FE fundinfo Alpha Manager James Thomson’s Rathbone Global Opportunities fund has long been a favourite with investors.

With £4.1bn in assets under management, it was one of the most researched funds of 2024 for Trustnet readers and has surged by 258.2% over the past 10 years, handily beating the MSCI World. It features on Hargreaves Lansdown’s Wealth Shortlist, is Elite Rated by FundCalibre and is highly recommended by RSMR.

Analysts at Hargreaves Lansdown described Thomson as a “rare breed” who has demonstrated his stock-picking talent over many years through investing in “excellent companies, regardless of their size sector or location”.

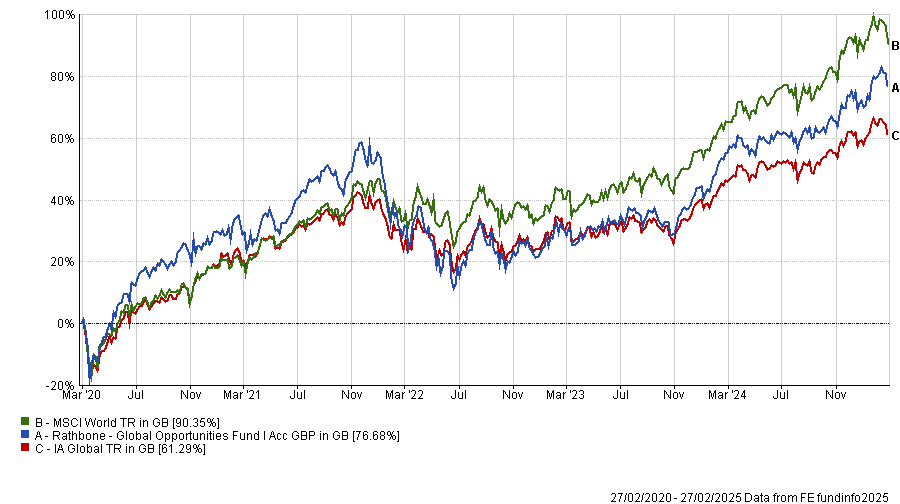

Although Rathbone Global Opportunities has failed to beat the MSCI World over one, three and five years to 28 February 2025, it has still ranked within the second quartile of its peer group.

Jason Hollands, managing director at Bestinvest, said: “Beating the MSCI World has been very hard to do given the stock concentration in the index towards the ‘Magnificent Seven’ (Microsoft, Nvidia, Apple, Tesla, Meta, Alphabet and Amazon) – but it has performed relatively well compared to other actively managed peers.”

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

While Thomson is well-regarded by analysts and fund selectors, investors may want to diversify manager risk and offset his fund’s growth bias. To that end, Trustnet asked experts to suggest complementary strategies.

Evenlode Global Income

Hollands pointed to the £1.7bn Evenlode Global Income fund as a compelling pairing. Managers Ben Peters and Chris Elliott have a “buy-and-hold approach to portfolio construction, which targets cash-generative and capital-lite businesses”, he explained.

As a result, Evenlode and Rathbones have “limited stock overlap,” with no common holdings in their top 10. Evenlode invests primarily in consumer staples and healthcare, while Rathbones emphasises information technology and consumer discretionary.

“Holding Evenlode Global Income alongside Rathbone Global Opportunities would effectively add a more defensive set of stocks to your portfolio,” Hollands said.

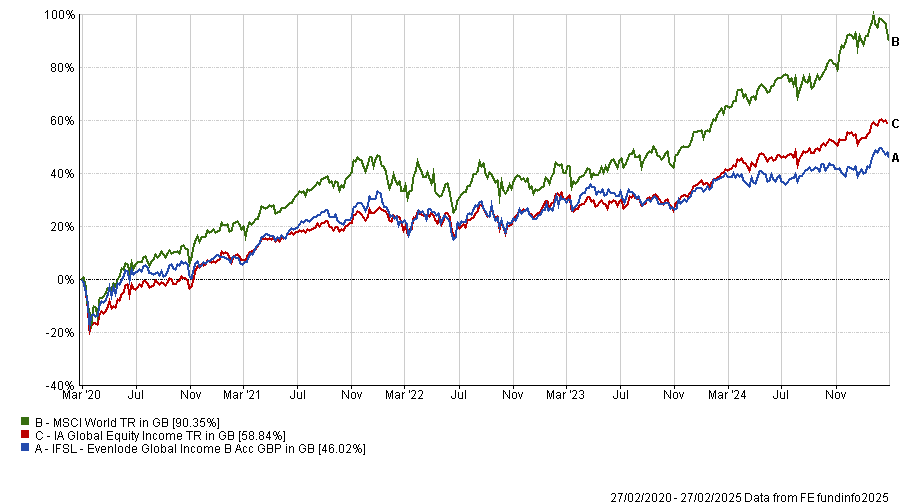

Performance of fund vs sector and benchmark over the past 5yrs

Source: FE Analytics

Thomson’s portfolio has a 70% allocation towards the US, while by contrast, Evenlode has around 30% of its holdings in the US, with a greater allocation towards European equities.

As a result of its low exposure to the world’s best performing equity market in recent years, Evenlode’s performance is in the bottom quartile of over the past one, three and five years.

