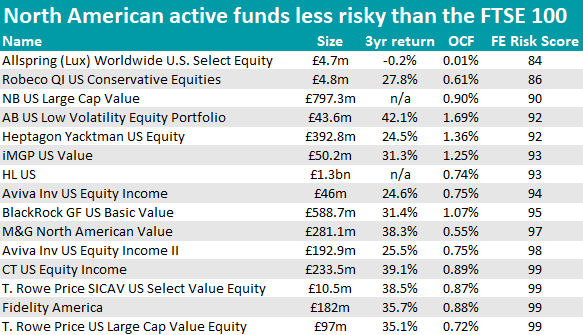

Investors with a conservative mindset have the opportunity to get exposure to North American assets with even less risk than if investing at home, as 13 active funds in the IA North America sector are less risky than the FTSE 100, data from FE Analytics has shown.

On top of that, less than half are focused on value investments, meaning that investors don’t have to give up on owning US growth names to be on the safer side.

For this study, we used the FE fundinfo risk score, a measure that ranks funds based on their performance over the past 18 months to three years on a graduated scale where the FTSE 100 is given the arbitrary value of 100 and cash of 0.

All funds below – including the growth-based ones – are less risky both than the average North America passive fund (average risk score: 123) and the FTSE 100.

The first to stand out was the popular £1.3bn HL US, which is part of Hargreaves Lansdown (HL)’s ‘portfolio building blocks’ for do-it-yourself investors.

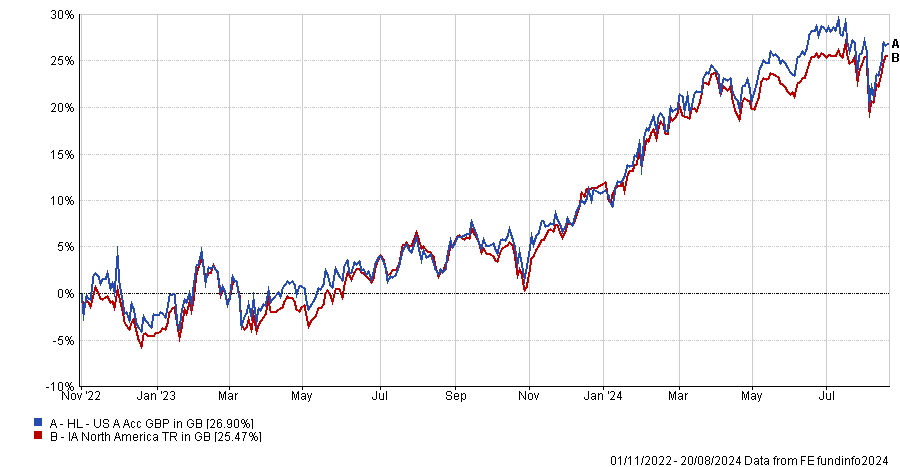

The strategy is actively managed and, as such, has the potential to beat the market, but it still has to prove that it can, having not done so since its launch in November 2022.

It is run by third-party managers who follow the rules and allocation limits set by HL, by focusing on long-term growth through large-cap companies. The top 10 holdings include all of the Magnificent Seven, the iShares S&P 500 Information Technology UCITS ETF, as well as UnitedHealth Group and Texas Instruments. It has a risk score of 93.

Performance of fund against sector since launch

Source: FE Analytics

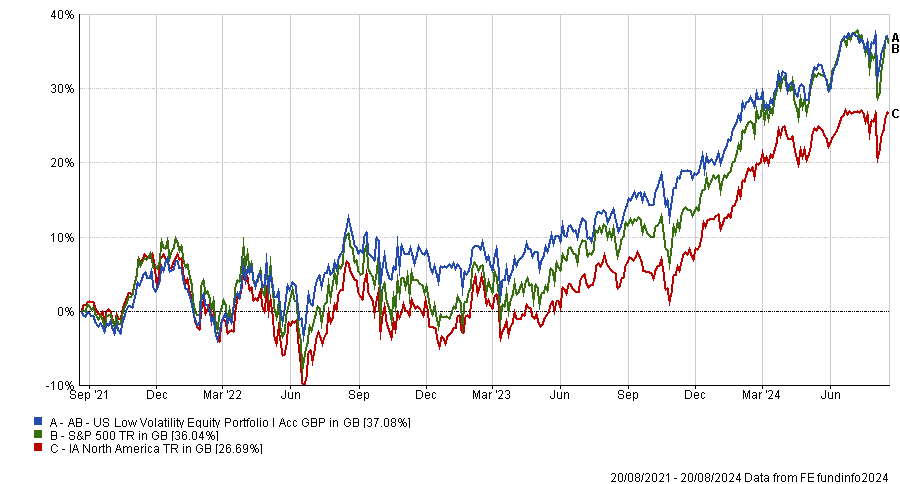

The AB US Low Volatility Equity Portfolio was also a prominent name on the list. Managed by two FE fundinfo Alpha Managers, Kent Hargis and Sammy Suzuki, the strategy has achieved the maximum FE fundinfo Crown rating of five, thanks to its first-quartile performance over the past three years, the best result in the whole list

Performance of fund against sector and index over 3yrs

Source: FE Analytics

The philosophy of this fund is to limit volatility, mitigate losses and focus on absolute risk and return, rather than benchmarks. This has allowed it to achieve the fifth-best Sortino ratio in the whole sector (0.96) over three years, which indicates it has low levels of ‘bad’ (downward) volatility.

With a risk score of 99, Fidelity America is only marginally less risky than the UK top 100 companies and returned 35.7% over the past three years.

Managed by Ayesha Akbar and Chris Forgan, the strategy has a longer track record than HL’s, but it has been lacklustre over the long term, stalling in the third quartile for performance over the past 10 and five years and only rising to the second over three years and 12 months.

Aviva Inv US Equity Income II and CT US Equity Income were the two income strategies on the list, while there were a host of value portfolios, of which the largest was the £797.3m NB US Large Cap Value.

Benchmarked against the Russell 1000 Value index, it has a risk score of 90. Managers David Levine and Eli Salzmann maintain an overweight to utilities (11.2 percentage points more than the benchmark), materials (8.7 percentage points) and consumer staples (3.6 percentage points) and an underweight to industrials (-9.9 percentage points), consumer discretionary (-5.6 percentage points) and real estate (-3.9 percentage points).

Also looking for value in the US were Daniel White and Richard Halle of M&G North American Value. Their sector preferences go to materials (3 percentage points relative to the S&P500), healthcare (2.7 percentage points) and communication services (2.3 percentage points), while their favourite stocks include Cisco Systems (1.8 percentage points) and Oracle (1.7 percentage points).

The most defensive IA North America fund, however, with an FE risk score of 84, is the tiny Allspring (Lux) Worldwide U.S. Select Equity, with only £4.7m of assets under management.

The manager, Jonathan Fox, maintains a portfolio of 36 stocks, most of which in the industrials sector (31.6%), followed by telecom, media and technology (23.1%) and healthcare (13.8%).

Source: FE Analytics

Previously in this series Trustnet has also covered the UK small-cap funds and emerging market funds less risky than the FTSE 100.