The FTSE 100 will be “the best-performing index bar none” in the next 20 years, according to Gervais Williams, co-manager of the Premier Miton UK Multi Cap Income fund.

It is an about-turn for the fund manager, whose fund rocketed higher in 2020 thanks to a put option it held against the FTSE 100 during Covid. This also benefited his Diverse Income trust, but last month the manager announced the investment company had pulled its FTSE 100 put option, something it had held for a decade.

The index has been performing well in recent times despite investors choosing to put their cash elsewhere. Outflows from open-ended UK funds have continued at “substantial levels” for the past three years, and yet, the FTSE 100 has beaten its record highs and broken out of its trading range on the upside.

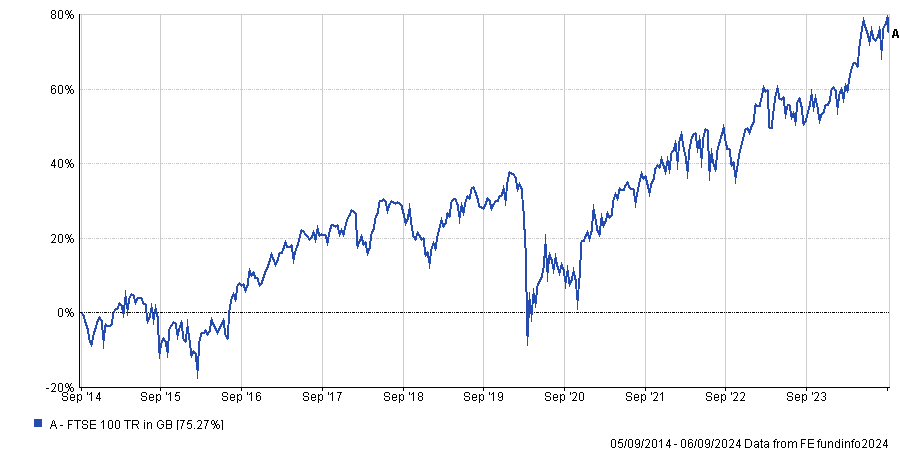

Performance of index over 10yrs

Source: FE Analytics

Doing so when there is near-record levels of outflows by UK investors almost every month is “an extraordinary thing” and can be attributed to three factors, said Williams – buybacks, takeovers and, “most thrillingly”, international investors.

Many large-caps and some small-caps have been buying back their own shares in “vast amounts”, offsetting a lot of the outflows in the UK market, and to a certain degree, takeovers have done the same.

But ultimately, it’s international investors that will make the biggest difference, while domestic investors continue to sell.

“There is a little inkling of international investors with lots of capital growth strategies and exchange-traded funds (ETFs) just beginning to flex into a different way of making money, that is through good and growing income.”

Trustnet has reported on many industry experts tipping off income investing as a good option moving forwards, as income funds are poised to rebound as well as some sectors that are traditionally considered value powerhouses, including utilities, which should benefit from artificial intelligence (AI), industrials, consumer products and non-bank financials.

The comeback is fuelled by international investors realising that they don't want to be all-in on growth but need diversification in the form of income, at least at the margin of their portfolios.

"The UK is at knee height to a grasshopper, so even a flicker in the international markets makes a big difference to us,” Williams said.

“As we find that local investors sell less and perhaps international investors buy a tiny bit more, this UK breakout can be substantial.”

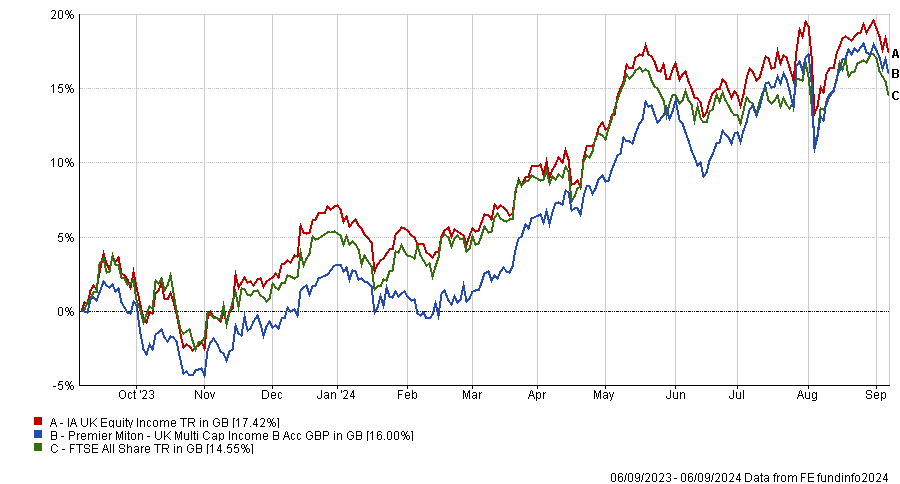

Performance of fund against sector and index over 1yr

Source: FE Analytics

Williams understands, however, that being able to say that the UK is “disgustingly cheap” is not enough. But when things are outperforming and they're getting into a sector that is outperforming, more investors come round to it and momentum builds, he explained.

This is what gives him the confidence to say that the FTSE 100 “will be the best-performing indices bar none for the next 20 years”, as the risk–reward ratio is now “very attractive”.

The manager had a taste of how substantial this turnover can be, as his Premier Miton UK Multi Cap Income fund went from being 73rd in a 74-strong peer group, the IA UK Equity Income sector, over the past three years, to being the seventh over the past six months.

Last year, the fund was admittedly “very much the bottom of the heap”, as lots of other income funds focused on large-caps weren’t as badly affected as this strategy was, the manager said. Now that has reversed and, most notably, without stocks having moved. It was “a little tiny chink of sunlight coming our way”, Williams said.

“Large parts of the portfolio haven't moved, but the momentum has. This just shows that when things come, they don't just make money – they can make so much more return than most people expect,” he continued. “It makes you wonder what could happen if you get the rest of the stocks moving”.

This leaves an open door for the labour government to come in and push the market even higher through much-anticipated reforms, primarily to pension schemes, as Williams noted recently on Trustnet.

“It's unusual for governments to have the opportunity to influence capital allocation trends at when at the bottom of the cycle and things are beginning to move upwards,” he said.

His views were echoed by James Klempster, deputy head of the Liontrust Multi-Asset team, who said that, previously, many global investors may have deemed the UK political environment to be too challenging to merit adding to their UK positions, which has led to the UK to be an undervalued market.

“It could turn versus the other majors, however. It is hard to predict when, but it will not require a major catalyst,” he said.

“UK stocks have already had a relatively strong start to 2024 and its economy has surprised on the upside as the UK emerges from the shallow recession that started at the back end of 2023.”