“If you are an investor in the camp with nagging concerns about US equity valuations, this might appeal”, he concluded.

With differing approaches to stock selection, sector allocations and regional allocations, Hollands said Evenlode and Rathbones made for a “solid pairing to weather-changing market environments”.

Ranmore Global Equity

Darius McDermott, managing director at FundCalibre, said Ranmore Global Equity’s value style makes it an “ideal fund to dovetail with Rathbone Global Opportunities”, which has an unconstrained growth approach.

“In a world where the number of value managers available to investors has started to dwindle, Ranmore Global Equity stands out like a shining star,” he added.

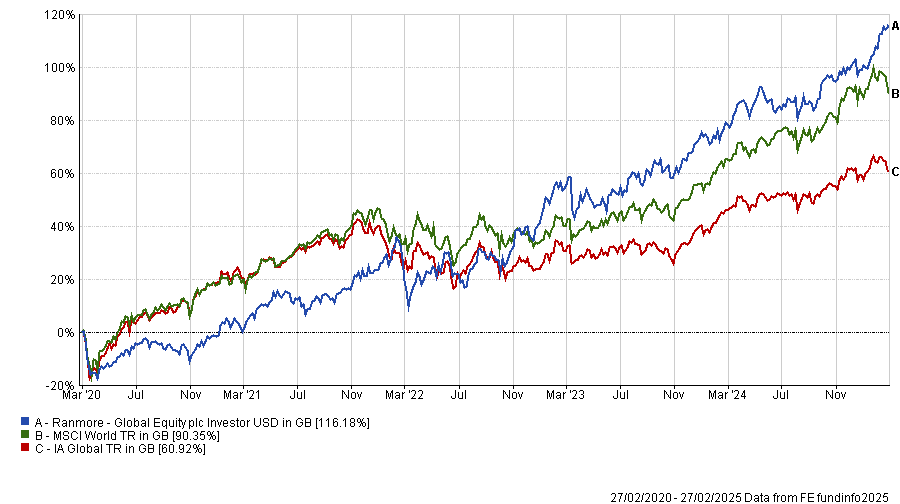

Ranmore Global Equity was the fifth best-performing fund in the IA Global sector in 2022, when the sudden bear market led to underperformance in tech and growth stocks, while the Rathbones portfolio fell by 20.6% that same year.

“We think Ranmore is a ‘hidden gem’ and should be a big consideration for those looking to add some value exposure to balance out their portfolios – and will sit comfortably beside the Rathbones strategy,” McDermott concluded.

Ranmore has delivered impressive returns despite its emphasis on mid- and small caps, which have struggled in recent years due to the popularity of their growth counterparts. It is up by 116.4% over the past five years, a top-quartile performance in the sector, and also achieved top-quartile results over one, three and 10 years.

Performance of fund vs sector and benchmark over the past 5yrs

Source: FE Analytics

M&G Global Strategic Value

For investors looking for another value-focused play, Chris Rush, investment manager at IBOSS Asset Management, identified the M&G Global Strategic Value fund.

Global funds “tend to have similar holdings” with major positions in the US but smaller allocations in other developed markets, and Thomson's strategy is no different, Rush said.

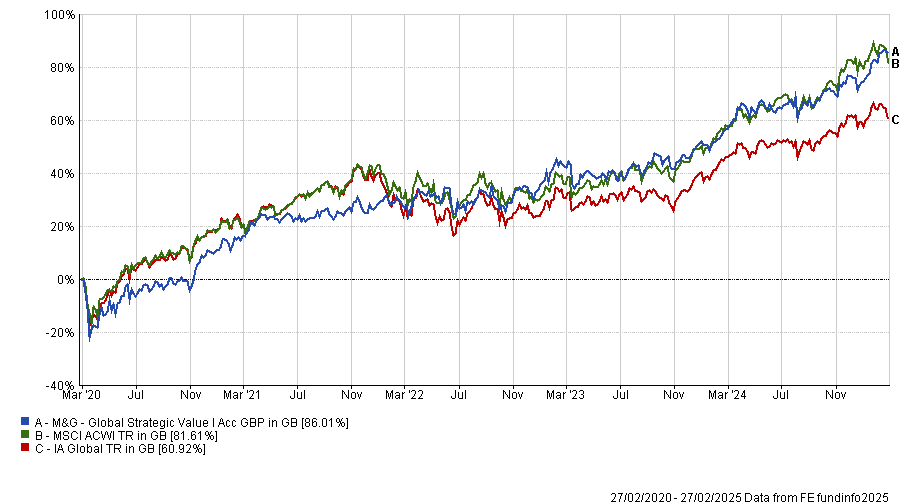

While he believes Thomson is one of the best managers in the global equity space, M&G’s fund offers an appealing contrast, he argued, because it has significantly different regional allocations. It has a 43% weighting to the US, giving prominence to other developed markets including the UK, Europe and South Korea.

Over the past five years, the fund has delivered 86% for investors, a top-quartile result in the IA Global sector, outperforming the MSCI All Country World Index.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Rush said: “Over time, both funds have delivered strong returns for investors, but more importantly, they tend to perform well at different times – helping to balance portfolio performance when one fund faces challenges.”