UK smaller companies, Asia and emerging markets, as well as bonds and global equities, have all been suggested as good places to allocate profits that have come from technology investments.

After the panic sell-off of 5 August, investors have been rethinking their allocation to the sector, and names such as Cathie Wood have come out to say that now is the time to diversify away from mega-cap tech stocks. But this could also be a good entry point for savers who have been stockpiling cash, encouraged by SJP experts to ‘buy the dip’ in equities. So where should they be looking next?

The shift needn’t be radical, according to Victoria Hasler, head of fund research at Hargreaves Lansdown, as investors might want to keep some exposure to technology, but a broader one that goes beyond the Magnificent Seven and the winners of the recent past.

If that’s the case, she suggested a global equity fund such as Rathbone Global Opportunities.

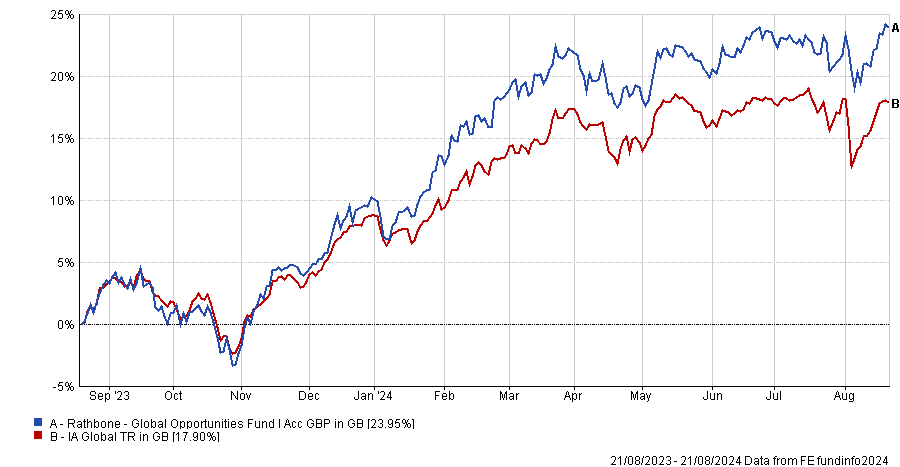

Performance of fund against sector and index over 1yr

Source: FE Analytics

Managed by FE fundinfo Alpha Manager James Thomson, it could be “a good place to start”. The manager invests across the global stock markets (including the UK) through a bottom-up, high-conviction approach that doesn’t follow any specific index.

RSMR analysts rate the fund, with the caveat that it might underperform at times when banks and commodities are on a bullish run.

Alternatively, Hasler suggested looking at an entirely different asset class: bonds. With the outlook for interest rates now on a downward trend across the UK, Europe and the US, fixed income looks “pretty attractive”.

Here, her pick was the Invesco Tactical Bond fund, managed by Stuart Edwards.

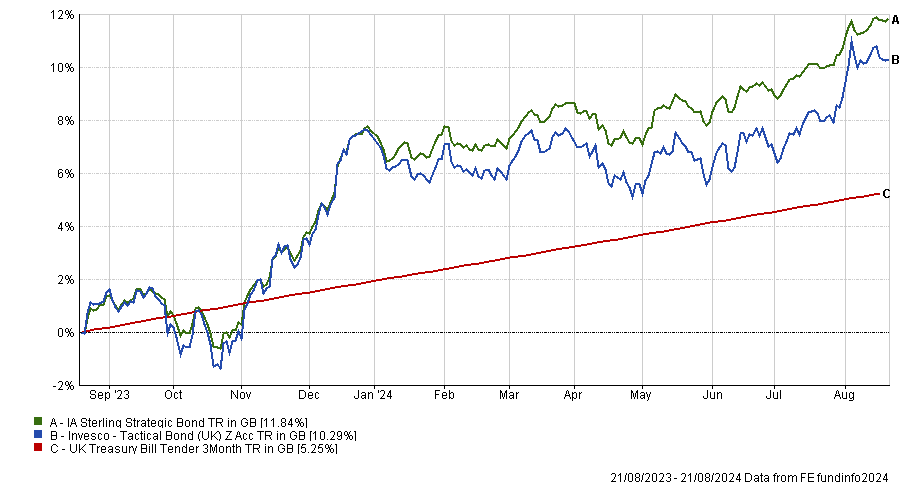

Performance of fund against sector and index over 1yr

Source: FE Analytics

It invests in all types of bonds depending on the managers’ views and has achieved a maximum FE fundinfo Crown Rating of five. “This can be a relatively high-risk bond fund or can be run on a conservative basis and it is good for exposure to the wider bond market,” Hasler said.

For Simon Evan-Cook, who runs the multi-asset range of funds at Downing Fox, “almost anywhere” in global stock markets other than US tech mega-caps would “probably be a reasonable investment”; but more specifically, UK smaller companies are looking “most attractive”.

The choice was down to a mixture of appealing valuations and good corporate governance, plus the fact that takeover activity and a general improvement in sentiment around the UK are starting to support share prices, making this look “as good a place as any”.

