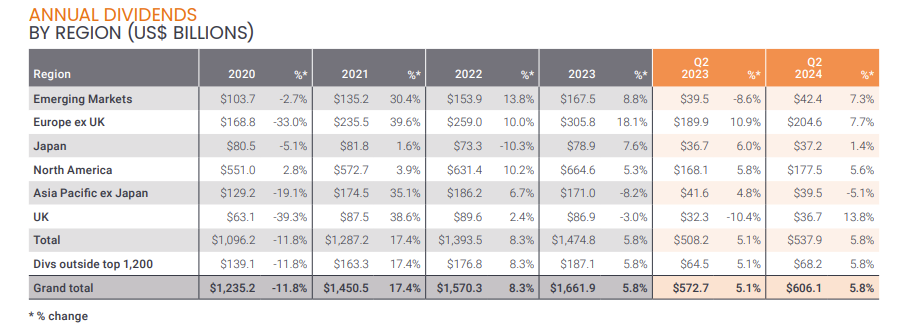

Companies paid out a record $606bn in the second quarter of this year, according to research by Janus Henderson, prompting the firm to lift its expectations for total income payouts across 2024.

The firm now expects companies around the world to distribute $1.74trn, up 6.4% year-on-year on an underlying basis and up from 5% at the time of the last report.

Jane Shoemake, portfolio manager on the global equity income team at Janus Henderson, said: “We had optimistic expectations for the second quarter and the picture was even brighter than we predicted thanks to strength in Europe, the US, Canada and Japan in particular.”

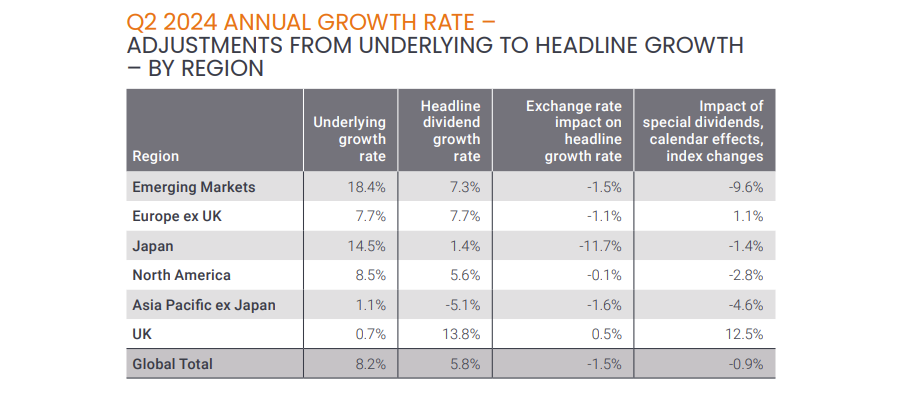

In total, some $606bn was paid out in the three months between April and June, up 5.8% year-on-year, while underlying growth was even stronger, up 8.2% once the drag caused by exchange rates, in particular the weak Japanese yen, was taken into account. Overall, some 92% of companies globally raised or held their dividend payments.

Source: Janus Henderson

The second quarter is an important one for income investors, marking the “seasonal high point” for European dividends as most companies pay a single annual dividend during this period.

A record high of $204.6bn was paid out by companies in the region, including record highs in France, Italy, Switzerland and Spain.

Meanwhile, in the US, large tech names such as Meta and Alphabet boosted the second-quarter numbers by initiating payouts. A total of $161.5bn was paid over the three months, up 8.6% on an underlying basis, although total payouts were only 7.1% higher as special dividends slowed.

“The initiation of dividends from big US media-technology companies, along with China’s Alibaba among others, is a really positive signal that will boost global dividend growth by 1.1 percentage points this year,” Shoemake said.

“These companies are following a path well-trodden by growth industries over the past couple of centuries, reaching a point of maturity where dividends are a natural route for returning surplus cash to shareholders.”

This has “confounded sceptics” who thought this would never happen and should “broaden their appeal” to include income investors, potentially encouraging more companies in the tech sector to follow suit, said Shoemake.

The biggest year-on-year rise came in the UK, with payouts up 13.8%, having dropped 10.4% in the second quarter of 2023. “The headline growth rate reflects the large special dividend paid by HSBC, which distributed the proceeds of the sale of its Canadian business,” the report noted.

However, underlying dividends rose just 0.7% as the mining sector cut heavily in the second quarter. Despite this, “in the UK, if you look beyond the impact the highly cyclical mining industry makes, dividend growth is encouraging,” said Shoemake.

Source: Janus Henderson

The only blemish was in Asia Pacific excluding Japan, where underlying dividends rose 1.1% year-on-year but the total paid out fell, largely due to a 24.3% drop in payouts from Australian businesses.

Woodside Energy, the largest payer in the second quarter of 2023, made a “very large reduction” to its payouts as profits fell due to lower commodity prices, inflationary pressures and asset impairments, the report noted. However, the second quarter is “not seasonally important”, it added.

At a sector level, banks were the biggest reason behind the uptick in global dividends between April and June, accounting for one-third of the underlying year-on-year increase. Higher interest rates in many developed markets have boosted their profits, which are being passed onto shareholders.

Insurers, vehicle manufacturers (especially in Japan) and telecoms were also important contributors to growth, the report noted.

“Around the world, economies have generally borne the burden of higher interest rates well. Inflation has slowed while economic growth has been stronger than anticipated,” concluded Shoemake.

“Companies have also proved resilient and in most industries continue to invest for future growth. This benign backdrop has been especially positive for the banking sector, which is enjoying strong margins and limited credit impairments, which has bolstered profits and generated a lot of cash for dividends.”