The Janus Henderson Absolute Return fund has gone 23 consecutive months with no drawdowns, the longest unbroken streak since its inception in April 2009.

Manager Luke Newman said his colleagues have promised him a birthday cake once he gets to two years. The £912m fund’s stellar returns also earned Newman and co-manager Ben Wallace an FE fundinfo Alpha Manager of the Year award in the absolute return category in May.

Newman attributes the fund’s success to a conducive environment for stock-picking on both the long and short side. Below, he explains why the fund is net short the US and how he is using pairs trades to benefit from the rising popularity of obesity drugs.

Describe your investment strategy

We are an equity long/short strategy within the absolute return sector, investing in developed market, large- and mega-cap equities. Over the long term, we've delivered equity-like performance with the volatility of sovereign fixed income. That's become the calling card of the strategy.

We run two separate investment books: a core book, which looks longer term on both the long and the short side; and then a tactical book, which is more trading-orientated and can react quickly to protect against downside risk and capitalise on shorter-term disruptions.

How has Janus Henderson Absolute Return performed recently?

We've delivered a run of 23 months without a drawdown. It's a new record for us and we've been running the strategy for 20 years.

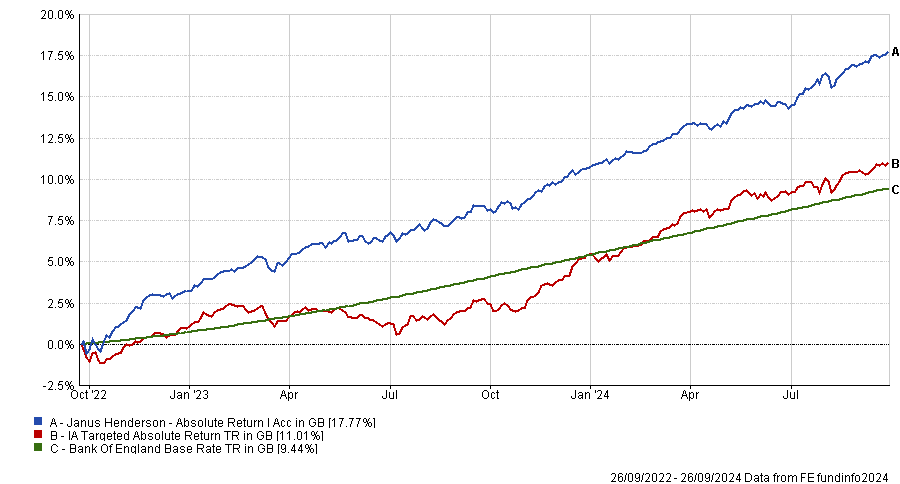

Performance of fund vs sector and benchmark over 2yrs

Source: FE Analytics

The big change during this time has been moving back to an environment where money has a cost. We've emerged from a period of near zero interest rates into an environment that feels more normal for equity investing.

The increase in dispersion between share prices is being driven by underlying company fundamentals more than macro headlines. That rationality is great news for stock-pickers, especially those able to benefit on the short side.

How much of your performance came from the short book this summer?

In down months for the broader market, we would expect more returns from the short book and that's exactly what happened through the summer, especially given we were positioned net short US companies.

But areas of the long book were still contributing. Earlier this year, we tilted the portfolio towards defensive, longer duration assets, particularly in Europe and the UK. Sectors such as utilities and real estate investment trusts (REITs) came into the portfolio and performed well this summer.

How long have you been net short US stocks?

Through the quantitative easing (QE) years, we were consistently net long the US. A lot of liquidity was injected into the US economy, which outperformed.

But that is unwinding. The levels of financial leverage at a household and corporate level, plus the much higher relative valuations of US assets, convinced us to take profits through the summer of 2022 and introduce some net shorts. We didn’t feel comfortable with the lofty valuations within the technology, consumer and industrial sectors. Our focus was on the US consumer, going short companies in retail, housing and consumer goods.

How have you been playing the tech sector?

In 2022, technology in the US was the first area we moved to short. That was due to valuation regime change with higher interest rates, as well as the normalisation of trading patterns after lockdowns when we were all sat at home replacing hardware and signing up to new subscriptions. There was a pronounced sell-off and we were able to protect capital through our short positions.

Since 2023 there has been much more stock-specific dispersion within technology. Businesses such as Microsoft, Oracle and Alphabet have been able to adapt to a higher cost of borrowing. In many cases, they have huge net cash positions, so high rates are actually a positive.

The contrast would be in the short book, where you have businesses such as electric vehicle manufacturers that have seen challenges in terms of demand, pricing, leverage and the higher cost of debt.

Do you have any exposure to obesity drugs?

