The UK equity market has broadly risen since late 2022 but the past three years have been a knuckle-biting ride at times. Downturns such as in February, June, September and early October 2022 and more recently in early August 2024 brought into sharp focus the benefits of investing with active fund managers who can offer an element of downside protection and shield their investors against the vagaries of stock market volatility.

Yet at the same time, investors would not want to have missed out on the overall upward trajectory of the FTSE All Share by investing too cautiously.

Trustnet is therefore seeking out funds that have protected investors during market dips but also participated in bull market gains during the past three years. Having initially looked at global equity funds, we are currently combing through the Investment Association’s three UK equity sectors, where pickings are slim.

Invesco UK Opportunities is the only fund in the IA UK All Companies sector with a three-year annualised downside capture ratio below 75 and upside capture above 100, when benchmarked against the FTSE All Share.

The fund endured 74.4% of the benchmark’s downside and enjoyed 112.5% of the upside during the past three years. This means that if the FTSE All Share fell 10%, Invesco UK Opportunities would only lose 7.4%, whereas if the index rose 10%, the fund would rise 12.5% more for a total return of 11.3%.

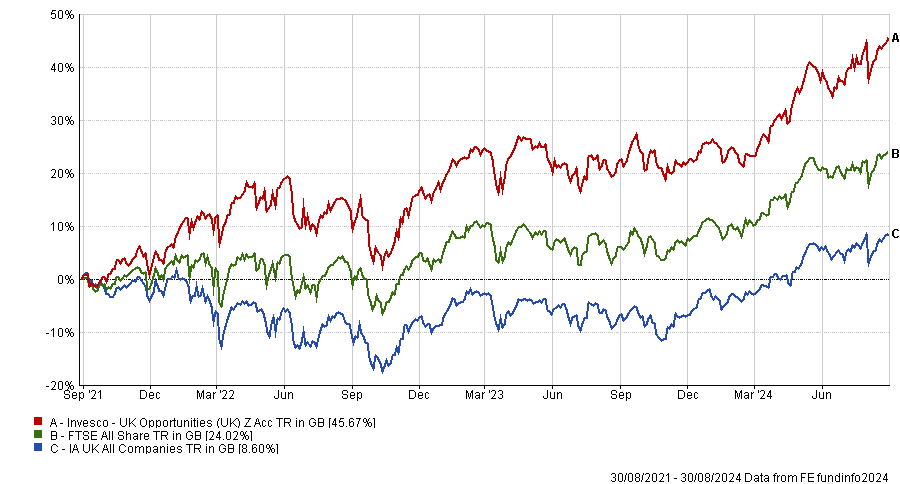

Its overall capture ratio (calculated by dividing the upside capture ratio by the downside ratio) was 1.51, which translated into sector-leading returns. It is the best performer in the whole of the IA UK All Companies sector for the three years to 30 August 2024, up 45.7% versus 24% for the FTSE All Share and a mere 7.7% for the sector average. It is the third-best fund in its peer group over five years and 10th over a decade.

Performance of fund vs benchmark and sector over 3yrs

Source: FE Analytics

Invesco UK Opportunities has a core/value style. It holds a concentrated portfolio of 35-45 stocks drawn from across the market-capitalisation spectrum, with a focus on large-caps.

Its largest holdings are Shell, BP, AstraZeneca, Imperial Brands and Unilever. BP and Imperial Brands represent significant overweights but the fund is underweight Shell, AstraZeneca and Unilever versus the FTSE All Share.

Martin Walker, head of Invesco’s UK equities team, has been running the £1.5bn fund since 2008 and was joined last year by deputy manager Bethany Shard. They believe a stock’s valuation at the point of purchase to be a critical element of returns.

No other funds in the IA UK All Companies, UK Equity Income or UK Smaller Companies sectors achieved a downside capture ratio below 75 with upside capture greater than 100 versus a relevant benchmark.

However, two UK equity income funds deserve an honourable mention for protecting against downside risk whilst participating in most of the upside during rising markets.

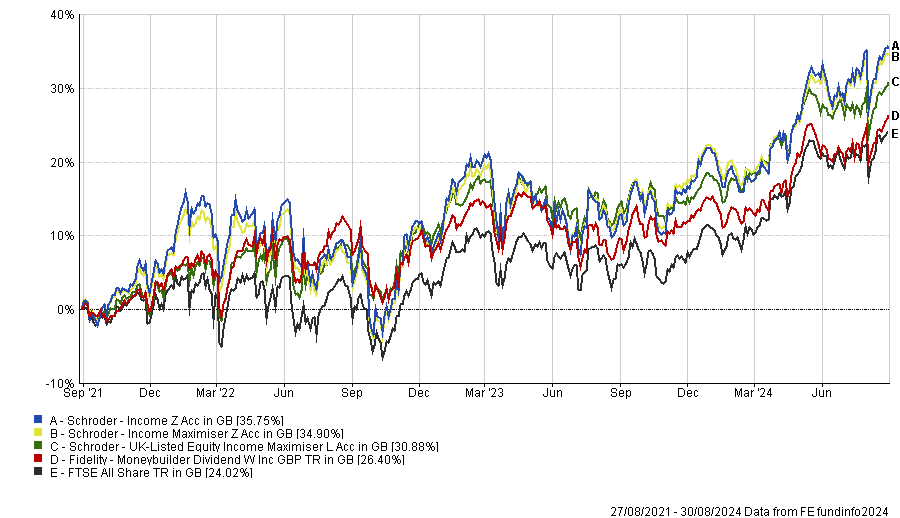

Schroder UK-Listed Equity Income Maximiser has an upside capture ratio of 85.6 and a downside capture ratio of 71.3 for the three years to 30 August 2024, according to FE Analytics. This results in an overall capture ratio of 1.2, meaning that the fund would have outperformed the FTSE All Share during this period.

This fund was launched on 4 December 2020 and is still relatively small with £48.7m under management. Schroder Income and Schroder Income Maximiser are better known and have £1.1bn and £787m under management, respectively, but their ratios indicate a different performance trajectory.

Both funds excelled in rising markets but fell slightly further than the FTSE All Share when it slid. Nonetheless, they have similar overall capture ratios of 1.2 and 1.19, respectively, which points to the same level of outperformance.

Elsewhere, Fidelity Moneybuilder Dividend provided some cushioning during falling markets with a downside capture ratio of 74.6 and participated in 80.9% of the upside.

It beat the FTSE All Share over three years, albeit to a smaller degree than the three aforementioned Schroders funds, with an overall capture ratio of 1.08. Its performance is second quartile over three and five years, thus above the sector average.

Performance of fund vs benchmark and sector over 3yrs

Source: FE Analytics