Fund platform AJ Bell made sweeping changes to the Japanese and UK equity funds recommended on its Favourite Funds list last month.

Out went the likes of Baillie Gifford Japanese and Man GLG Undervalued Assets while in came Fidelity Special Situations and M&G Japan.

Below Trustnet rounds up the main moves for investors who use the fund supermarket’s list as a guide for what to buy.

The UK

A review of the options in the IA UK All Companies and IA UK Equity Income sectors prompted several changes to the firm’s recommended list.

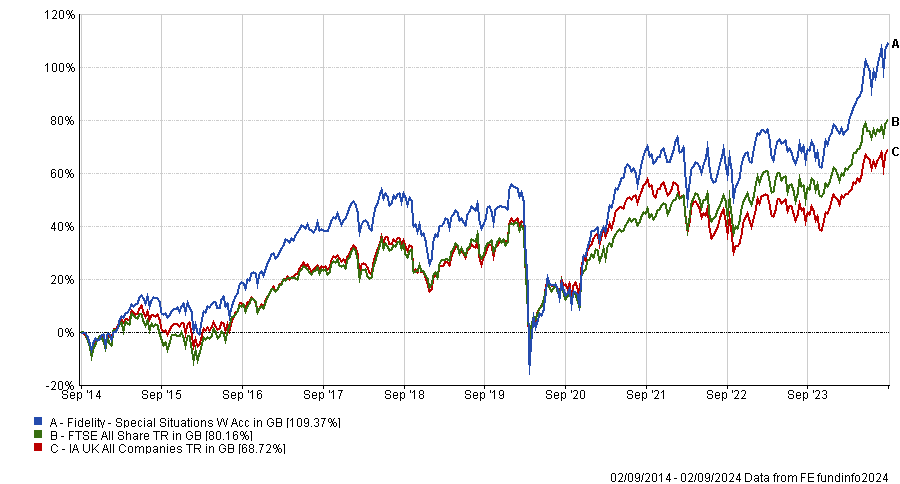

Starting with Fidelity Special Situations, which comes into the Favourite Funds. Managed by FE fundinfo Alpha Manager Alex Wright and Jonathan Winton, the fund has been a top-quartile performer in the IA UK All Companies sector over one, three five and 10 years, showing remarkable consistency during a time when the managers' value style has been largely out of favour – particularly over the long term.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Paul Angell, head of investment research at AJ Bell, said: “The managers aim to invest in overlooked companies with a catalyst for change which the market hasn’t factored in. They look to identify companies at the early stages of their turnaround and trim or exit once these changes have been realised.”

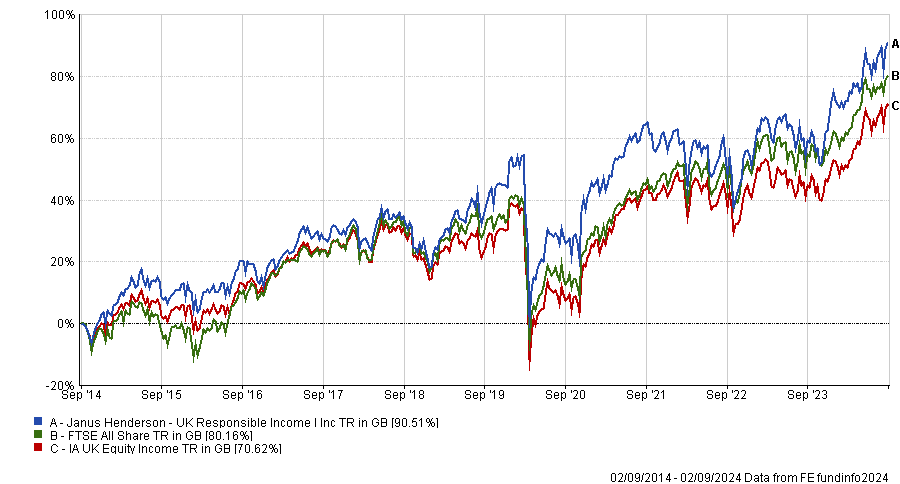

Also on the way in is the Janus Henderson UK Responsible Income fund – another top performer over 10 years but this time in the IA UK Equity Income sector.

Using exclusionary criteria in their investment universe, which prevents them from investing in oil and gas, tobacco, alcohol and armaments among other areas, managers Andrew Jones and David Smith aim to identify strong cash-generative companies that can deliver sustainable earnings growth and solid dividends.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund offers investors a differentiated approach in its sector, as its dual mandate of income and ethical exclusions are rarely seen together,” said Angell.

Leaving the list were Man GLG Undervalued Assets, where the AJ Bell head of investment research said he retains conviction but was concerned it “has significant crossover with its income equivalent (Man GLG Income)”, which remains on the list.

Meanwhile, Liontrust Sustainable Future UK Growth also got the bump despite the team being “credible”. “We have higher conviction in other funds on the list that adopt a similar investment philosophy, but with less volatility,” Angell said.

Japan

The Japan fund list was changed around in July when the firm swapped passive options, removing the iShares Japan Equity Index fund and adding the Fidelity Index Japan.

