Housebuilders could be on the rise in the coming months and years if interest rates continue to fall and the government pushes on with its manifesto pledge to build 1.5 million new homes over the next five years.

Last month inflation figures came in slightly higher than the previous – up to 2.2% in July from 2% in June. It marked the first time it had risen in 2024, but few believe this will deter the Bank of England from lowering interest rates.

Interest rates are key for housebuilders, as high mortgage rates (a knock-on effect of a higher Bank rate) mean fewer people move house.

At the same time, for the Labour party to achieve its ambitious housebuilding goal there would need to be a 41% uplift on the 212,570 homes completed during the 2022-23 financial year.

John Moore, senior investment manager at RBC Brewin Dolphin, “Housebuilders had a torrid 2023 in challenging macroeconomic conditions, but unlike in 2008 they were well capitalised and the sector weathered the storm relatively unscathed – at least at the larger end of the market.

“Now, with a government committed to building new homes and interest rates being cut to 5%, the picture looks a lot more positive.”

Danni Hewson, head of financial analysis at AJ Bell, agreed. “Housebuilders have had a difficult couple of years as costs spiralled and rate hikes impacted demand. But there have been a lot of changes, from a new Labour government seeking to reinvigorate the sector and open up greater opportunities to acquire potential plots, to a pivot in Bank of England monetary policy and a first interest rate cut in over four years,” she said.

Housebuilders

In the UK there are several options to choose from when it comes to housebuilders but there are two that caught the eye of RBC Brewin Dolphin’s Moore.

The first is Berkeley Group, which typically focuses on mixed-use developments, which helps to manage the risk of any downturn in demand for housing, he said.

“Preferring growth of its book value overpaying dividends out, it has never been a great yielder but has tended to be less volatile than many of its peers.”

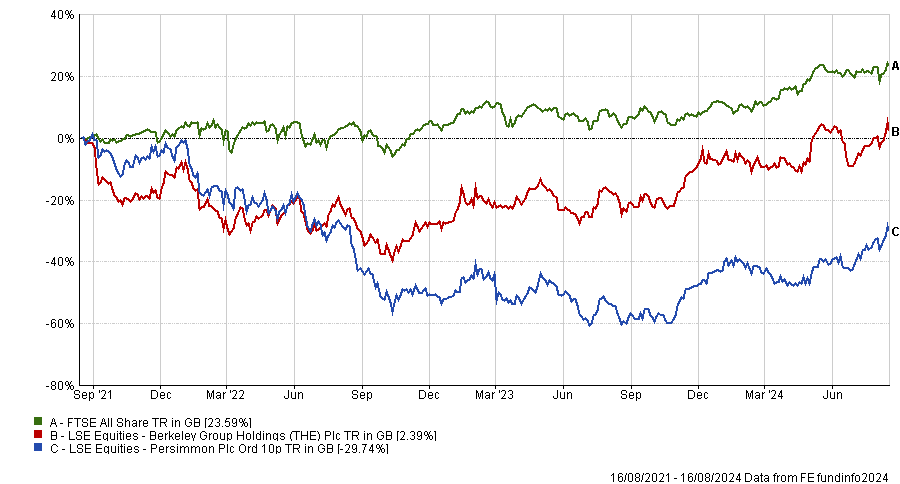

Performance of shares vs market over 3yrs

Source: FE Analytics

The other is Persimmon, which has been viewed as “the blue-chip choice” in the sector for quite some time but performance over the past few years has been particularly poor, as the above chart shows.

Although it had to cut its dividend hard last year to compensate for slowing sales, its 4.3% yield last year remains high. The firm is also considering a £1bn bid for rival Cala, which could “add another string to its bow with more exposure to the premium market and more geographic spread within the UK.”

There have been many merger and acquisition discussions in the sector. AJ Bell investment director Russ Mould highlighted Barratt’s acquisition of Redrow as a positive. It should “allow Barratt to replenish its landbank – a necessary precondition to ramping up volumes – with prices in the open market not having retrenched as much as might be expected in the current cycle,” he said.

Not all have been successful, however, reminding investors that investing based on takeover deals is a risky business. For example, rival housebuilder Bellway ended its pursuit of Crest Nicholson last week in a sudden change of heart. Hewson said: “The end of every romance leaves more than a few questions hanging in the air. The decision by Bellway to end its pursuit of Crest Nicholson came without clarification and sent shares in the latter plunging by almost 20%.”

Suppliers

Although only a couple of housebuilders stood out for Moore, in the supply trade there are four names of interest. Kitchen maker Howden Joinery is one. It has an “excellent track record and network reach throughout the country”, he said, noting that it should also benefit from a rise in the refurbishment market if mortgage rates remain high and people decide to stay put and improve their current properties.

Up next is Marshalls, the FTSE 250-listed construction supplies company, which provides materials for the housebuilding and landscaping markets.

“The business occupies a strong position in the UK and is generally well managed, but its shares have suffered in recent years as construction activity struggled. Its shares have rallied since the election of the new government, with plenty of room for further growth,” said Moore.

Performance of shares vs market over 3yrs

Source: FE Analytics

Breedon Group is a specialist in aggregates, asphalt and cement and has climbed into the FTSE 250 alongside Marshalls in recent years. “It forms a crucial part of the UK’s supply chain for raw materials,” he said.

Lastly, brickmaker Ibstock has “flown under the radar” during the difficult time for the industry but shares have risen recently on the back of the new government’s plans, which could produce “further opportunities for the company”, concluded Moore.