‘Lifestyling’ sounds potentially glamorous, with connotations of choosing the lifestyle you want to have and possessing the wealth to do so. Yet for millions of people approaching retirement, lifestyle pension funds have delivered the exact opposite.

In a nutshell, lifestyle pensions gradually transition people’s money from equities into bonds and cash as they get older. These funds usually start to de-risk about 10 years before retirement.

They are based on the premise that equities are high risk, high return investments, better suited to young people with a lot of time to ride out periods of volatility.

Bonds – theoretically at least – deliver lower returns but are less likely to lose money, so they were deemed appropriate for people who want to preserve capital and avoid losses as they approach retirement age.

The problem with lifestyle pension funds is that bonds did not turn out to be low risk at all.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said that in the post-financial crisis era of low interest rates, bonds delivered such low rates of return that “what they have turned out to offer is return-free risk, as anyone retiring in the past two years has probably discovered”.

Then when central banks hiked interest rates in 2022 to combat inflation, fixed income and equities both plummeted. But while equities bounced back and recouped their losses, bonds did not.

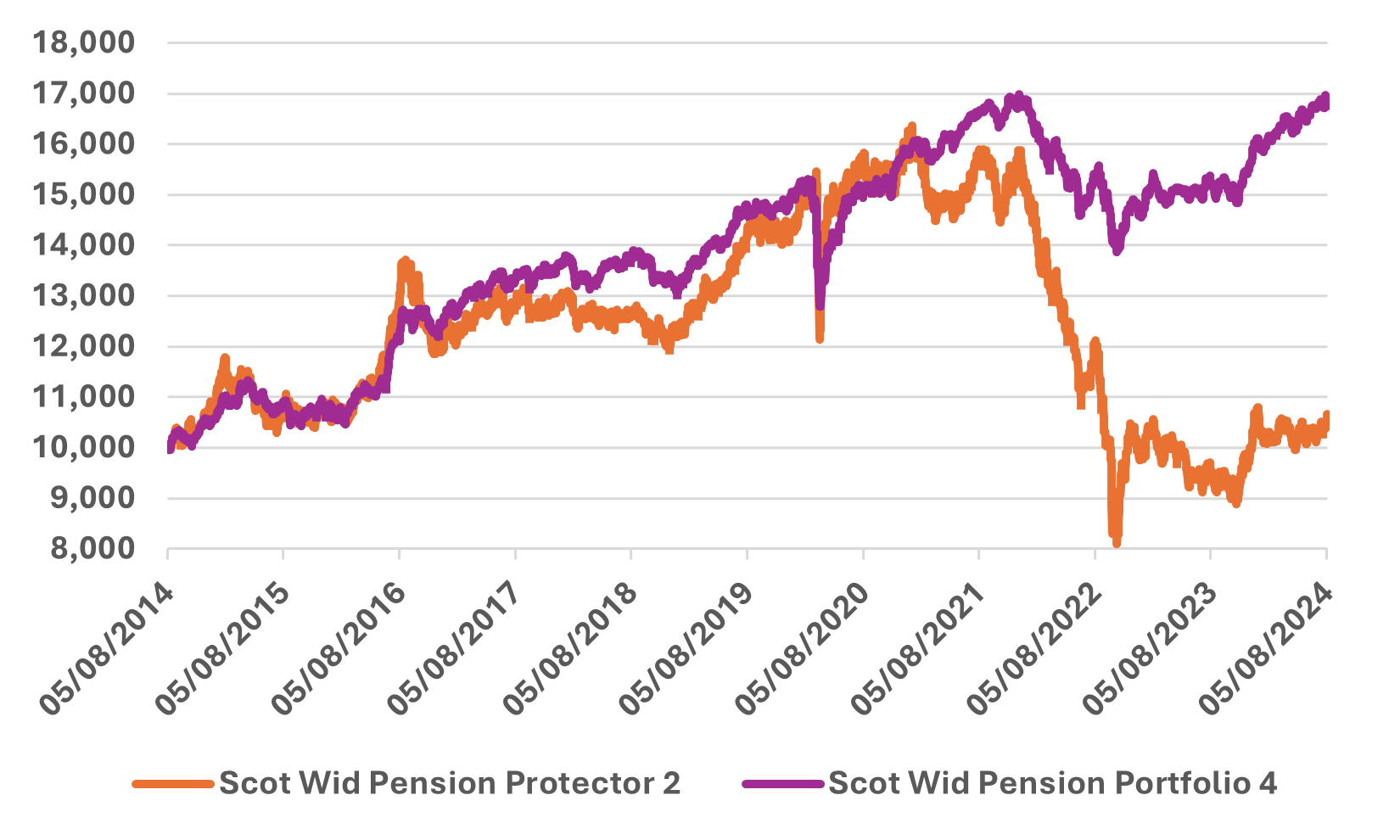

As a case in point, the Scottish Widows Pension Protector Series 2 pension fund, which is mostly comprised of bonds and money market funds, suffered a sharp fall in 2022, wiping out previous gains and ending up with flat performance over 10 years.

Meanwhile, the Scottish Widows Pension Portfolio Four Pension Series 4, which has a diversified portfolio that includes equities, did not fall as far and has recovered all its losses, as the chart below shows.

Performance of Scottish Widows Pension Protector 2 vs Scottish Widows Pension Portfolio Four Pension Series 4 over 10yrs

Sources: Refinitiv, RBC Brewin Dolphin

This proved disastrous for savers whose pensions had been moved into bonds, which either fell in value or did not grow as much as they had expected.

“Lifestyle funds have turned out to be at higher risk of not achieving their goals for retirement, leaving anyone on the cusp of retirement with a hole blown in their pension pots and little opportunity to rebuild the capital,” Burgeman stated.

His colleague Daniel Hough, a financial planner, added: “We’ve started receiving a lot of questions about these funds and whether they are suitable. In one case, someone came to us because their pension had grown by just 4% over five years right before they were set to retire – the fund had been in 95% cash for four of those years, but it wasn’t clear to them that’s how their pension was set up.”

The conundrum of whether lifestyle pension funds are suitable impacts a huge number of people who are saving for their futures. The National Employment Savings Trust (Nest) – the government-backed workplace pension scheme – has 10 million pension scheme members using lifestyle funds or equivalent investment strategies.

To make matters worse, many people whose money is held in this type of pension fund do not understand it.

In a recent survey conducted by RBC Brewin Dolphin, three-quarters of respondents said they did not know what a lifestyle pension fund was, while 64% were unaware that some pension funds transition to low-risk assets and cash ahead of retirement. Just 40% of respondents said they knew how their pension plan was invested.

Furthermore, lifestyle pension funds may no longer be appropriate in today’s evolving pensions landscape. They were originally designed to help people buy an annuity but 51% of respondents told RBC Brewin Dolphin that they do not intend to purchase one, while another 41% were unsure about whether to do so.

People retiring at 65 may expect to live for another 20 or 30 years so might feel they have a long enough time horizon to risk a bit of equity market volatility in pursuit of gains. Additionally, for some people, their investment horizon may extend after their death if they plan to pass on their wealth to the next generation and/or leave a bequest to charity.

Hough believes that retirees should remain invested in a diversified portfolio, if their circumstances allow them to do so. “You can take the natural yield from these assets as income and when the time comes it can be passed down to your family members,” he said.

“Lifestyle pensions can stop your fund from growing right when you could be benefitting most.”