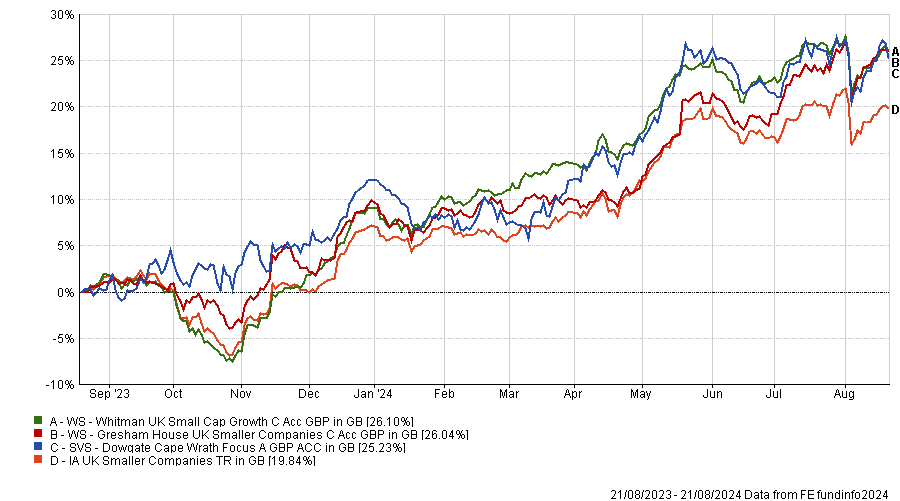

To access the market, his preference went to “right-sized, well-managed equity funds”, which includes the small-cap specialists Cape Wrath UK Focus, Whitman UK Growth and Ken Wotton’s five-crown strategy Gresham House UK Smaller Companies.

Performance of funds against sector over 1yr

Source: FE Analytics

Darius McDermott, managing director at FundCalibre, agreed with Evan-Cook that UK smaller companies look interesting.

His picks included TM Tellworth UK Smaller Companies and Unicorn UK Smaller Companies, both with “a solid investment process and highly competent teams, making them great options for investors seeking exposure to UK small cap equities”.

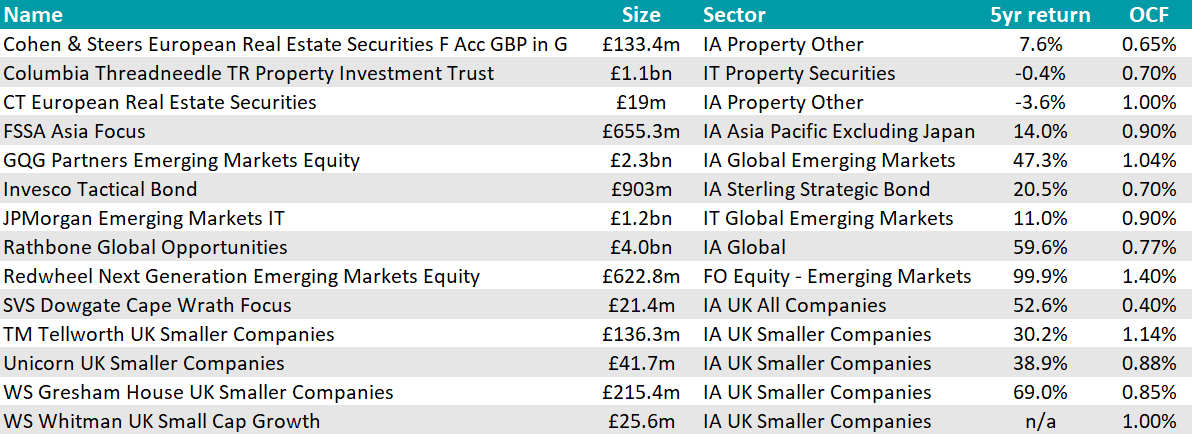

Elsewhere, Fairview Investing director Ben Yearsley’s long-term growth pick was emerging markets, or more specifically, Asia.

“The middle-class consumption story has largely been ignored during the tech boom of the past few years and even during the past decade, with the exception of India,” he said.

“But I still believe in it, and many of the countries within emerging market indices have a far lower debt burden than the developed world”.

His picks for this sector were FSSA Asia Focus for “something broad-based” or a more specialist Redwheel Next Generation Emerging Markets.

In this space, McDermott favoured the GQG Partners Emerging Markets Equity fund because of its “well-designed process and highly experienced team” and the JPMorgan Emerging Markets Investment Trust, which currently trades at an 11% discount.

Its manager, Austin Forey, has “consistently delivered excellent returns over two decades and his extensive experience in the region, including managing the trust through numerous crises, is a significant advantage”.

Finally, after a challenging 18 months, McDermott anticipated a comeback for real estate investment trusts (REITs) on the basis of “favourable macro factors, solid fundamentals and the nearing end of the rate cycle”, which has historically been beneficial for REITs.

In addition to the Cohen & Steers European Real Estate Securities and CT European Real Estate Securities funds, investors may also want to consider the TR Property investment trust.

It invests in both the UK and European commercial property market, “appealing to investors seeking solid capital growth and a growing dividend,” said McDermott.

On top of that, it has historically performed well during periods of market turbulence and is currently trading at an “attractive” discount of 7.4%.

Source: FE Analytics