A strong selling discipline can make or break your investment portfolio but resisting the temptation to sell and cut your losses takes a lot of self-control.

When a fund is underperforming, style has more often than not been an influence on the most recent disappointments, according to John Moore, senior investment manager at RBC Brewin Dolphin.

If that is the case, and if it’s something temporary, then investors “should be patient and see through the cycle”. Below, he reveals three underperforming investment companies that he is still backing and explains why investors should stick with them for now.

Scottish Mortgage

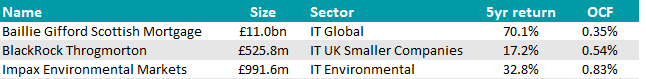

Scottish Mortgage finds itself at the bottom of the global growth investment trust sector in NAV terms over three years and the discount has widened in that time too, reaching today’s level of 12.8%, making it “a challenging time for investors”.

Performance of trust against sector and index over 3yrs

Source: FE Analytics

But Moore looked at the performance over five years and longer to see “a whole different story”. The key approach of Scottish Mortgage is to invest in disruption and “if anything, this theme has remained prominent in headlines and returns over the past three years,” he said.

At points in that three-year period, exposure to private companies and China have been high-profile drags, and “stock blow-ups such as Moderna haven’t helped either”.

But movements in the Chinese stock market should “offer a window into how these things can change quickly”, which is “the very nature of a disruptive investment approach”.

Impax Environmental

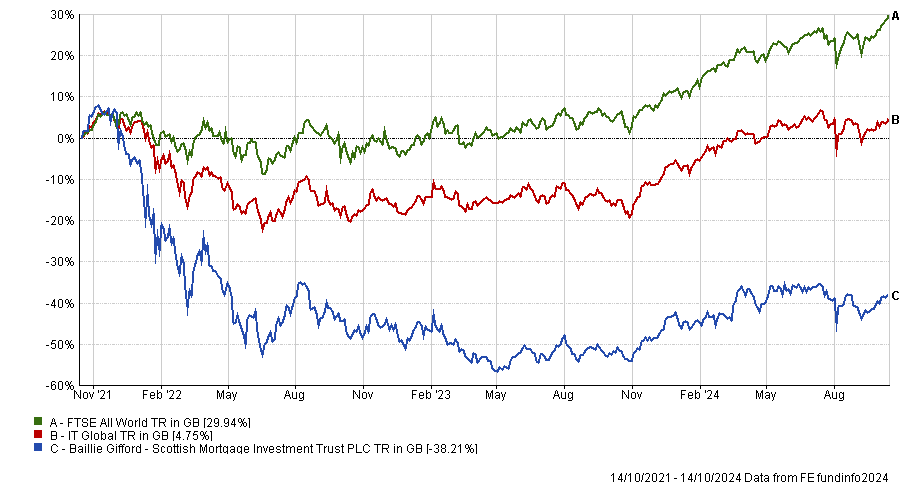

Impax Environmental is “the original environmental, sustainability and governance (ESG)-focused trust”, something which “can often be overlooked”.

Since its launch in 2002, its investment style has lead the trust to invest in businesses that have a degree of short- to medium-term cyclicality, prior to longer-term trends kicking in, Moore observed.

Performance of trust against sector and index over 3yrs

Source: FE Analytics

“The hangover after the retail-fuelled ESG enthusiasm earlier in the decade combined with higher interest rates have acted as a drag, with the latter likely to be a key influence in deferring capital expenditure on efficiency and change,” he said.

“Lower interest rates will help, as will the passing of time. This often leads to a catch-up of capex spending to meet the longer-term structural trends that Impax Environmental is well placed to capture.”

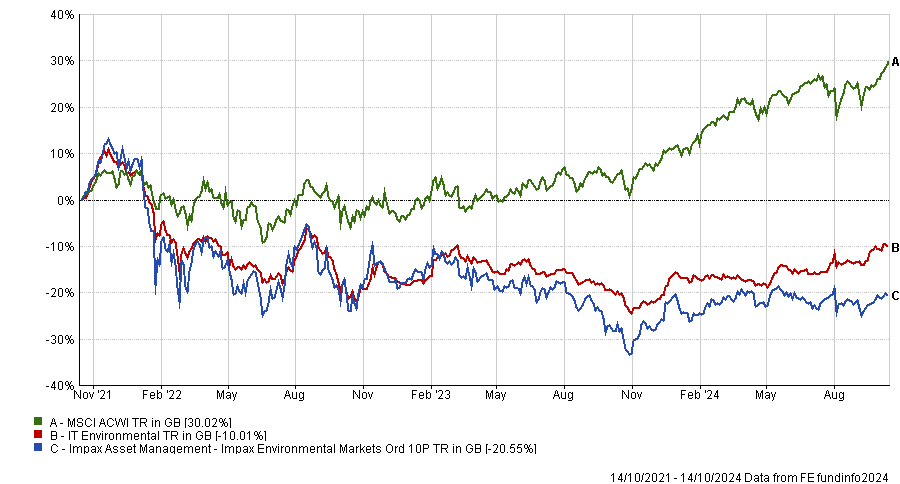

Blackrock Throgmorton

Focused on fast-growing UK companies, Blackrock Throgmorton is managed by Blackrock head of emerging companies Dan Whitestone and has a mandate that can use hedging, typically by shorting businesses deemed unattractive, and gearing (currently at 21% gross) to add exposure and magnify returns.

Growth investing by its very nature is an optimist’s game, according to Moore.

Performance of trust against sector and index over 3yrs

Source: FE Analytics

“Truth be told, it’s been a little hard to be optimistic about the UK over the past three years,” he said,

“This has resulted in low valuations, and uncertainty about AIM [the Alternative Investment Market] and capital gains tax in recent times won’t have particularly helped this.”

In a recent call, Whitestone talked about the lack of attractive short opportunities due to low valuations and low expectations, Moore revealed, concluding that “for the optimists, this might be the first step to better times ahead”.