Investment demands an element of risk-taking to generate returns but highly volatile funds are more likely to experience wide fluctuations in performance. While cautious savers often avoid volatile funds, for investors comfortable with taking higher risks, the pay-off of greater returns can be worth the bumpy ride.

Several global equity funds have successfully toed the line between high risks and high rewards. Below, we look at the funds in the bottom decile for volatility over the past five years that have enjoyed top-decile performance within the IA Global Sector.

This was a turbulent period for global equities, with the impact of the pandemic and high interest rates leading to challenging years for many of the funds below.

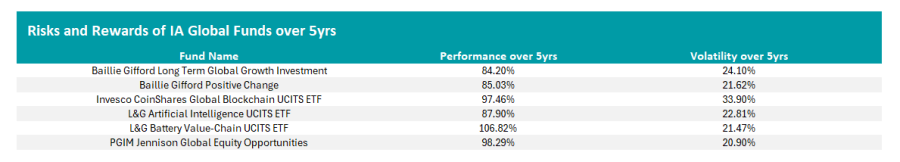

Returns and volatility of IA Global funds over 5yrs

Source: FE Analytics; data in sterling terms to 31 Aug 2024

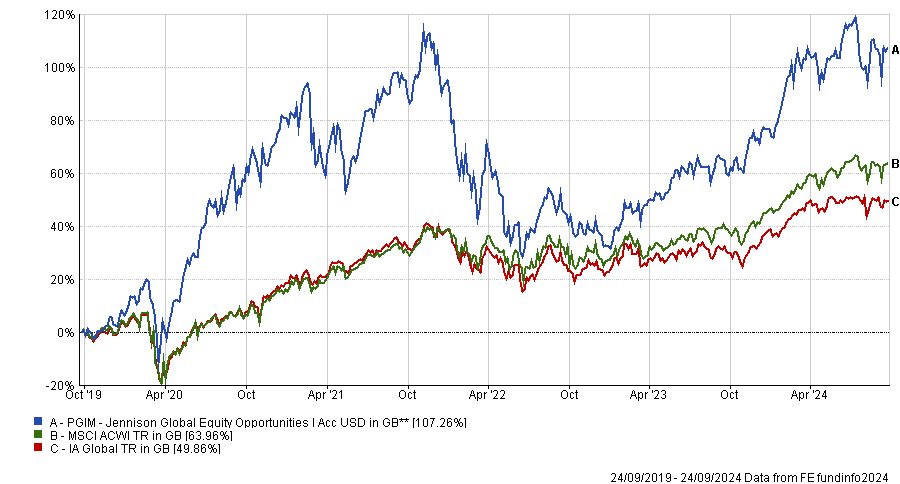

First up is the £739.6m PGIM Jennison Global Equal Opportunities fund, managed by Mark Baribeau and Thomas Davis.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

With volatility of 20.9%, the portfolio is one of the riskiest funds in the IA Global peer group, with one of the widest tracking errors in its sector at 14.7%.

This comparatively aggressive strategy saw one of the worst maximum drawdowns of -39.9% over the past five years. Yet the fund recouped its losses and achieved top-decile performance over the past five years, up by 98.3%.

As a result, its 0.53% Sharpe ratio ranks in the top quartile for risk-adjusted returns. Its other metrics have also been respectable with the portfolio enjoying alpha of 2.3 above the MSCI All Country World Index over the past five years. This makes the fund top-decile for alpha generation in the IA global sector.

This means that while the fund has doubtlessly been high risk, its investors have been amply compensated for the volatility.