We’ve been close to Novo Nordisk during the 20 years we’ve been running the strategy. We're always interested in companies whose challenges are on the supply side rather than generating demand; that is usually an advantageous position to be in.

The second and third derivatives of obesity drugs are interesting when you think about the lifestyle changes we are likely to see as adoption increases. We are shorting quick service restaurants in the US.

We're long Coca-Cola, which has no snacking exposure, and short a beverage and snack competitor; that’s a pairs trade which has worked well.

How do you use pairs trades?

During the QE years of low interest rates and high correlations, pair trading strategies were really challenged. You simply didn't have the dispersion at a single stock level to make them worthwhile.

Over the past two years, pairs trading – going long and short two different companies in the same region or industry to isolate macro risks – has become an important part of our strategy again.

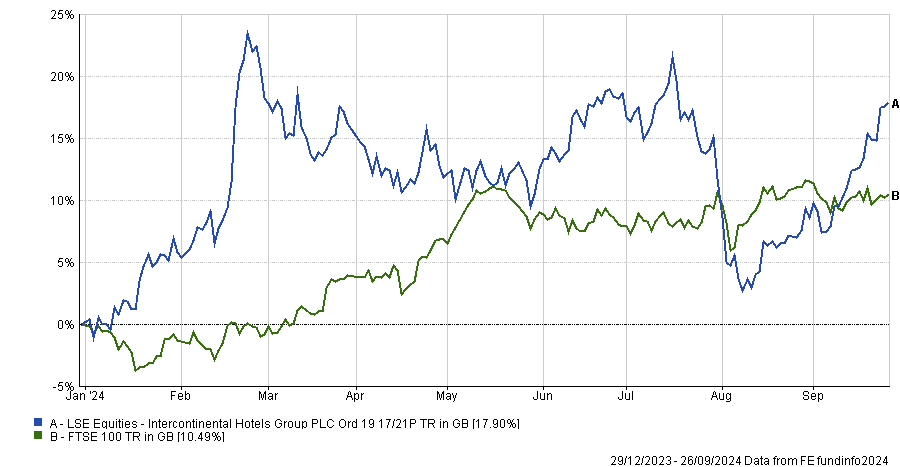

An example would be long InterContinental Hotels versus shorts in US hotel groups. InterContinental Hotels was trading at a material discount at the start of this year because it is London listed and has more Chinese exposure than US competitors. We benefitted from the normalisation of the relationship between those valuations.

Performance of Intercontinental Hotels this year vs FTSE 100

Source: FE Analytics

What has been your best performing position recently?

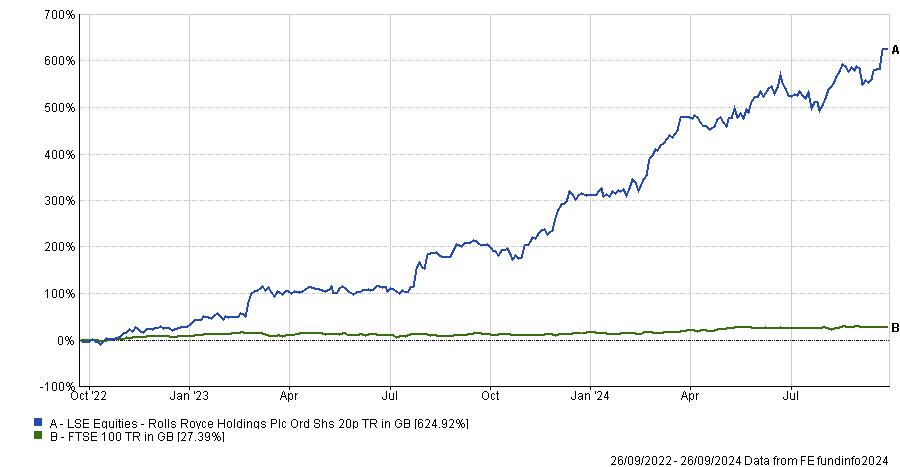

Rolls-Royce, the aircraft engine manufacturer. We met the new management team early last year and understood the opportunity. The share price was implying that the business would need to raise equity, whereas it became clear to us that Rolls-Royce – with a dynamic new management team – would be in a strong position to recover from travel disruption and resume dividends.

Performance of Rolls-Royce vs FTSE 100 over 2yrs

Source: FE Analytics

What positions detracted from returns in the past year?

We haven't had a significant detractor over that period because of the low level of risk in the strategy. We usually have a long list of very small detractors because we operate with a stop loss in the tactical book. We stay in liquid positions and if the fundamentals change or a share price’s reaction to an announcement differs from our expectations, we close that position. Similarly, if any position moves 10% against us, we close it.

What do you enjoy doing outside investing?

I ran the Marathon du Médoc last year, which is a perfect way of combining two passions – running and wine.