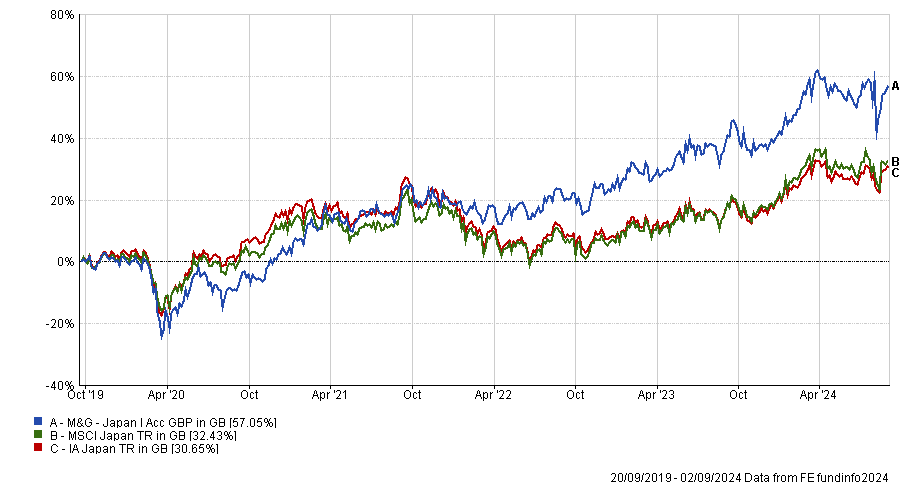

This time around it was the turn of the active managers to get switched about, with M&G Japan coming onto the Favourite Funds list. Run by FE fundinfo Alpha Manager Carl Vine since 2019, Angell said the fund has been around a long time (since the 1970s) but “changed significantly” when the new manager took charge.

“Over time, Vine and his team have curated a core universe of companies undertaking thorough research assessed from a variety of lenses that looks to understand how a company generates profits, the sustainability of revenues, and what might impact returns in the future,” he said.

“By constantly interrogating their universe, the team believe they can take advantage of mispriced opportunities. The team aren’t wedded to a particular investment style, though we expect the portfolio to be fairly core with a value tilt.”

Performance has been strong since Vine took charge, with the fund up 57%, almost double that of the average peer in the IA Japan sector, as the below chart shows.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

Angell said the “strong analyst team” and “experienced” Vine were reasons the fund was added, as well as its cost. Its ongoing charges figure (OCF) of 0.51% is “particularly compelling”, he noted.

On the way out was Baillie Gifford Japanese, which has been removed as its growth style “can, and has, caused long periods of variable performance versus the fund’s core index”, Angell said.

“As such, we view the more balanced investment approach of the M&G Japan fund to be preferable for investors.”

Strategic bonds

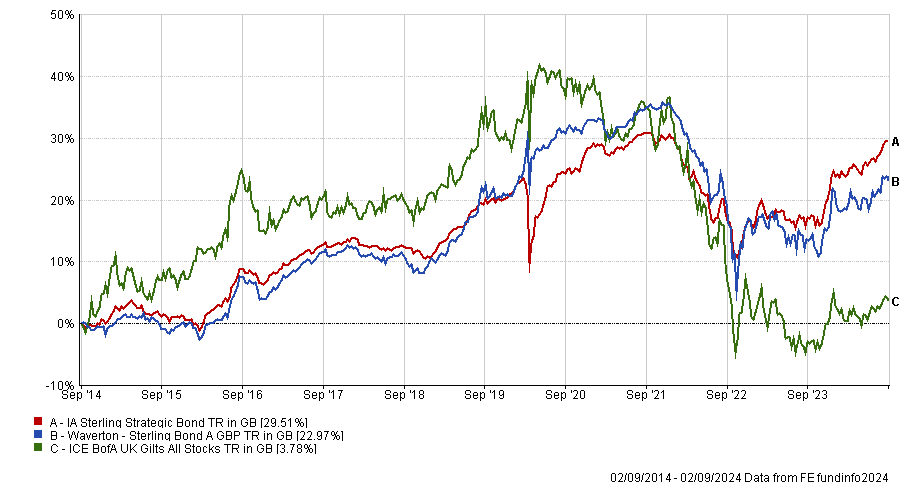

Lastly, in the IA Sterling Strategic Bond sector, Waverton Sterling Bond was brought in to bolster the recommended list. The “carefully managed” fund is headed by Jeff Keen, who has been at the helm since it was launched in 2010. He is supported by co-manager James Carter, who joined from Moody’s ratings agency in 2018.

Angell said: “This is a carefully managed strategic bond fund that is guaranteed to be at least 80% invested in higher quality, investment grade bonds at any point. Additionally, the fund has a five-year minimum duration requirement (duration measures a bond fund’s sensitivity to interest rates).

“This high weighting in higher quality bonds and minimum duration threshold strengthens the fund’s likelihood of delivering an uncorrelated return profile to higher risk equity markets.”

However, it is the only one of the incoming funds to suffer bottom-quartile performance over varying periods, including one, three, five and 10 years.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

Angell noted that “minimum duration and high credit quality can, at times, mean the fund has a variable return profile to the rest of the sector” but that gives the fund “defensive characteristics”.