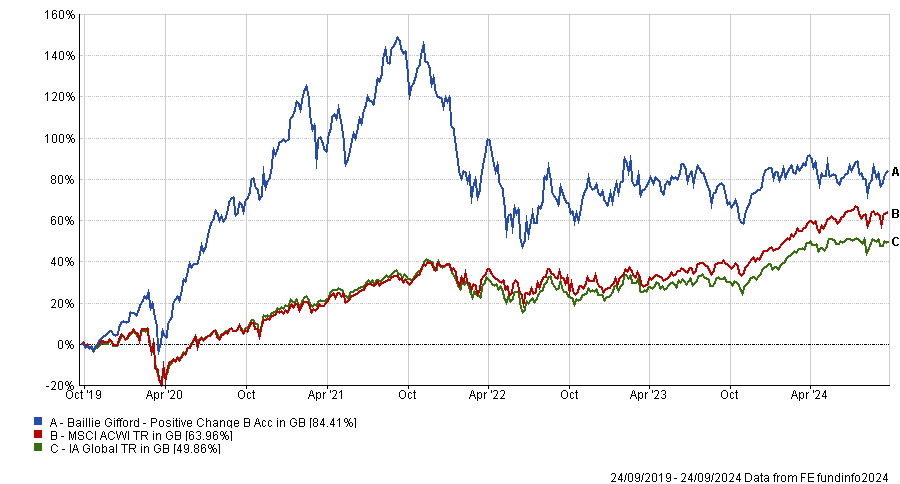

Second, we have the £1.8bn Baillie Gifford Positive Change fund. Led by Kate Fox and Lian Qian since 2017, the fund has returned 84.2% over five years, with a total volatility of 21.8%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

These results were down to consistently strong performance between 2018 and 2020. The fund has struggled more recently, however. Its top-quartile five-year performance was followed by a drop to the fourth quartile over three years and the past year.

The fund has maintained a strong reputation and is recommended by Square Mile, who have given it a Responsible A ranking on their Academy of Funds.

“We believe this fund is currently one of the most attractive responsible fund offerings in the market. Baillie Gifford has clearly put a lot of thought, effort and resources into this product,” analysts at Square Mile commented.

“It has a well-defined and distinctive investment process and places a strong emphasis on both returns and providing a positive impact over the long run.”

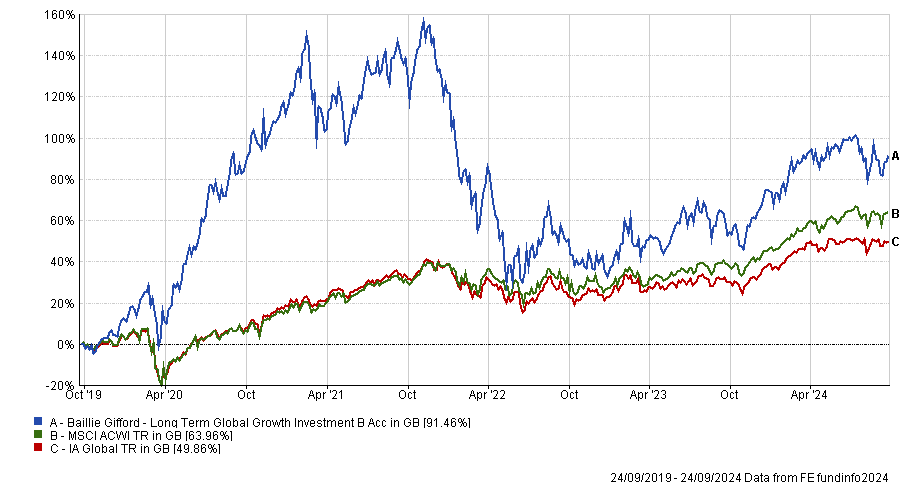

Finally, the £1.8bn Baillie Gifford Long-Term Global Growth Investment fund is one of the 10 riskiest funds in the sector, with 24.1% volatility.

Nevertheless, FE fundinfo Alpha Managers Mark Urquhart and John MacDougall, who helm the fund, have achieved top-decile performance, returning 84.2% over five years.

Moreover, the portfolio has enjoyed strong excess returns, generating alpha of 2.6 above the MSCI ACWI. This puts the fund within the top quartile for alpha generation in this period.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Over the past five years, the fund has experienced one of the widest tracking errors in the peer group, at 21.4%, a bottom-quartile ranking. It also experienced one of the largest maximum drawdowns compared to its peers at -49.4%, the sixth largest in its sector.

Finally, three sector-specific exchanged-traded funds (ETFs) in the IA Global peer group gave their investors a white-knuckle ride that was ultimately rewarding. The most notable of these was the £389m L&G Battery Value-Chain UCITS ETF, which was the only fund that matched our criteria and enjoyed returns of over 100%.

Other examples include the £514.3m L&G Artificial Intelligence UCITS ETF, as well as the £405.3m Invesco CoinShares Global Blockchain UCITS ETF which ranked amongst the most volatile funds in the IA Global sector but delivered top-decile performance.