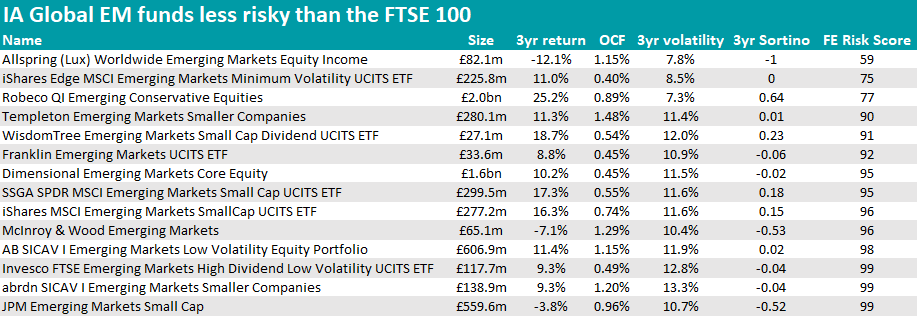

Fourteen global emerging markets (EM) funds are less risky than the FTSE 100 index, data from FE Analytics has shown, even though countries in the EM region are typically more volatile.

To evaluate this, Trustnet looked at the FE fundinfo Risk Score. This metric evaluates relative risk by assigning a baseline risk of 100 to the FTSE 100 and of 0 to cash, and then ranking funds on this scale based on their performance over the past 18 months to three years.

We begin with the least risky fund of the 168 in the sector – the Allspring (Lux) Worldwide Emerging Markets Equity Income fund.

This $105m strategy co-managed by Alison Shimada and Elaine Tse has a risk score of 59, but it doesn’t score as well on other risk measures. For example, it has one of the highest Sortino ratios, which measures the volatility of a fund specifically in bear markets.

It also has a negative return of 12.1% over three years, a timeframe when most other funds in the list grew at a double-digit pace.

Source: FE Analytics

With a risk score of 75, the iShares Edge MSCI Emerging Markets Minimum Volatility UCITS exchange-traded fund (ETF) came second place, and with a ongoing charges figure of 0.40%, it was the cheapest fund in the list.

Other passive options included WisdomTree Emerging Markets Small Cap Dividend UCITS ETF (risk score: 91), SSGA SPDR MSCI Emerging Markets Small Cap UCITS ETF (95) and Invesco FTSE Emerging Markets High Dividend Low Volatility UCITS ETF (99).

On the active side, Robeco QI Emerging Conservative Equities leads the way with a risk score of 77 – the least risky and the most popular vehicle, with £2bn of assets under management (AUM).

It has achieved a full FE fundinfo Crown Rating of five and is co-run by a team of five managers, who focus on companies with high dividend yields, attractive valuations, strong momentum and positive analyst revisions.

Its Sortino ratio of 0.64 is the best of the list and the second-best in the whole peer group, giving investors a good chance at protecting their money in down markets but also marking returns when markets are going up. It was the best performer in the list, with a three-year return of 25.2%.

The team invest in low-volatility stocks, aiming to make comparable returns to an emerging market benchmark with a much lower level of downside risk.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Another sizable strategy with an AUM of £1.6bn, Dimensional Emerging Markets Core Equity had a risk score of 95. It was also among the cheapest active strategies, charging only 0.45%. The fund’s portfolio is generally invested in three buckets: shares of smaller companies; highly profitable businesses; and value stocks.

Next up was the Templeton Emerging Markets Smaller Companies fund, a bottom-up strategy with the key tenet of choosing smaller companies with sustainable earnings power, as RSMR analysts explained.

“The potential for investors is that market valuations tend to be significantly lower than in large-cap stocks whilst the downside is that there can be a lack of liquidity in many of the names. As a result, investors in the fund should have a long-term investment horizon,” they said.

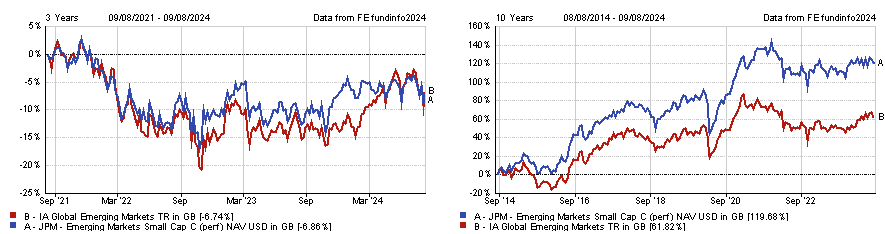

Another strategy with a focus on smaller companies, JPM Emerging Markets Small Cap is run by FE fundinfo Alpha Manager Amit Mehta and Austin Forey and has featured repeatedly on Trustnet recently, including as part of the top-quartile emerging market funds that weren’t afraid to stray from their benchmarks, the most consistent emerging market fund of the decade and the discounted investment trusts specialist stock pickers are snapping up.

It is a high-conviction portfolio of high-quality companies with “superior and sustainable” growth potential and with a risk score of 99, it is almost as risky as the FTSE 100. While its approach has made a 3.8% loss over the past three years, most small-cap funds have struggled and its longer-term track record is much better, as the chart below shows.

Performance of fund against sector over 3 and 10 yrs

Source: FE Analytics

Other funds that also stood out were abrdn SICAV I Emerging Markets Smaller Companies, AB SICAV I Emerging Markets Low Volatility Equity Portfolio and McInroy & Wood Emerging Markets.

Previously, we also covered the UK small-cap funds less risky than the FTSE 100.