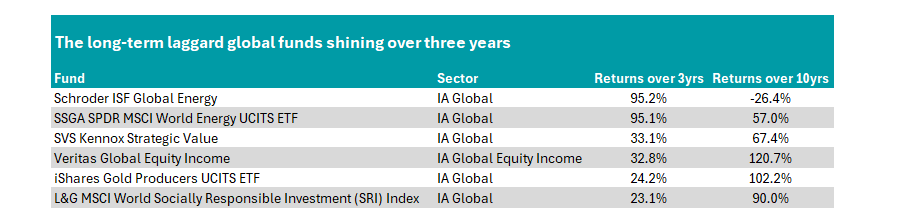

Veritas Global Equity Income and SVS Kennox Strategic Value have turned around long-term struggles to make top-quartile returns in their respective Investment Association sectors, according to data from FE Analytics.

In this series, Trustnet looks at the funds that have been bottom-quartile performers in their peer groups over 10 years but have risen to the top 25% over the past three years. Here we compare funds in the IA Global and IA Global Equity Income sectors.

The two best funds on the list over the past three years have been energy specialists, with active strategy Schroder ISF Global Energy joined by passive vehicle SSGA SPDR MSCI World Energy UCITS ETF.

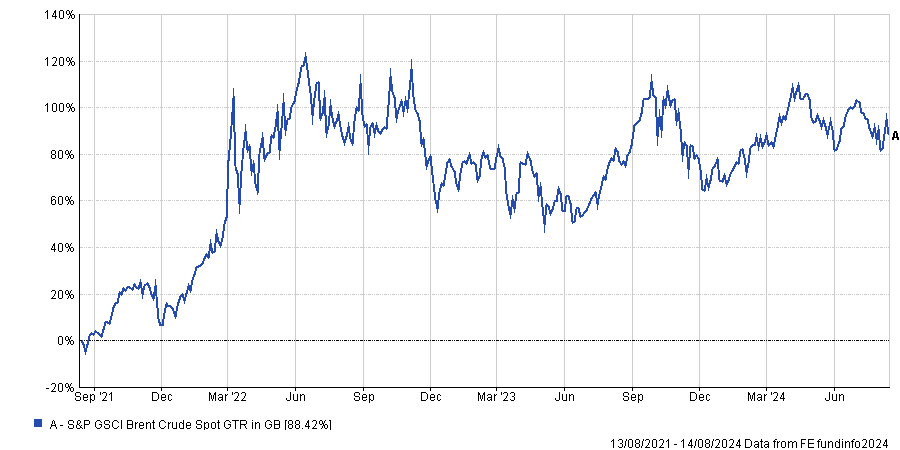

Oil has surged in recent years thanks in part to Covid-related backlogs in supply chains, as well as the invasion of Ukraine by Russia, which caused countries to impose sanctions on the aggressor’s exports.

Performance of index over 3yrs

Source: FE Analytics

An unwinding of environmental, social and governance (ESG) trade in recent years has also helped boost traditional energy funds, with rivals in the renewable energy sector struggling by comparison.

On top of the recent woes, both are in the bottom quartile over the past decade, with the Schroder ISF Global Energy fund down 26.4% – the only portfolio in the sector to make a loss over that time.

Managed by Mark Lacey, Alex Monk and Felix Odey, the £300m has been the best performer over the past three years, however, up 95.2%, with SSGA SPDR MSCI World Energy UCITS ETF in second place.

Source: FE Analytics

Also from the commodities space, the £1.3bn iShares Gold Producers UCITS ETF is on the list. Like oil, gold has been in demand over the past three years as investors have used the precious metal as a safe haven asset.

With Covid, war, political risk, rampant inflation and rising interest rates, the macroeconomic picture has been mixed at best. Yet equity markets have continued to thrive on the back of tech names and the boom in artificial intelligence (AI), leaving some fearing they could be frothy.

As such, gold has been a popular hedge in recent years, with the S&P GSCI Gold Spot index up 46.1% in four years.

This has boosted the gold producers this exchange-traded fund (ETF) invests in, with the fund up 24.4% over the past three years.

Splitting the commodity funds on the list is the £69.5m SVS Kennox Strategic Value fund managed by Charles Heenan and Geoff Legg. It has struggled over 10 years as the value style of investing has been out of favour.

It was a bottom-quartile in all three years from 2019-2021 but boomed in 2022 when the recovery trade led to a strong rebound for unloved names, making 12.6% in that year alone.

This was followed by another fourth-quartile effort in 2023 as the AI boom caused tech to shoot higher once again, although this year it is in the second quartile so far. Overall, it means the fund is up 33.1% over three years.

Rounding out the IA Global funds on the list is the £505m L&G MSCI World Socially Responsible Investment (SRI) Index fund, which is a passive ESG portfolio.

The fund has boomed in recent years as the index’s largest holding is Nvidia. The chipmaker has had the biggest positive impact on markets in recent years and represents some 18.6% of this fund.

The only portfolio on the list from the IA Global Equity Income sector is the £211m Veritas Global Equity Income fund, headed by Ian Clark, Mike Moore and FE fundinfo Alpha Manager Andrew Headley.

It aims to have a yield of 10% above that of the MSCI World index over rolling five-year periods and therefore invests more in income-heavy regions such as Europe (48.6% of the fund) and the UK (19%).

The fund was among the 10 best funds in the sector in 2023 and is above average again so far in 2024. However, it has not always been plain sailing, with the portfolio suffering more than its peers from pandemic-related dividend cuts.

Previously in this series, we have looked at the emerging markets and UK All Companies sectors.