Only four Baillie Gifford strategies out of 33 across all Investment Association sectors have achieved first-quartile performance over the past five years compared to their relative peer groups, data from FE Analytics has shown. Four more ranked in the second quartile, but almost 40% (12) didn’t rise above the fourth quartile.

These disappointing results are usually attributed to style. Baillie Gifford is renowned for favouring growth stocks, which have come under a lot of stress since the zero-interest-rates environment came to a close post-Covid.

If there is a soft landing and rates bottom between 3% and 4%, we will not get a repeat of the past decade’s boom in growth and the fund house might continue to struggle, according to director of Fairview Investing Ben Yearsley.

But this is not the only reason he finds for its underperformance, alluding to some “dubious” stock picking as managers got “so fixated on high growth that they missed the downside”.

“It felt like for a few years, they were missing the wood for the trees. Hopefully, the past few years will have made a difference to them in avoiding the obvious glaring mistakes,” he said.

One such mistake was bigging up Peloton after the bubble had burst, which “ wasn’t the most sensible”, according to Yearsley, who felt that “they got very entrenched and defensive in their approach” – all of which “probably cost clients.”

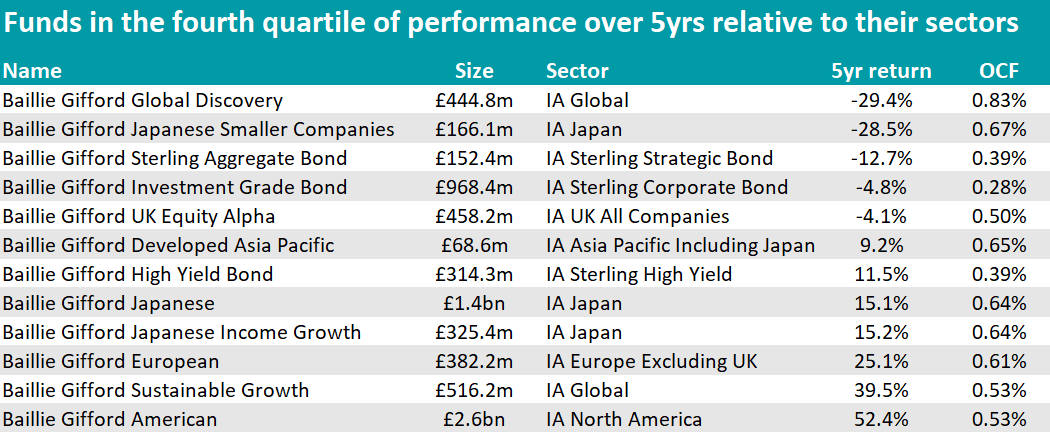

How much it cost them, however, depends on the strategies they were invested in. In the table below are the funds that underperformed the most, ranked by worst returns.

Source: FE Analytics

Baillie Gifford European was third quartile over 10 years and fourth ever since (over five, three and one year, as well as shorter time frames). The Global Discovery fund was never above the fourth quartile except in the past three months, when it was in the third and a similar fate befell Baillie Gifford UK Equity Alpha, another consistent underperformer.

Still challenged, but with a more nuanced track record, were Baillie Gifford American (which was first quartile over 10 years and seems to have turned a corner more recently) and the three IA Japan funds as well as Baillie Gifford Pacific (which all proved to be able to reach the first quartile of relative performance).

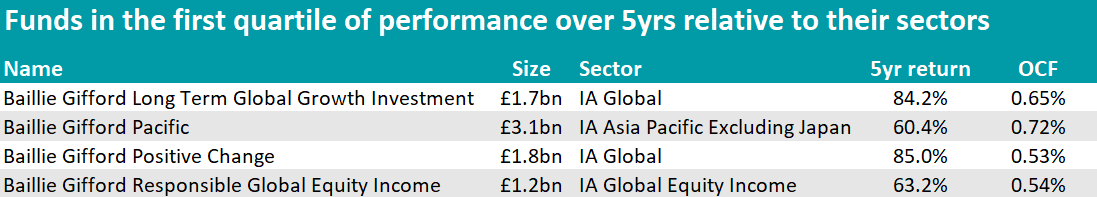

Turning to the more positive side, investors who bought the Baillie Gifford Long Term Global Growth Investment and Positive Change funds five years ago chose the only two Baillie Gifford funds in the IA Global sector (out of eight) to have achieved first-quartile returns over that period.

Source: FE Analytics

IA Global Equity Income and IA Global Emerging Markets funds are also less strained. In fact, Bestinvest managing director Jason Hollands said the Responsible Global Equity Income fund, managed by James Dow and Ross Mathison, is the only Baillie Gifford strategy on the firm’s recommended list.

“It is suited to investors wanting a sustainable approach and, due to its focus on stocks with dividend growth potential, has been less impacted by the style bias headwinds faced by other Baillie Gifford products,” he said.

Yearsley also liked Baillie Gifford funds that are less focused on all-out growth and “more nuanced”, such as Rodney Snell’s Emerging Markets Leading Companies and Spencer Adair’s Monks on the investment trusts side – both he described as “more rounded than many other Baillie Gifford managers”.

China and emerging markets have been more of an outlier in terms of style and “less ultra-growth focused”, Yearsley noted, as equity income tends to be an area less dominated by growth stocks and more skewed towards value.

To the question of whether investors should stick with Baillie Gifford funds, Yearsley said yes, provided they are part of a balanced portfolio.

“A few years back, many investors were caught with portfolios stuffed with Baillie Gifford, all nominally in different areas but highly correlated,” he said.

“Stick to Baillie Gifford, but ensure you have proper style diversification in your portfolio.”

Hollands agreed: “There is nothing to suggest this underperformance won’t prove temporary,” he said.

This is thanks to US rates likely to start declining this month, which “should broadly be supportive for the long-duration growth stocks” which Baillie Gifford’s managers typically favour.

“Most investors focus on specific teams and products rather than arrive at an overall view of an asset manager unless it is going through a period of corporate upheaval or ownership instability; this is not the case with Baillie Gifford, which is a partnership owned by its senior professionals,” he said.

“This stability of ownership has led to strong retention of key people. I am sure Baillie Gifford will have its day in the sun again.”

Joe Richardson, discretionary investment manager at Dennehy Wealth, was more cautious.

“When you're renowned for having a style bias, things can quickly change depending on the environment and growth generally has been out of favour for a few years, so Baillie Gifford has seen outflows reflecting that,” he said.

“This does mean there could be more headwinds if value outperforms in the years ahead and it's obvious that valuations today are clearly stretched.”

Whether investors decide to stick to the fund house or not, Richardson warned them not to get caught up in fund manager worship.

“Like anyone, fund managers are flesh and blood and there are real dangers in putting them on a pedestal. No one manager is infallible and what matters is having a robust process and remaining disciplined in applying it,” he concluded.

James Budden, director of marketing and distribution at Baillie Gifford, replied: “Despite a difficult and extended period when growth investing has been sharply out of favour, we remain confident that many growth companies we currently own are resilient in terms of pricing power, sales growth, and operational leverage. Over the long term, share prices tend to follow fundamentals and recent operational progress has been excellent in many cases.”

“As a result, we believe the market is underestimating the earnings potential of firms pioneering disruptive technologies, including artificial intelligence, synthetic biology, the digitisation of commerce, the electrification of transport and the transition to renewables. In addition, sentiment towards growth equities should improve from here given the pause and likely about-turn of interest rates and inflation.”

Asset managers previously covered in this series: Jupiter, Schroders, Liontrust, Fidelity and Artemis.