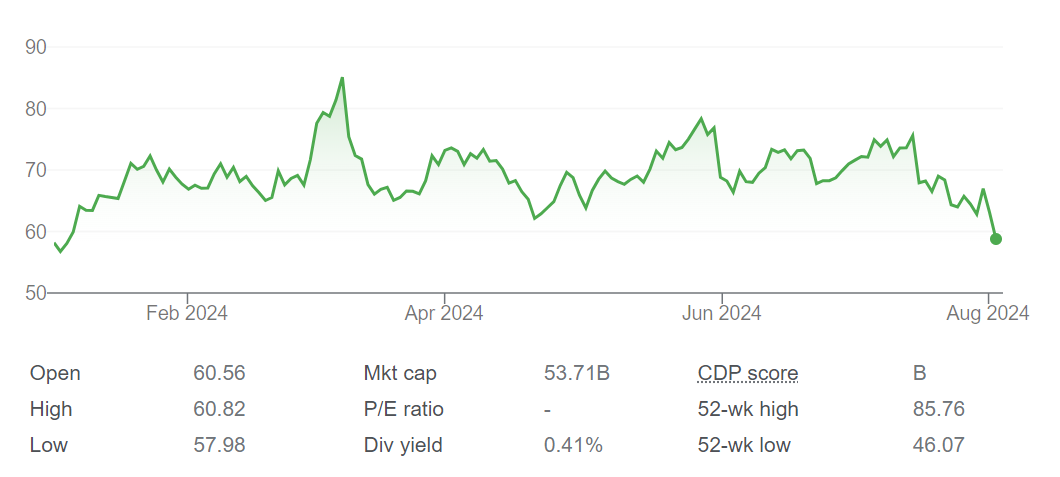

Share price of Qualcomm over 1yr

Source: Google Finance

The $1.3bn GQG Partners US Equity fund, among others, holds Qualcomm alongside several of the Magnificent Seven.

Broadcom

Next, Tahir identified Broadcom, which produces the Tomahawk series of switches to enable data transfer in data centres, as another investment opportunity.

With major customers including Google and Microsoft, its stock price has risen by 45% this year.

Share Price of Broadcom over 1yr

Source: Google Finance

This rising share price is reflected in the stock’s popularity amongst fund managers, with the £762m M&G North American Dividend fund holding almost 7% of its assets in Broadcom, its second largest holding behind Microsoft.

Micron Technology

Third, WisdomTree suggested Micron Technology. It specialises in digital storage devices, which have proven popular this year with Dell and HP, resulting in a 54% rise in its share price.

Share price of Micron Technology over 1yr

Source: Google Finance

The FTF Templeton Global Leaders fund has a stake in Micron Technology.

Teradyne

Next, Tahir identified Teradyne, whose UltraFLEX testing system has established the company as one of the leading semiconductor testers, with its share price rising by 37% over the past six months.

Share price of Teradyne over 1yr

Source: Google Finance

The Herald Worldwide Technology fund has a position in Teradyne.

Marvell Technologies

Finally, Tahir highlighted Marvell Technologies, whose share price has gained 16% this year due to the popularity of its QLogic Fibre Channel adapter amongst businesses such as Cisco.

Share price of Marvell Technologies over 1yr

Source: Google Finance

It features in the top 10 holdings of the Janus Henderson Global Technology Leaders fund, alongside several Magnificent Seven names.

“As global demand for computing power rises and the need for data storage and processing continues to surge, these companies will play an increasingly vital role. Their performance in the first half of 2024 demonstrates a growing recognition from the markets of their importance,” Tahir concluded.